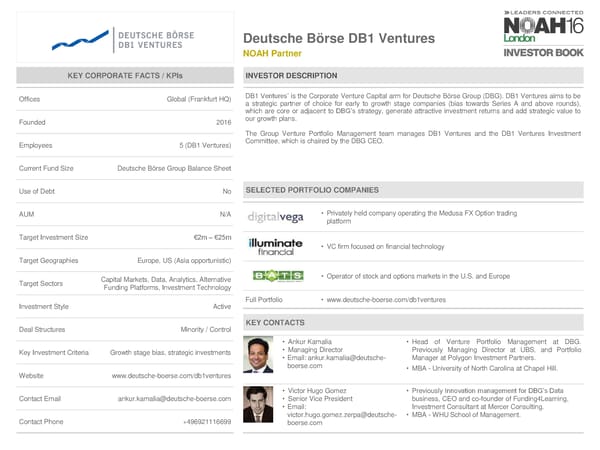

Deutsche Börse DB1 Ventures NOAH Partner KEY COKEY CORPORPORARATE TE FAFACTS CTS / / KPIsKPIs INVESTOR DESCRIPTION Offices Global (Frankfurt HQ) DB1Ventures’ is the Corporate Venture Capital arm for Deutsche Börse Group (DBG). DB1 Ventures aims to be a strategic partner of choice for early to growth stage companies (bias towards Series A and above rounds), which are core or adjacent to DBG’s strategy, generate attractive investment returns and add strategic value to Founded 2016 our growth plans. The Group Venture Portfolio Management team manages DB1 Ventures and the DB1 Ventures Investment Employees 5 (DB1 Ventures) Committee,which is chaired by the DBG CEO. Current Fund Size Deutsche Börse Group Balance Sheet Use of Debt No SELECTED PORTFOLIO COMPANIES AUM N/A • Privately held company operating the Medusa FX Option trading platform Target Investment Size €2m – €25m • VC firm focused on financial technology Target Geographies Europe, US (Asia opportunistic) Capital Markets, Data, Analytics, Alternative • Operator of stock and options markets in the U.S. and Europe Target Sectors Funding Platforms, Investment Technology Investment Style Active Full Portfolio • www.deutsche-boerse.com/db1ventures Deal Structures Minority / Control KEY CONTACTS • Ankur Kamalia • Head of Venture Portfolio Management at DBG. Key Investment Criteria Growth stage bias, strategic investments • Managing Director Previously Managing Director at UBS, and Portfolio • Email: ankur.kamalia@deutsche- Manager at Polygon Investment Partners. boerse.com • MBA-University of North Carolina at Chapel Hill. Website www.deutsche-boerse.com/db1ventures • Victor Hugo Gomez • Previously Innovation management for DBG’s Data Contact Email ankur.kamalia@deutsche-boerse.com • Senior Vice President business, CEO and co-founder of Funding4Learning, • Email: Investment Consultant at Mercer Consulting. victor.hugo.gomez.zerpa@deutsche- • MBA - WHU School of Management. Contact Phone +496921116699 boerse.com

NOAH 2016 London Investor Book Page 26 Page 28

NOAH 2016 London Investor Book Page 26 Page 28