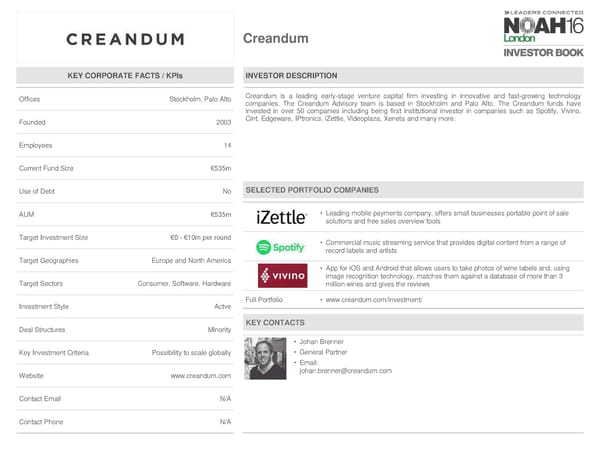

Creandum KEY CORPORATE FACTS / KPIs INVESTOR DESCRIPTION Offices Stockholm, Palo Alto Creandum is a leading early-stage venture capital firm investing in innovative and fast-growing technology companies. The Creandum Advisory team is based in Stockholm and Palo Alto. The Creandum funds have invested in over 50 companies including being first institutional investor in companies such as Spotify, Vivino, Founded 2003 Cint, Edgeware, IPtronics, iZettle, Videoplaza, Xeneta and many more. Employees 14 Current Fund Size €535m Use of Debt No SELECTED PORTFOLIO COMPANIES AUM €535m • Leading mobile payments company, offers small businesses portable point of sale solutions and free sales overview tools Target Investment Size €0 - €10m per round • Commercial music streaming service that provides digital content from a range of record labels and artists Target Geographies Europe and North America • App for iOS and Android that allows users to take photos of wine labels and, using image recognition technology, matches them against a database of more than 3 Target Sectors Consumer, Software, Hardware million wines and gives the reviews Investment Style Actve Full Portfolio • www.creandum.com/investment/ Deal Structures Minority KEY CONTACTS • Johan Brenner Key Investment Criteria Possibility to scale globally • General Partner • Email: Website www.creandum.com johan.brenner@creandum.com Contact Email N/A Contact Phone N/A

NOAH 2016 London Investor Book Page 25 Page 27

NOAH 2016 London Investor Book Page 25 Page 27