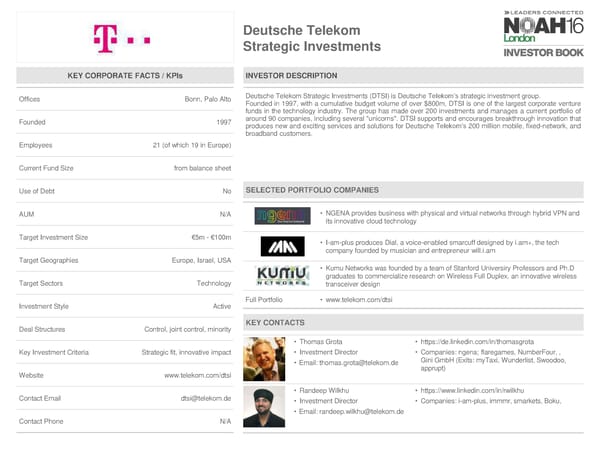

Deutsche Telekom Strategic Investments KEY CORPORATE FACTS / KPIs INVESTOR DESCRIPTION Offices Bonn, Palo Alto Deutsche Telekom Strategic Investments (DTSI) is Deutsche Telekom’s strategic investment group. Founded in 1997, with a cumulative budget volume of over $800m, DTSI is one of the largest corporate venture funds in the technology industry. The group has made over 200 investments and manages a current portfolio of Founded 1997 around 90 companies, including several "unicorns". DTSI supports and encourages breakthrough innovation that produces new and exciting services and solutions for Deutsche Telekom’s 200 million mobile, fixed-network, and broadband customers. Employees 21 (of which 19 in Europe) Current Fund Size from balance sheet Use of Debt No SELECTED PORTFOLIO COMPANIES AUM N/A • NGENAprovides business with physical and virtual networks through hybrid VPN and its innovative cloud technology Target Investment Size €5m - €100m • I-am-plus produces Dial, a voice-enabled smarcuff designed by i.am+, the tech company founded by musician and entrepreneur will.i.am Target Geographies Europe, Israel, USA • Kumu Networks was founded by a team of Stanford Universiry Professors and Ph.D graduates to commercialize research on Wireless Full Duplex, an innovative wireless Target Sectors Technology transceiver design Investment Style Active Full Portfolio • www.telekom.com/dtsi Deal Structures Control, joint control, minority KEY CONTACTS • Thomas Grota • https://de.linkedin.com/in/thomasgrota Key Investment Criteria Strategic fit, innovative impact • Investment Director • Companies: ngena; flaregames, NumberFour, ‚ • Email: thomas.grota@telekom.de Gini GmbH (Exits: myTaxi, Wunderlist, Swoodoo, apprupt) Website www.telekom.com/dtsi • Randeep Wilkhu • https://www.linkedin.com/in/rwilkhu Contact Email dtsi@telekom.de • Investment Director • Companies: i-am-plus, immmr, smarkets, Boku, • Email: randeep.wilkhu@telekom.de Contact Phone N/A

NOAH 2016 London Investor Book Page 27 Page 29

NOAH 2016 London Investor Book Page 27 Page 29