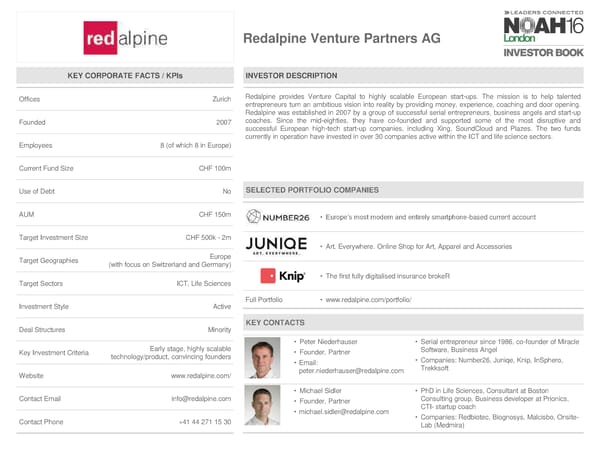

Redalpine Venture Partners AG KEY CORPORATE FACTS / KPIs INVESTOR DESCRIPTION Offices Zurich Redalpine provides Venture Capital to highly scalable European start-ups. The mission is to help talented entrepreneurs turn an ambitious vision into reality by providing money, experience, coaching and door opening. Redalpine was established in 2007 by a group of successful serial entrepreneurs, business angels and start-up Founded 2007 coaches. Since the mid-eighties, they have co-founded and supported some of the most disruptive and successful European high-tech start-up companies, including Xing, SoundCloud and Plazes. The two funds currently in operation have invested in over 30 companies active within the ICT and life science sectors. Employees 8 (of which 8 in Europe) Current Fund Size CHF 100m Use of Debt No SELECTED PORTFOLIO COMPANIES AUM CHF 150m • Europe’s most modern and entirely smartphone-based current account Target Investment Size CHF 500k - 2m • Art. Everywhere. Online Shop for Art, Apparel and Accessories Target Geographies Europe (with focus on Switzerland and Germany) • The first fully digitalised insurance brokeR Target Sectors ICT, Life Sciences Investment Style Active Full Portfolio • www.redalpine.com/portfolio/ Deal Structures Minority KEY CONTACTS • Peter Niederhauser • Serial entrepreneur since 1986, co-founder of Miracle Key Investment Criteria Early stage, highly scalable • Founder, Partner Software, Business Angel technology/product, convincing founders • Email: • Companies: Number26, Juniqe, Knip, InSphero, [email protected] Trekksoft Website www.redalpine.com/ • Michael Sidler • PhD in Life Sciences, Consultant at Boston Contact Email [email protected] • Founder, Partner Consulting group, Business developer at Prionics, • [email protected] CTI- startup coach Contact Phone +41 44 271 15 30 • Companies: Redbiotec, Biognosys, Malcisbo, Onsite- Lab (Medmira)

NOAH 2016 London Investor Book Page 59 Page 61

NOAH 2016 London Investor Book Page 59 Page 61