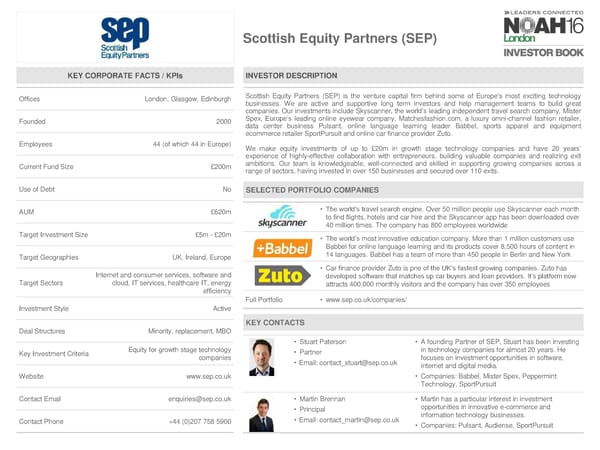

Scottish Equity Partners (SEP) KEY CORPORATE FACTS / KPIs INVESTOR DESCRIPTION Offices London, Glasgow, Edinburgh Scottish Equity Partners (SEP) is the venture capital firm behind some of Europe's most exciting technology businesses. We are active and supportive long term investors and help management teams to build great companies. Our investments include Skyscanner, the world’s leading independent travel search company, Mister Founded 2000 Spex, Europe’s leading online eyewear company, Matchesfashion.com, a luxury omni-channel fashion retailer, data center business Pulsant, online language learning leader Babbel, sports apparel and equipment ecommerceretailer SportPursuit and online car finance provider Zuto. Employees 44 (of which 44 in Europe) We make equity investments of up to £20m in growth stage technology companies and have 20 years’ experience of highly-effective collaboration with entrepreneurs, building valuable companies and realizing exit Current Fund Size £200m ambitions. Our team is knowledgeable, well-connected and skilled in supporting growing companies across a range of sectors, having invested in over 150 businesses and secured over 110 exits. Use of Debt No SELECTED PORTFOLIO COMPANIES AUM £620m • The world’s travel search engine. Over 50 million people use Skyscanner each month to find flights, hotels and car hire and the Skyscanner app has been downloaded over 40 million times. The company has 800 employees worldwide Target Investment Size £5m - £20m • The world’s most innovative education company. More than 1 million customers use Babbel for online language learning and its products cover 8,500 hours of content in Target Geographies UK,Ireland, Europe 14 languages. Babbel has a team of more than 450 people in Berlin and New York Internet and consumer services, software and • Car finance provider Zuto is pne of the UK’s fastest growing companies. Zuto has Target Sectors cloud, IT services, healthcare IT, energy developed software that matches up car buyers and loan providers. It’s platform now efficiency attracts 400,000 monthly visitors and the company has over 350 employees Full Portfolio • www.sep.co.uk/companies/ Investment Style Active KEY CONTACTS Deal Structures Minority, replacement, MBO • Stuart Paterson • A founding Partner of SEP, Stuart has been investing Key Investment Criteria Equity for growth stage technology • Partner in technology companies for almost 20 years. He companies • Email: contact_stuart@sep.co.uk focuses on investment opportunities in software, internet and digital media. Website www.sep.co.uk • Companies: Babbel, Mister Spex, Peppermint Technology, SportPursuit Contact Email enquiries@sep.co.uk • Martin Brennan • Martin has a particular interest in investment • Principal opportunities in innovative e-commerce and Contact Phone +44 (0)207 758 5900 • Email: contact_martin@sep.co.uk information technology businesses. • Companies: Pulsant, Audiense, SportPursuit

NOAH 2016 London Investor Book Page 62 Page 64

NOAH 2016 London Investor Book Page 62 Page 64