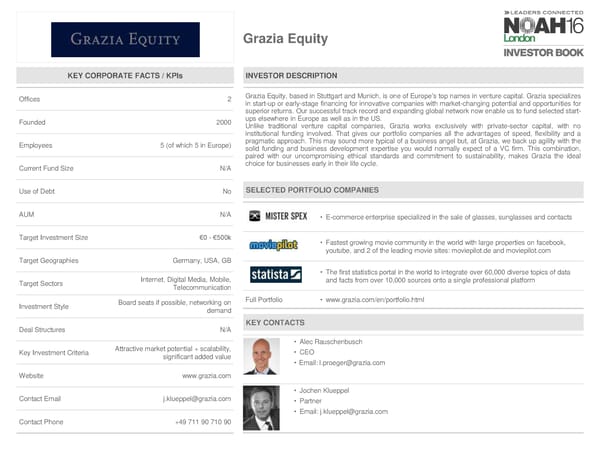

Grazia Equity KEY CORPORATE FACTS / KPIs INVESTOR DESCRIPTION Offices 2 Grazia Equity, based in Stuttgart and Munich, is one of Europe’s top names in venture capital. Grazia specializes in start-up or early-stage financing for innovative companies with market-changing potential and opportunities for superior returns. Our successful track record and expanding global network now enable us to fund selected start- Founded 2000 ups elsewhere in Europe as well as in the US. Unlike traditional venture capital companies, Grazia works exclusively with private-sector capital, with no institutional funding involved. That gives our portfolio companies all the advantages of speed, flexibility and a Employees 5 (of which 5 in Europe) pragmatic approach. This may sound more typical of a business angel but, at Grazia, we back up agility with the solid funding and business development expertise you would normally expect of a VC firm. This combination, paired with our uncompromising ethical standards and commitment to sustainability, makes Grazia the ideal Current Fund Size N/A choice for businesses early in their life cycle. Use of Debt No SELECTED PORTFOLIO COMPANIES AUM N/A • E-commerce enterprise specialized in the sale of glasses, sunglasses and contacts Target Investment Size €0 - €500k • Fastest growing movie community in the world with large properties on facebook, youtube, and 2 of the leading movie sites: moviepilot.de and moviepilot.com Target Geographies Germany, USA, GB • The first statistics portal in the world to integrate over 60,000 diverse topics of data Target Sectors Internet, Digital Media, Mobile, and facts from over 10,000 sources onto a single professional platform Telecommunication Investment Style Board seats if possible, networking on Full Portfolio • www.grazia.com/en/portfolio.html demand Deal Structures N/A KEY CONTACTS • Alec Rauschenbusch Key Investment Criteria Attractive market potential + scalability, • CEO significant added value • Email: l.proeger@grazia.com Website www.grazia.com • Jochen Klueppel Contact Email j.klueppel@grazia.com • Partner • Email: j.klueppel@grazia.com Contact Phone +49 711 90 710 90

NOAH 2016 London Investor Book Page 35 Page 37

NOAH 2016 London Investor Book Page 35 Page 37