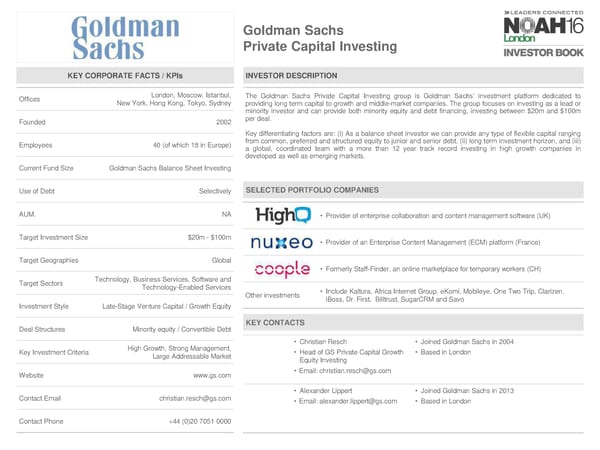

Goldman Sachs Private Capital Investing KEY CORPORATE FACTS / KPIs INVESTOR DESCRIPTION Offices London, Moscow, Istanbul, The Goldman Sachs Private Capital Investing group is Goldman Sachs’ investment platform dedicated to New York, Hong Kong, Tokyo, Sydney providing long term capital to growth and middle-market companies. The group focuses on investing as a lead or minority investor and can provide both minority equity and debt financing, investing between $20m and $100m Founded 2002 per deal. Key differentiating factors are: (i) As a balance sheet investor we can provide any type of flexible capital ranging Employees 40 (of which 18 in Europe) from common, preferred and structured equity to junior and senior debt, (ii) long term investment horizon, and (iii) a global, coordinated team with a more than 12 year track record investing in high growth companies in developed as well as emerging markets. Current Fund Size Goldman Sachs Balance Sheet Investing Use of Debt Selectively SELECTED PORTFOLIO COMPANIES AUM. NA • Provider of enterprise collaboration and content management software (UK) Target Investment Size $20m - $100m • Provider of an Enterprise Content Management (ECM) platform (France) Target Geographies Global • Formerly Staff-Finder, an online marketplace for temporary workers (CH) Target Sectors Technology, Business Services, Software and Technology-Enabled Services • Include Kaltura, Africa Internet Group, eKomi, Mobileye, One Two Trip, Clarizen, Other investments iBoss, Dr. First, Billtrust, SugarCRM and Savo Investment Style Late-Stage Venture Capital / Growth Equity Deal Structures Minority equity / Convertible Debt KEY CONTACTS High Growth, Strong Management, • Christian Resch • Joined Goldman Sachs in 2004 Key Investment Criteria Large Addressable Market • Head of GS Private Capital Growth • Based in London Equity Investing Website www.gs.com • Email: christian.resch@gs.com • Alexander Lippert • Joined Goldman Sachs in 2013 Contact Email christian.resch@gs.com • Email: alexander.lippert@gs.com • Based in London Contact Phone +44 (0)20 7051 0000

NOAH 2016 London Investor Book Page 81 Page 83

NOAH 2016 London Investor Book Page 81 Page 83