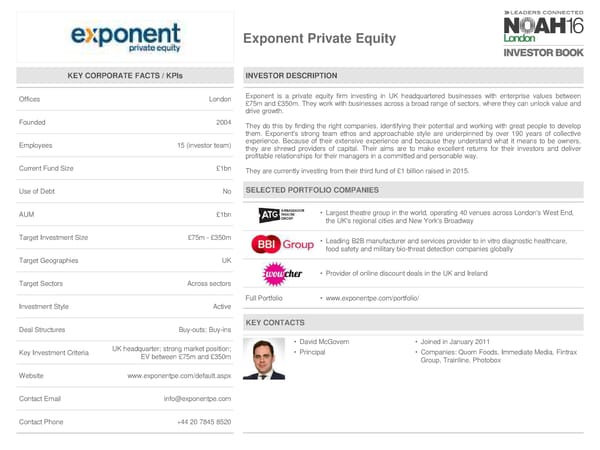

Exponent Private Equity KEY CORPORATE FACTS / KPIs INVESTOR DESCRIPTION Offices London Exponent is a private equity firm investing in UK headquartered businesses with enterprise values between £75m and £350m. They work with businesses across a broad range of sectors, where they can unlock value and drive growth. Founded 2004 They do this by finding the right companies, identifying their potential and working with great people to develop them. Exponent's strong team ethos and approachable style are underpinned by over 190 years of collective Employees 15 (investor team) experience. Because of their extensive experience and because they understand what it means to be owners, they are shrewd providers of capital. Their aims are to make excellent returns for their investors and deliver profitable relationships for their managers in a committed and personable way. Current Fund Size £1bn They are currently investing from their third fund of £1 billion raised in 2015. Use of Debt No SELECTED PORTFOLIO COMPANIES AUM £1bn • Largest theatre group in the world, operating 40 venues across London's West End, the UK's regional cities and New York's Broadway Target Investment Size £75m - £350m • Leading B2B manufacturer and services provider to in vitro diagnostic healthcare, food safety and military bio-threat detection companies globally Target Geographies UK • Provider of online discount deals in the UK and Ireland Target Sectors Across sectors Full Portfolio • www.exponentpe.com/portfolio/ Investment Style Active Deal Structures Buy-outs; Buy-ins KEY CONTACTS • David McGovern • Joined in January 2011 Key Investment Criteria UK headquarter; strong market position; • Principal • Companies: Quorn Foods, Immediate Media, Fintrax EV between £75m and £350m Group, Trainline, Photobox Website www.exponentpe.com/default.aspx Contact Email info@exponentpe.com Contact Phone +44 20 7845 8520

NOAH 2016 London Investor Book Page 100 Page 102

NOAH 2016 London Investor Book Page 100 Page 102