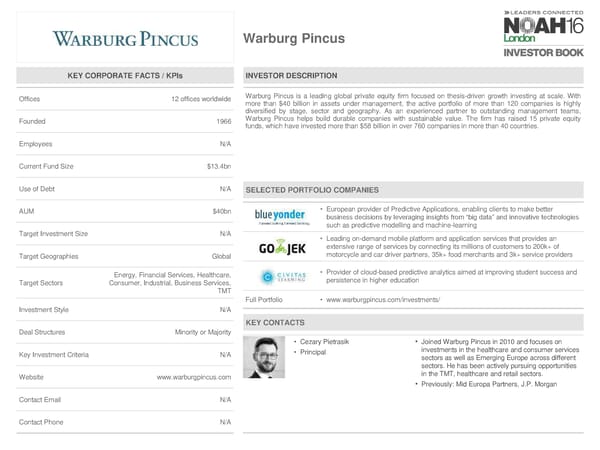

Warburg Pincus KEY CORPORATE FACTS / KPIs INVESTOR DESCRIPTION Offices 12 offices worldwide Warburg Pincus is a leading global private equity firm focused on thesis-driven growth investing at scale. With more than $40 billion in assets under management, the active portfolio of more than 120 companies is highly diversified by stage, sector and geography. As an experienced partner to outstanding management teams, Founded 1966 Warburg Pincus helps build durable companies with sustainable value. The firm has raised 15 private equity funds, which have invested more than $58 billion in over 760 companies in more than 40 countries. Employees N/A Current Fund Size $13.4bn Use of Debt N/A SELECTED PORTFOLIO COMPANIES AUM $40bn • European provider of Predictive Applications, enabling clients to make better business decisions by leveraging insights from “big data” and innovative technologies such as predictive modelling and machine-learning Target Investment Size N/A • Leading on-demand mobile platform and application services that provides an extensive range of services by connecting its millions of customers to 200k+ of Target Geographies Global motorcycle and car driver partners, 35k+ food merchants and 3k+ service providers Energy, Financial Services, Healthcare, • Provider of cloud-based predictive analytics aimed at improving student success and Target Sectors Consumer, Industrial, Business Services, persistence in higher education TMT Full Portfolio • www.warburgpincus.com/investments/ Investment Style N/A KEY CONTACTS Deal Structures Minority or Majority • Cezary Pietrasik • Joined Warburg Pincus in 2010 and focuses on Key Investment Criteria N/A • Principal investments in the healthcare and consumer services sectors as well as Emerging Europe across different sectors. He has been actively pursuing opportunities Website www.warburgpincus.com in the TMT, healthcare and retail sectors. • Previously: Mid Europa Partners, J.P. Morgan Contact Email N/A Contact Phone N/A

NOAH 2016 London Investor Book Page 103 Page 105

NOAH 2016 London Investor Book Page 103 Page 105