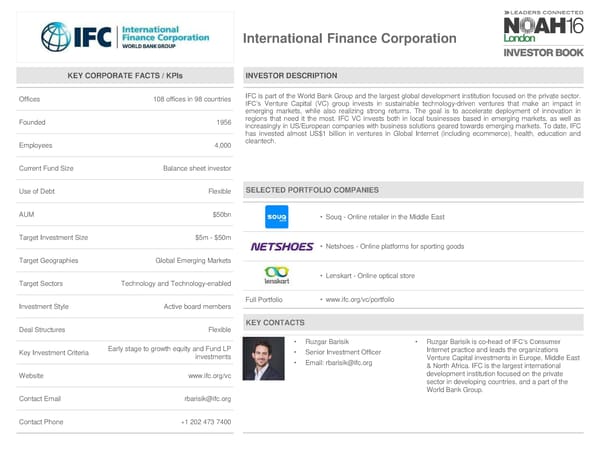

International Finance Corporation KEY CORPORATE FACTS / KPIs INVESTOR DESCRIPTION Offices 108 offices in 98 countries IFC is part of the World Bank Group and the largest global development institution focused on the private sector. IFC’s Venture Capital (VC) group invests in sustainable technology-driven ventures that make an impact in emerging markets, while also realizing strong returns. The goal is to accelerate deployment of innovation in Founded 1956 regions that need it the most. IFC VC invests both in local businesses based in emerging markets, as well as increasingly in US/European companies with business solutions geared towards emerging markets. To date, IFC has invested almost US$1 billion in ventures in Global Internet (including ecommerce), health, education and Employees 4,000 cleantech. Current Fund Size Balance sheet investor Use of Debt Flexible SELECTED PORTFOLIO COMPANIES AUM $50bn • Souq - Online retailer in the Middle East Target Investment Size $5m - $50m • Netshoes - Online platforms for sporting goods Target Geographies Global Emerging Markets • Lenskart - Online optical store Target Sectors Technology and Technology-enabled Full Portfolio • www.ifc.org/vc/portfolio Investment Style Active board members Deal Structures Flexible KEY CONTACTS • Ruzgar Barisik • Ruzgar Barisik is co-head of IFC’s Consumer Key Investment Criteria Early stage to growth equity and Fund LP • Senior Investment Officer Internet practice and leads the organizations investments • Email: rbarisik@ifc.org Venture Capital investments in Europe, Middle East & North Africa. IFC is the largest international Website www.ifc.org/vc development institution focused on the private sector in developing countries, and a part of the World Bank Group. Contact Email rbarisik@ifc.org Contact Phone +1 202 473 7400

NOAH 2016 London Investor Book Page 42 Page 44

NOAH 2016 London Investor Book Page 42 Page 44