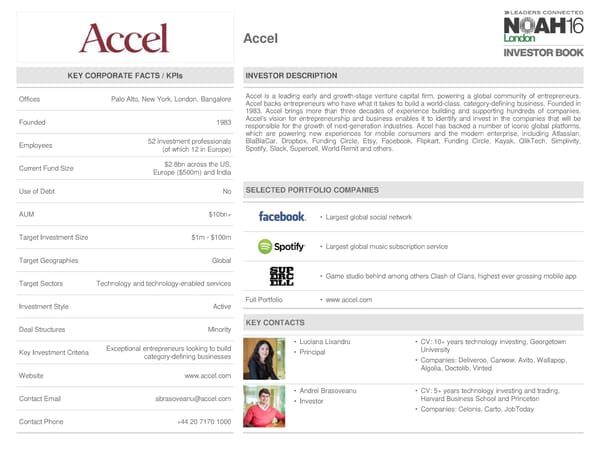

Accel KEY CORPORATE FACTS / KPIs INVESTOR DESCRIPTION Offices Palo Alto, New York, London, Bangalore Accel is a leading early and growth-stage venture capital firm, powering a global community of entrepreneurs. Accel backs entrepreneurs who have what it takes to build a world-class, category-defining business. Founded in 1983, Accel brings more than three decades of experience building and supporting hundreds of companies. Founded 1983 Accel's vision for entrepreneurship and business enables it to identify and invest in the companies that will be responsible for the growth of next-generation industries. Accel has backed a number of iconic global platforms, which are powering new experiences for mobile consumers and the modern enterprise, including Atlassian, Employees 52 investment professionals BlaBlaCar, Dropbox, Funding Circle, Etsy, Facebook, Flipkart, Funding Circle, Kayak, QlikTech, Simplivity, (of which 12 in Europe) Spotify, Slack, Supercell, World Remit and others. Current Fund Size $2.8bn across the US, Europe ($500m) and India Use of Debt No SELECTED PORTFOLIO COMPANIES AUM $10bn+ • Largest global social network Target Investment Size $1m - $100m • Largest global music subscription service Target Geographies Global • Game studio behind among others Clash of Clans, highest ever grossing mobile app Target Sectors Technology and technology-enabled services Investment Style Active Full Portfolio • www.accel.com Deal Structures Minority KEY CONTACTS Exceptional entrepreneurs looking to build • Luciana Lixandru • CV: 10+ years technology investing, Georgetown Key Investment Criteria category-defining businesses • Principal University • Companies: Deliveroo, Carwow, Avito, Wallapop, Algolia, Doctolib, Vinted Website www.accel.com • Andrei Brasoveanu • CV: 5+ years technology investing and trading, Contact Email abrasoveanu@accel.com • Investor Harvard Business School and Princeton • Companies: Celonis, Carto, JobToday Contact Phone +44 20 7170 1000

NOAH 2016 London Investor Book Page 11 Page 13

NOAH 2016 London Investor Book Page 11 Page 13