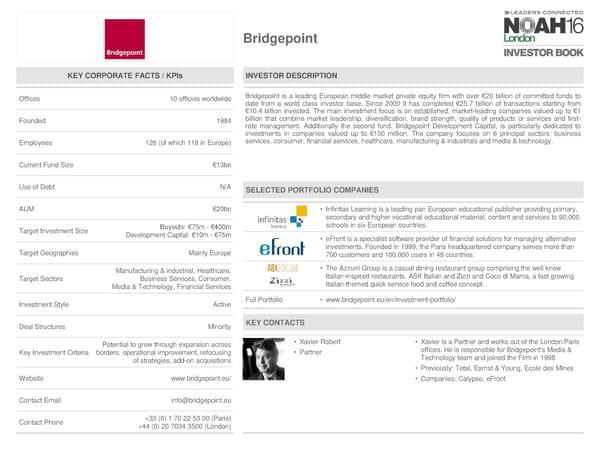

Bridgepoint KEY CORPORATE FACTS / KPIs INVESTOR DESCRIPTION Offices 10 officies worldwide Bridgepoint is a leading European middle market private equity firm with over €20 billion of committed funds to date from a world class investor base. Since 2000 it has completed €25.7 billion of transactions starting from €10.4 billion invested. The main investment focus is on established, market-leading companies valued up to €1 Founded 1984 billion that combine market leadership, diversification, brand strength, quality of products or services and first- rate management. Additionally the second fund, Bridgepoint Development Capital, is particularly dedicated to investments in companies valued up to €150 million. The company focuses on 6 principal sectors: business Employees 126 (of which 118 in Europe) services, consumer, financial services, healthcare, manufacturing & industrials and media & technology. Current Fund Size €13bn Use of Debt N/A SELECTED PORTFOLIO COMPANIES AUM €20bn • Infinitas Learning is a leading pan European educational publisher providing primary, secondary and higher vocational educational material, content and services to 90,000 Target Investment Size Buyouts: €75m - €400m schools in six European countries. Development Capital: €10m - €75m • eFront is a specialist software provider of financial solutions for managing alternative Target Geographies Mainly Europe investments. Founded in 1999, the Paris headquartered company serves more than 700 customers and 100,000 users in 48 countries. Manufacturing & industrial, Healthcare, • The Azzurri Group is a casual dining restaurant group comprising the well know Target Sectors Business Services, Consumer, Italian-inspired restaurants, ASK Italian and Zizzi and Coco di Mama, a fast growing Media & Technology, Financial Services Italian-themed quick service food and coffee concept. Investment Style Active Full Portfolio • www.bridgepoint.eu/en/investment-portfolio/ Deal Structures Minority KEY CONTACTS Potential to grow through expansion across • Xavier Robert • Xavier is a Partner and works out of the London/Paris Key Investment Criteria borders, operational improvement, refocusing • Partner offices. He is responsible for Bridgepoint's Media & of strategies, add-on acquisitions Technology team and joined the Firm in 1998 • Previously: Total, Esrnst & Young, Ecole des Mines Website www.bridgepoint.eu/ • Companies: Calypso, eFront Contact Email info@bridgepoint.eu Contact Phone +33 (0) 1 70 22 53 00 (Paris) +44 (0) 20 7034 3500 (London)

NOAH 2016 London Investor Book Page 75 Page 77

NOAH 2016 London Investor Book Page 75 Page 77