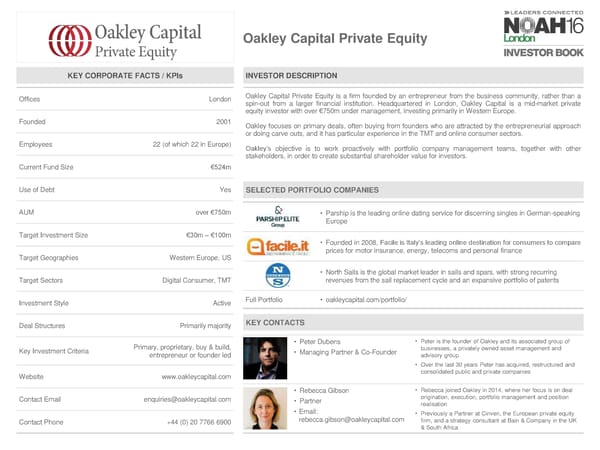

Oakley Capital Private Equity KEY CORPORATE FACTS / KPIs INVESTOR DESCRIPTION Offices London Oakley Capital Private Equity is a firm founded by an entrepreneur from the business community, rather than a spin-out from a larger financial institution. Headquartered in London, Oakley Capital is a mid-market private equity investor with over €750m under management, investing primarily in Western Europe. Founded 2001 Oakley focuses on primary deals, often buying from founders who are attracted by the entrepreneurial approach or doing carve outs, and it has particular experience in the TMT and online consumer sectors. Employees 22 (of which 22 in Europe) Oakley’s objective is to work proactively with portfolio company management teams, together with other stakeholders, in order to create substantial shareholder value for investors. Current Fund Size €524m Use of Debt Yes SELECTED PORTFOLIO COMPANIES AUM over €750m • Parship is the leading online dating service for discerning singles in German-speaking Europe Target Investment Size €30m – €100m • Founded in 2008, Facile is Italy’s leading online destination for consumers to compare prices for motor insurance, energy, telecoms and personal finance Target Geographies Western Europe, US • North Sails is the global market leader in sails and spars, with strong recurring Target Sectors Digital Consumer, TMT revenues from the sail replacement cycle and an expansive portfolio of patents Investment Style Active Full Portfolio • oakleycapital.com/portfolio/ Deal Structures Primarily majority KEY CONTACTS Primary, proprietary, buy & build, • Peter Dubens • Peter is the founder of Oakley and its associated group of Key Investment Criteria • Managing Partner & Co-Founder businesses, a privately owned asset management and entrepreneur or founder led advisory group • Over the last 30 years Peter has acquired, restructured and Website www.oakleycapital.com consolidated public and private companies • Rebecca Gibson • Rebecca joined Oakley in 2014, where her focus is on deal Contact Email enquiries@oakleycapital.com • Partner origination, execution, portfolio management and position realisation • Email: • Previously a Partner at Cinven, the European private equity Contact Phone +44 (0) 20 7766 6900 rebecca.gibson@oakleycapital.com firm, and a strategy consultant at Bain & Company in the UK & South Africa

NOAH 2016 London Investor Book Page 86 Page 88

NOAH 2016 London Investor Book Page 86 Page 88