NOAH Advisors Overview

Complete Introduction of all NOAH Advisors

® INTRODUCTION TO NOAH ADVISORS MARCH 2018

® TABLE OF CONTENTS INTRODUCTION TO Corporate Finance Practice 3 NOAH Conference 14 NOAH ADVISORS Select Completed Transactions 26 2

® INTRODUCTION TO CORPORATE FINANCE PRACTICE NOAH ADVISORS 3

EUROPE’S LEADING INTERNET Selected Completed NOAH Transactions CORPORATE FINANCE BOUTIQUE August 2017 December 2016 ® Acquisition of a Majority Stake in Investment in Unique Industry Know-How Strong Investment Banking Competence by by Focus on Leading European Internet companies Over 40 years of combined relevant M&A Covering over 400 companies across 25 online experience at a valuation of $200m verticals, a broad range of over 500 investors Routine execution of M&A and financing as well as 100+ online-focused corporates transactions with sizes of several billion euros Financial Advisor to EMK Capital Financial Advisor to Silver Lake Deep understanding of industry dynamics 30 successfully completed NOAH Advisors transactions underline successful transfer of October 2016 September 2016 Ability to add value beyond banking advice M&A competencies to the Internet sector Investment in Acquisition of a Majority Stake in Facilitates overall process and minimizes management distraction by by Unmatched Network and Relationships Full Commitment - We Are Entrepreneurs! from NOAH Advisors is globally well connected Entrepreneurial mind-set, focused on growing the 84% Ownership at a valuation of €300m and has direct access to virtually all key business and establishing a reputation for excellence Exclusive Financial Advisor to KäuferPortal players in the industry and its Shareholders Financial Advisor to Oakley Capital Knowledge of and strong relationships with Ability to deliver top results in short time frames potential buyers’ key decision makers December 2014 October 2014 Highly success-based compensation structures Sale of 100% of Proactively finds and unlocks attractive align interests of clients and NOAH Advisors, and Sale of 100% of investment opportunities for leading investors demonstrate conviction to deliver top results Annual NOAH Conference in its 8th year Creative deal solutions for $800m to for €80m to The NOAH Advisors Core Banking Team Marco Rodzynek Jan Brandes Exclusive Financial Advisor to Exclusive Financial Advisor to Fotolia and the Selling Shareholders Trovit and its Shareholders Managing Director & Founder Managing Director September 2014 May 2014 marco.rodzynek@noah-advisors.com jan.brandes@noah-advisors.com Sale of controlling stake in +41 799 581 512 +49 174 2010 984 sold 100% of Nikhil Parmar Aleksander Skwarczek to Director Analyst for $228m to a joint venture between nikhil.parmar@noah-advisors.com aleksander.skwarczek@noah-advisors.com +44 7521 835 241 +48 692 270 613 Exclusive Financial Advisor to Exclusive Financial Advisor to Yad2 Facile.it and its Shareholders and its Shareholders 4

THE NOAH ECOSYSTEM MEDIA LARGE CAP INTERNET OTHER VENTURE CAPITAL AGE Y ST EARL eventures CORPORATES INVESTORS GROWTH CAPITAL INTERNET ® Connecting Leaders to Support the European Digital Ecosystem SERVICE PROVIDERS RECRUITING ADVERTISING LEGAL BUYOUT AGE TE ST ACCOUNTING PR AGENCIES CONSULTING LA 5

EUROPE’S LARGEST INTERNET COMPANIES A significant number of companies valued above €100 million ® ADVERTISING CLASSIFIEDS ECOMMERCE SERVICES GAMING LEAD GENERATION & MARKETPLACES TRAVEL APPS 6

UNIQUE ACCESS TO A WIDE RANGE OF INTERNET INVESTORS Long lasting relationships with strategic and financial investors ® INTERNET Coverage of 75,000 industry leaders TRADITIONAL LARGE CAP through conferences and M&A TMT & RETAIL VC AND PRIVATE EQUITY GROWTH FUNDS ANGELS / HEDGE FUNDS FAMILY OFFICES 7

NOAH HAS ACQUIRED UNIQUE UNDERSTANDING OF THE EUROPEAN ONLINE ECOSYSTEM ® SECTOR KPIs EBITDA CAGR 2017E-2019E 49% 45% 41% 35% 35% 28% 25% 23% 18% 21% 21% 14% 15% 11% 9% 8% 8% 5% Marketplaces E-commerce Search & Portals Gaming Social Classifieds Lead Generation Travel Advertising Europe United States EBITDA MARGIN 2018E 57% 37% 32% 32% 31% 29% 28% 28% 29% 19% 19% 16% 20% 19% 13% 13% 11% 5% Gaming Social Search & Portals Lead Generation Travel Advertising Classifieds Marketplaces E-commerce Europe United States CASH CONVERSION: FCF / EBITDA 2018E 94% 63% 54% 49% 48% 54% 48% 48% 49% 45% 47% 44% 44% 44% 43% 38% 29% 29% E-commerce Advertising Lead Generation Marketplaces Gaming Travel Social Search & Portals Classifieds Europe United States Note: Calculation based on sector aggregates. 8

UNDERSTANDING COMPANY VALUATIONS ® GROWTH DRIVEN VALUATION SECTOR VALUATIONS EUROPE EV / EBITDA 2018E EV / EBITDA 2017E 50x March 2018 44.6x 40x E-commerce 22.9x 30x 40.3x Marketplaces 11.8x 20x Search & 18.4x 10x Portals 11.6x 14.2x 5% 10% 15% 20% Social EBITDA CAGR 2017E-2019E 12.2x Note: Size of bubble represents Enterprise Value. HISTORICAL VALUATION BY REGION 12.5x Classifieds EV / 1 YEAR FORWARD EBITDA 12.6x 35x Lead 8.2x 30x Generation 8.3x 25x 5.8x Travel 20x 20.1x 15x 2.6x Gaming 9.3x 10x 5x 2.6x Advertising Europe United States Rest of World 10.5x Jan-10May-10Sep-10Jan-11May-11Sep-11Jan-12May-12Sep-12Jan-13May-13Sep-13Jan-14May-14Sep-14Jan-15May-15Sep-15Jan-16May-16Sep-16Jan-17May-17Sep-17Jan-18EuropeUnited States Note: NTM EBITDA derived by time-weighted estimates. Forward multiples are median values for region. Note: Calculation based on sector aggregates. 9

SELECT COMPLETED TRANSACTIONS ® August 2017 December 2016 October 2016 September 2016 Acquisition of a Majority Stake in Investment in Investment in Acquisition of a Majority Stake in by by by by from at a valuation of $200m 84% Ownership at a valuation of €300m Financial Advisor to EMK Capital Financial Advisor to Silver Lake Exclusive Financial Advisor to Financial Advisor to Oakley Capital KäuferPortal and its Shareholders May 2016 November 2015 September 2015 August 2015 Investment in Sale of a 70% stake in 10Bis $5m fundraising and Drushim $30m fundraising and NOAH NOAH as the Lead Investor as Co-Investor by to Exclusive Financial Advisor to Exclusive Financial Advisor to Pipedrive Exclusive Financial Advisor to Exclusive Financial Advisor to Aloha 10Bis and its Shareholders Drushim and its Shareholders July 2015 December 2014 October 2014 September 2014 Primary funding for Sale of 100% of Sale of 100% of Sale of controlling stake in from for $800m to for €80m to to Advisor to BIScience Exclusive Financial Advisor to Exclusive Financial Advisor to Exclusive Financial Advisor to Fotolia and the Selling Shareholders Trovit and its Shareholders Facile.it and its Shareholders 10

SELECT COMPLETED TRANSACTIONS (Cont’d) ® September 2014 August 2014 May 2014 February 2013 sold 100% of Growth equity investment from sale to for $228m to a joint for a 30% stake alongside Softonic’s Founders and Angel Investors at a valuation of €275m Analysed Strategic Alternatives for mytaxi Advisor to the Selling Shareholders Exclusive Financial Advisor to Yad2 Exclusive Financial Advisor to and its Shareholders Softonic and its shareholders May 2012 April 2012 December 2011 November 2011 Sale of 100% in Fund raising for Sale of a majority stake in $150 million growth equity investment from to to for a 50% stake alongside Fotolia’s Founders from various investors including and TA Associates Additional $150 million Angel Investors Quants Financial Services AG senior debt financing Financial Advisor to Fotolia and Financial Advisor to Toprural Advisor to Work4 Labs Exclusive Financial Advisor to its Shareholders and its Shareholders grupfoni and its Shareholders August 2011 July 2011 April 2011 April 2011 Fund raising for Sale of a majority stake in Fund raising for have acquired a majority stake in to from various investors for $350m from from various investors at a valuation of €40m Advisor to RankAbove Exclusive Advisor to EnGrande Exclusive Advisor to Exclusive Advisor to AdTelligence Summit Partners and TA Associates 11

The NOAH Advisors Team ® Marco Rodzynek Jan Brandes Managing Director & Founder Managing Director Apr-09 With NOAH Advisors since Aug-10 marco.rodzynek@noah-advisors.com jan.brandes@noah-advisors.com Mobile: +41 799 58 1512 Mobile: +49 174 2010 984 Previous Experience Previous Experience Lehman Brothers, 1998 - April 2009 (acquired by Nomura end 2008) - Head of Internet, Media Investment Banking Lehman Brothers, 2005 – May 2010 (Nomura from end 2008) - Media/TMT Investment Banking 40+ completed M&A deals ($95bn+), including: 20+ completed M&A deals, including: Justus Lumpe Jaime Jiménez Dr. Gerhard Cromme Managing Director Managing Director Chairman With NOAH Advisors since Dec-15 With NOAH Advisors since Jan-18 With NOAH Advisors since Jun-17 justus.lumpe@noah-advisors.com jaime.jimenez@noah-advisors.com Mobile: +44 77 0811 6401 Mobile: +34 606 133 812 Previous Experience Previous Experience Previous Experience Lehman Brothers / Nomura, Industrials, 2005-2012 Executive with +18 years of experience leading global Digital Companies Chairman of the Supervisory Board of Siemens AG Royal Bank of Canada, Industrials, 2013-2015 SVP and co-Founder for Softonic International, CEO for iContainers Former Chairman of the Executive Board and later Chairman of the Selected transactions include: Active Business Angel and Advisor Supervisory board of ThyssenKrupp AG MBA and PDD by the IESE Business School Board memberships include: Compagnie de Saint-Gobain, Allianz SE, Deutsche Lufthansa AG, E.ON AG, BNP Paribas S.A., Suez S.A., Volkswagen AG, ABB Ltd., Thales S.A. and Axel Springer AG Nikhil Parmar Aleksander Skwarczek Marco Bombach Director Analyst Creative Director With NOAH Advisors since Jul-12 With NOAH Advisors since Sep-15 With NOAH Advisors since Jun-10 Previous Experience Previous Experience Previous Experience BSc in Economics and MSc in Economics (with specialisation in M&A / corporate finance at IPOPEMA Securities, EY and KPMG Digital content creation, creative concept development, covering the Finance) from the London School of Economics Completed M&A deals include: full audio-visual production chain, content distribution and optimization Completed M&A deals include: 14+ years in the new media industry 10+ years audio-visual production Maria del Mar Pérez Gema Alba Paula García CTO New Media Designer VP NOAH With NOAH Advisors since Feb-17 With NOAH Advisors since Jun-15 With NOAH Advisors since Jan-16 Previous Experience Previous Experience Previous Experience 9+ years experience in software development 12+ years experience in visual and user interface design, and UI Sales & Marketing, QP Magazine @ The Telegraph, London BSc in Computer Engineering development Client Service, Global Forest Partners, NH, USA Martina Grivnova Marina Krolovich Daniel Wasowicz VP Conference Management Assistant Head of Data Team With NOAH Advisors since May-17 With NOAH Advisors since Jan-12 With NOAH Advisors since Feb-16 Previous Experience Previous Experience Previous Experience Ba in International Business and Management from Euro- Manager in International Business Department of SOE Assistant Director of Sales in HERMES POLAND pean Business School London “Belaeronavigation” (Civil Aviation Industry) Business Owner’s assistant in Ledkos 12

SELECTED INVESTOR REFERENCES The best trust us and work with us ® Index Ventures is one of Europe’s leading Internet VC European serial entrepreneur. Founded Amen and European Founders have helped shape some of the group Fotolia, Europe’s leading stock photography company most successful internet companies in the region and Joined Yahoo! from Kelkoo, when Yahoo! acquired the First client of NOAH Advisors beyond company in March 2004 Deals: Amen, Fotolia Select past investments include: Facebook, LinkedIn, Dom Vidal CEO of Yahoo! Europe from 2004 to 2007 Oleg Tscheltzoff Oliver Samwer Delivery Hero, HomeAway, Trivago Partner Deals: Kelkoo, Adconion, Be2, Criteo CEO Co-founder Index Ventures Fotolia European Founders Accel is a leading globally active VC Founder of Xing. One of Germany’s most successful Formerly with Providence Equity Partners, Morgan Before joining Accel, was at Perry Capital, a $10bn start-ups Stanley and Lehman Brothers. Co-founder of hedge fund Cinco Capital is building a portfolio of holdings in Continuum Group Spent a decade in Silicon Valley and was founder of private & public companies Deals: Casema, Canal Digitaal, Com Hem, Digiturk, Harry Nelis E-motion Lars Hinrichs Deals: Xing, Boettcher Hinrichs AG Jörg Mohaupt Versatel, Bibit, Perfrom Group, Acision, Warner Music Partner Deals: Gameforge, Check24, Kayak, Netvibes, CEO Head of TMT Accel Spreadshirt & more Cinco Capital Access Industries Klaus is Europe’s most successful and respected angel Head of KKR’s European Media Industry team A bulge-bracket private equity and growth capital investor Led investments in Fotolia Holdings and in BMG investor Joined AOL in 1995 Rights Management with a significant role in a number Focuses on firm’s European technology, media and Deals: AOL, Freenet, Skype, King.com, Stardoll, XING, of other transactions communications investments, and activities in Klaus Hommels Spotify, Xing Philipp Freise Jo Schull emerging Europe CEO Partner Managing Director Deals: Ziggo, FiberNet, Centrum, Nectar (Loyalty Lakestar KKR Warburg Pincus Management) TA Associates is a leading European growth capital More than 14 years of experience in the private equity Summit is one of the world’s leading providers of investor industry growth capital Deals: M&M, eCircle, Micromax, AVG, Fotolia, Has invested in more than 80 companies, built several Deals: AVAST Software, Ogone, SafeBoot, Web eDreams, GlobeOp, OpenLink, Radialpoint, Datek category leading businesses in consumer internet Reservations International, vente-privee.com among Jonathan Meeks Online Holdings, Idea Cellular and The Island EC Martin Weber Deals: Brands4Friends, Parship, Experteer, GameDue- Scott Collins others Partner Managing Partner ll, Adscale, Zalando & more Managing Director TA Associates Holtzbrinck Ventures Summit Partners HF is the globally leading private equity investor in the Founder of Softonic.com, one of the most visited sites Head of the European Technology and the Media Internet sector in Spain with 70m monthly unique visitors Investment Banking Group at Goldman Sachs Deals: Doubleclick, Getty Images, Web Reservations, European leader in software downloading Deals: Numerous (incl. Facebook fundraising) IRIS, SSP Second client of NOAH Advisors Patrick Healy Tomás Diago Sold a <15% stake to U.S. listed Digital River in Dec John Lindfors Partner - Hellman Founder / CEO 2009 Managing Partner & Friedman Softonic DST Founding partner and main shareholder of Grupo Appointed to the position of Managing Director Res- Maryland manages direct company investments for the Intercom (founded 1995) ponsible for Financial Management at Holding Italiana Herz family office Mayfair Vermögensverwaltung Intercom is a successful incubator model focused on Quattordicesim in December 2011 Deals: Puma, Germanischer Lloyd, Vapiano, DNV GL Spain A holding company which has stakes in Fininvest and B Group Antonio Deals: Softonic, InfoJobs, Emagister, over 20 start-ups Luigi Berlusconi Cinque Hinrich Stahl González Barros MD Managing Director CEO Holding Italiana Maryland Grupo Intercom Quattordicesima 13

® INTRODUCTION TO NOAH CONFERENCE NOAH ADVISORS 14

Three Conferences, One Mission: Empower the European Digital Ecosystem Connecting European Champions Connecting Capital and Connecting Israel’s Startups with and Challengers Entrepreneurs Large Corporates and Investors 6-7 June 2018 30-31 October 2018 9-10 April 2019 Tempodrom, Berlin Old Billingsgate, London Haoman 17, Tel Aviv Mission To bring together future-shaping Mission To provide a physical marketplace Mission To promote Israel - European executives and investors active across that facilitates funding of digital relationships and enable funding segments driven by digital revolution European companies at all stages ~3,500 attendees – executives, investors, digital 1,500+ attendees – the “who is who” of ~800 selected attendees – 200 European service providers European Internet corporates and 600 Israeli start-ups and Unique mix of CEOs from European traditional 100+ of Europe’s leading digital businesses leading executives large caps and top-funded startups on stage and 80+ handpicked top start-ups on stage Presentations by 60+ selected Israeli Focus on emerging start-ups - 80+ handpicked New program focus: Investors and entrepreneurs investors and top start-ups young companies on the Startup Stage tell their common success stories Company visits and events hosted by Partner dinners and satellite events throughout Pre-event matchmaking – tell us who you start-ups on day 2 the city want to meet Casual networking events Workshops and exhibitions by leading digital Totally revamped conference app and Conference app with top search and meeting service providers networking / matchmaking technology functionalities Totally revamped conference app and Topical meeting areas to make new relevant Invitation only networking / matchmaking technology contacts Pre-event matchmaking – tell us who you Pre-event matchmaking – tell us who you want to meet want to meet 15

Eric Schmidt Robert Gentz Executive Chairman CEO Dr. Mathias Döpfner ® Travis Kalanick CEO CEO Jose Neves Dr. Dieter Zetsche CEO Chairman of the Board of Management HIGH PROFILE Simone Menne SPEAKERS CFO Henry Blodget Ralph Hamers CEO, Editor-In-Chief Riccardo Zacconi CEO Berlin 2017 KPIs Founder & CEO 110+ Speakers Dr. Richard Lutz 81 Partners CEO 18 Workshops Niklas Östberg Arianna Huffington Co-Founder & CEO Oliver Samwer Co-Founder and London 2017 KPIs Founder & CEO Editor-in-Chief Thomas Ebeling 120+ Speakers CEO 36 Partners Herbert Hainer 7 Workshops Hakan Koç CEO CEO Rolf Schrömgens Tel Aviv 2018 KPIs Co-Founder & CEO Sir Martin Sorrell 70+ Speakers CEO 17 Partners Glenn Fogel 200+ International Guests CEO Internet Dr. Klaus Hommels Julie Linn Teigland Founder & CEO MP EY Germany, Corporate Switzerland, Austria Rainer Maerkle Karel Dörner Philipp Freise General Partner Senior Partner Partner Karim Jalbout Head of the European Digital Practice Patrick Healy Pieter van der Does Deputy CEO Alex Kayyal CEO Sonali De Rycker Head of Salesforce Partner Ventures Europe Service Provider Niklas Zennström Investor John Collison CEO President Mikkel Svane Mike Lynch CEO Founder & CEO 16

Senior Decision Makers 6,212 Unique Attendees to Date 28% C-Level 21% Investment 200+ Unique Speakers Partner 7% Owner, Founder 70% Germany 2% Board Member 8% UK 42% Other 4% Switzerland ~60% senior decision makers 2% US Other 16% Company Size (# employees) 13% Over 10,000 38% Internet Entrepreneurs 15% 1001-10,000 and Executives 5% 501-1,000 22% Corporate Executives 7% 251-500 19% Investors 11% 101-250 17% Service Providers 7% 51-100 3% Press 27% 11-50 1% Other 16% 1-10 17

6,100+ Unique Attendees Senior Decision Makers to Date 49% C-Level 300+ Unique Speakers 21% Investment 500+ Company Financings and M&A Partner Transactions Originated @NOAH 8% Owner, Founder 1% Board Member 33% UK 21% Other 32% Germany ~80% senior decision makers 5% Switzerland 4% Spain Company Size (# employees) Launched in 2009, the NOAH Conference has 4% Poland grown into the preeminent European event where 4% USA 5% Over 10,000 over 4,000 senior executives and investors meet 18% Other to 10% 1001-10,000 • Gain insights into the latest proven concepts 3% 501-1,000 • Network and establish new business 47% Internet Entrepreneurs 6% 251-500 relationships and Executives 12% 101-250 • Find customers and top B2B service 25% Investors providers 14% Corporate Executives 10% 51-100 • Enjoy other events organized around the 9% Service Providers 33% 11-50 main conference (Speaker Dinner, NOAH 3% Press 20% 1-10 Party, satellite events) 2% Other 18

721 Attendees 70+ Speakers 68% Israel 10% Germany 5% UK 5% USA 2% Switzerland 9% Other Company Size (# employees) Senior Decision Makers 11% Over 10,000 11% 1001-10,000 36% C-Level 3% 501-1,000 20% Senior Executive 7% 251-500 15% Investment 11% 101-250 Partner 4% Owner, Founder 6% 51-100 2% Board Member 29% 11-50 24% Other 76% senior decision makers 21% 1-10 19

“ THIS IS NOAH CONFERENCE “It´s a very good conference, NOAH CONNECTS LEADERS AT ONE PLACE USING one can do business! BEST-IN-CLASS CONFERENCES AND TECHNOLOGY Oliver Samwer TO EMPOWER THE EUROPEAN DIGITAL ECOSYSTEM CEO, Rocket Internet SPEAKERS AT NOAH HEARING THE STORY OF EUROPEAN DIGITAL LEADERS TO LEARN MAIN STAGE: $100M MINIMUM VALUATIONVALUATION OF $100M+VALUATION OF $100M+ STARTUP STAGE FOR YOUNG OUR AUDIENCE IS OUR STAGE EUROPEAN COMPANIES 110+ speakers at NOAH18 Berlin main stage By invitation only 100 Firms on NOAH17 London Main Stage100 Firms on NOAH17 London Main Stage 12,000+ unique attendees to date at NOAH 640 companies presented since 2009 (37 digital [ ] Companies presented on Main Stage[ ] Companies presented on Main Stage Conferences unicorns) 90 x 6-min pitches at NOAH Berlin Of which [ ] UnicornsOf which [ ] Unicorns 23,000 viewers watch the recordings or live Speakers are CEOs and founders CEOs and founders from emerging companies less Of the top 100 Internet Exits in last 5 years in EuOf the top 100 Internet Exits in last 5 years in Eu-- streams Including: Adyen, BlaBlaCar, Check24, Criteo, than 4 years old rope by size, [%] passed through our stagerope by size, [%] passed through our stage Videos and presentations of all past conferences Deliveroo, Delivey Hero, Farfetch, Gett, HelloFresh, Live audience of 100 (Berlin) to 200 (London), video King.com, MoneySuperMarket, Scout24, Spotify, live stream and inclusion in NOAH media library Corporate champions attending regularly NOAH: Stripe, TransferWise, Trivago, UBER, WeWork, 3 winners (online voting) present on main stage at Credit Suisse, Daimler, Deutsche Bank, Digital Wix, Yandex, etc. next NOAH McKinsey, eBay, Facebook, Google, ING, Naspers, Porsche, Priceline, ProSiebenSat.1, TUI, etc. Unique track record of funding origination NOAH17 BERLIN ATTENDEES BY COUNTRY 70% Germany 8% UK NOAH17 BERLIN SPEAKER BOOK WNNERS TO DATE 4% Switzerland 2% US STARTUP STAGE 16% Other NOAH17 London: #1 The Work Crowd, #2 Misterporter, #3 Everdine ATTENDEES BY SENIORITY NOAH17 Berlin: #1 Lalafo, #2 Bitbond, #3 TravelPerk NOAH16 London: #1 Beezer, #2 CodeMonkey, #3 EyefitU 28% C-Level CLICK NOAH16 Berlin: #1 Fraugster, #2 123Sonography, 21% Investment Partner TO VIEW #3 adMingle, #4 Scalable Capital, #5 Webdata Solutions 7% Owner, Founder SEVENVENTURES PITCH DAY 2% Board Member NOAH15 London SnapCam 42% Other NOAH15 Berlin Withings NOAH14 London Cashboard ~60% senior decision makers NOAH13 London GetYourGuide 20

NOAH CONNECTS CAPITAL AND ENTREPRENEURS TO INVEST, RAISE MONEY AND BUILD LONG TERM INVESTOR RELATIOSHIPS INVESTORS AT NOAH VC PANEL INVESTOR BOOK NOAH hosts the top VC, Growth Capital and A classic session at NOAH since 2009 100 - 150 detailled investor profiles with Buyout investors interested in Internet Berlin 2018: Lakestar, Generation Investment contact details and the NOAH Investor Book We hosted on main stage 60% of the top 50 and Management, Insight Venture Partners, We do the NOAH Investor Book since 2013 56% of the top 80 digital M&A Exits in Europe Permira and Holtzbrinck Ventures over the last 7 years since the launch of NOAH Conference in Nov 2009 NOAH17 BERLIN INVESTOR BOOK 11 Investors present their portfolio Stars on NOAH18 Berlin Main Stage 700+ VC, Growth and Buyout investors at NOAH18 Berlin 500 unique investor funds attended NOAH to date CLICK TO VIEW TOP INVESTORS COME TO NOAH REGULARLY! - Total Attendees over the Last 8 Years 1. Lakestar 91 14. Macquarie Capital 32 27. Earlybird Venture Capital 23 40. Deutsche Telekom Capital 15 2. Index Ventures 76 15. MCI Capital 32 28. Atomico Ventures 22 Partners 3. Hellman & Friedman 74 16. e.ventures 30 29. Nokia Growth Partners 20 41. Advent International 14 4. Holtzbrinck Ventures 68 17. Acton Capital 30 30. Northzone 20 42. Balderton Capital 14 5. KKR 63 18. EQT Partners 29 31. Oakley Capital 20 43. Harbert Management 14 6. SevenVentures 61 19. TCV 29 32. HPE Growth Capital 19 Corporation 7. Target Global 49 20. Spectrum Equity Investors 25 33. Scottish Equity Partners 17 44. Permira 14 8. Vitruvian Partners 49 21. Maryland 25 34. Highland Capital Partners 17 45. Endeit 13 9. General Atlantic 46 22. Partech Ventures 25 35. Silver Lake Partners 16 46. Vulcan Capital 13 10. Accel Partners 42 23. Insight Venture Partners 25 36. DN Capital 16 47. Creathor Venture 13 11. TA Associates 37 24. Project A Ventures 24 37. TPG Capital 16 48. EMK Capital 13 12. Eight Roads 37 25. Goldman Sachs 24 38. InVenture Partners 15 49. Great Hill Partners 12 13. Summit Partners 33 26. HgCapital 23 39. Providence Equity 15 50. Finstar Financial Group 11 21

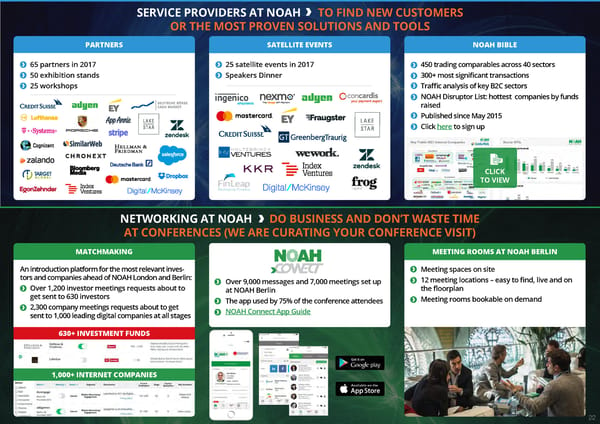

SERVICE PROVIDERS AT NOAH TO FIND NEW CUSTOMERS OR THE MOST PROVEN SOLUTIONS AND TOOLS PARTNERS SATELLITE EVENTS NOAH BIBLE 65 partners in 2017 25 satellite events in 2017 450 trading comparables across 40 sectors 50 exhibition stands Speakers Dinner 300+ most significant transactions 25 workshops Traffic analysis of key B2C sectors NOAH Disruptor List: hottest companies by funds raised Published since May 2015 Click here to sign up CLICK TO VIEW NETWORKING AT NOAH DO BUSINESS AND DON’T WASTE TIME AT CONFERENCES (WE ARE CURATING YOUR CONFERENCE VISIT) MATCHMAKING MEETING ROOMS AT NOAH BERLIN An introduction platform for the most relevant inves- Meeting spaces on site tors and companies ahead of NOAH London and Berlin: Over 9,000 messages and 7,000 meetings set up 12 meeting locations – easy to find, live and on Over 1,200 investor meetings requests about to at NOAH Berlin the floorplan get sent to 630 investors The app used by 75% of the conference attendees Meeting rooms bookable on demand 2,300 company meetings requests about to get NOAH Connect App Guide sent to 1,000 leading digital companies at all stages 630+ INVESTMENT FUNDS 1,000+ INTERNET COMPANIES 22

OUR MOST COMPELLING SESSION TRAVIS KALANICK DR. DIETER ZETSCHE Founder CEO NOAH CONFERENCE 2017 HIGHLIGHTS TO WATCH Whitney Wolfe, Bumble Are you Ready for Take Off? Sebastiaan Vaessen Dharmash Mistry, Lakestar Investor Panel Andrey Andreev, Badoo Remo Gerber, Lilium Naspers Peter Smith, Blockchain EMK Capital, Insight Venture Florian Reuter, Volocopter Partners, Target Global, iAngels Glenn Fogel Christian Sewing John Collison Online Food Delivery Panel Mobility Panel Priceline Group Deutsche Bank Stripe Takeaway.com, JUST EAT, BlaBlaCar, Drivy, FlixBus, Delivery Hero, 10bis DriveNow, car2go, Gett 23

NOAH IS A UNICORN BREEDING GROUND Challengers with a combined valuation of > $150bn and Champions with a combined market cap of > $2,800bn presented at NOAH since 2009 Speaking # of Times First Segment Founded Raised Current Status Speaking # of Times First Segment Founded Raised Current Status Company at NOAH Time ($m) Company at NOAH Time ($m) Challengers Challengers Adyen 11 2010 Payments 2006 266 Reached unicorn status Uber 1 2016 Taxi Apps 2009 11,562 Reached unicorn status AutoTrader 4 2010 Classifieds - Cars 1977 - $4.74bn market cap Waze 3 2011 Navigation & Parking 2007 67 Sold to Google for $1.1 Avast 1 2012 Cybersecurity & Anti-Virus 1988 100 Reached unicorn status WeWork 4 2015 Workspaces 2010 9,854 Valued at $20bn AVG 2 2009 Cybersecurity & Anti-Virus 1991 252 Sold to Avast for $1.3bn Wix.com 4 2012 Horizontal SaaS 2006 59 $3.07bn market cap after IPO Wooga 7 2011 Gaming 2009 32 Successful private company Babylon Health 2 2013 Health & MedTech 2013 85 Successful private company XING 9 2009 Content & Media 2003 7 $1.74bn market cap BlaBlaCar 7 2013 Rider Sharing & Car Pooling 2006 335 Reached unicorn status Yad2 6 2012 Classifieds - Horizontal 2005 - Sold to Axel Springer Careem 1 2017 Rider Sharing & Car Pooling 2012 571 Valued at $1.2bn for $228m CHECK24 2 2015 Lead Generation Services 1999 - Reached unicorn status Yandex 7 2012 Content & Media 2000 - $10.23bn market cap Cloudflare 2 2016 Cybersecurity & Anti-Virus 2009 182 Valued at $3.2bn Zooplus 1 2011 Vertical E-Commerce 1999 - $1.13bn market cap CTS Eventim 7 2012 Marketplaces 1999 - $4.11bn market cap Zalando 7 2011 Fashion E-Commerce 2008 468 $12.92bn market cap Criteo 8 2009 Display & Retargeting 2005 63 $2.89bn market cap Zendesk 4 2012 Horizontal SaaS 2007 86 $2.94bn market cap Deliveroo 1 2015 Meal Delivery 2013 860 Reached unicorn status Delivery Hero 9 2010 Meal Delivery 2011 2,581 $7.17bn market cap Total Capital Raised: $34bn Total Valuation: > $150bn Farfetch 2 2011 Fashion E-Commerce 2007 702 Reached unicorn status Fotolia 10 2009 Marketplaces 2005 225 Sold to Adobe for $800m Champions Gett 7 2012 Taxi Apps 2010 613 Reached unicorn status GetYourGuide 7 2013 Travel 2008 96 Successful private company Adidas 1 2016 Consumer Goods 1949 - $48.14bn market cap Immobiliare 3 2014 Travel 2005 - Successful private company AXA 3 2015 Insurance & Finance 1982 - $72.8bn market cap Ironsource 2 2012 Developer Tools 2009 105 Reached unicorn status Axel Springer 10 2010 Digital & Media 1946 - $7.17bn market cap iZettle 2 2013 Payments 2010 269 Successful private company Bayer 3 2015 Healthcare 1863 - $114.17bn market cap Just Eat 2 2014 Meal Delivery 2001 72 $6.16bn market cap Bertelsmann 9 2010 Digital & Media 1835 - Private company Klarna 4 2012 Payments 2005 637 Valued at $2.5bn BMW 3 2015 Automotive 1916 - $67.79bn market cap King.com 7 2010 Gaming 2003 84 Sold to EA for $5.9bn after IPO Daimler 3 2015 Automotive 1998 - $85.82bn market cap Kreditech 8 2010 Personal Loans 2012 497 Successful private company Deutsche Bahn 2 2015 Travel & Transportation 1994 - Government controlled company Markafoni 2 2012 Fashion E-Commerce 2008 8 Sold to Naspers for $200m Deutsche Börse 6 2012 Finance & Banking 1992 - $21.29bn market cap Momondo Group 5 2011 Travel 1996 152 Sold to Priceline Group eBay 11 2010 Digital & Media 1995 - $40.3bn market cap for $550m Facebook 12 2009 Digital & Media 2004 2.336 $498.65bn market cap MoneySuperMarket 3 2011 Lead Generation Services 1993 - $2.86bn market cap Google 10 2010 Digital & Media 1998 - $678.60bn market cap Photobox 3 2013 Marketplaces 2000 305 Sold to Exponent & Electra Huffington Post 4 2012 Digital & Media 2005 - Acquired by AOL for $615m IAC 1 2015 Digital & Media 1995 - $9.76bn market cap Privalia 5 2011 Fashion E-Commerce 2006 219 Sold to Vente-Privee for $560 innogy 6 2014 Industrials 2015 - $24.97bn market cap Scout24 9 2011 Marketplaces 1998 - $4.3bn market cap Klöckner & Co 3 2016 Industrials 1906 - $1.20bn market cap SeLoger 7 2010 Classifieds - Real Estate 1992 - Sold to Axel Springer for $847 Lufthansa 5 2015 Travel & Transportation 1953 - $13.64bn market cap Showroomprive 8 2010 Fashion E-Commerce 2006 44 $717m market cap METRO Group 6 2011 Consumer Goods 1996 - $7.33bn market cap Sigfox 2 2016 Internet of Things 2010 327 Valued at $708m Naspers 10 2010 Digital & Media 1915 - $103.4bn market cap SimilarWeb 5 2014 Analytics & Intelligence 2007 112 Successful private company Porsche 5 2015 Automotive 1931 - $9.88bn market cap Skrill 6 2009 Payments 2001 800 Sold to Optimal Payments Priceline Group 8 2011 Travel & Transportation 1997 - $94.18bn market cap for $1.98bn ProSiebenSat.1 Media 10 2010 Digital & Media 2000 - $8.16bn market cap Skyscanner 3 2012 Travel 2003 197 Sold to Ctrip for $1.7bn RTL 10 2009 Digital & Media 1931 - $11.74bn market cap Spotify 5 2009 Music 2006 2,563 Getting ready for $16bn Schibsted 7 2011 Digital & Media 1839 - $5.64bn market cap rumoured IPO Siemens 7 2013 Industrials 1847 - $127.19bn market cap Stripe 3 2015 Payments 2010 440 Valued at $9.2bn Tencent 1 2014 Digital & Media 1898 - $429.81bn market cap Taboola 2 2014 Content Advertising 2007 160 Reached unicorn status ThyssenKrupp 1 2017 Industrials 1999 - $17.00bn market cap tado° 6 2013 Internet of Things 2011 56 Successful private company TUI 1 2017 Travel & Transportation 1923 - $10.17bn market cap TeamViewer 4 2015 Communication & Collaboration 2005 - Sold to Permira for $1bn Vivendi 3 2012 Digital & Media 1853 - $32.50bn market cap TomTom 2 2015 Navigation & Parking 1991 - $2.55bn market cap VISA 1 2017 Insurance & Finance 1958 - $245.9bn market cap Trainline 3 2011 Travel 1997 - Sold to KKR for $681 WPP 5 2012 Advertising 1971 - $23.36bn market cap Transferwise 4 2011 Banking Fintech 2010 116 Reached unicorn status Total Market Cap: $3tn trivago 5 2011 Travel 2005 54 $3.17bn market cap Unicorns Source: Unicorn definition actual reported data where available and NOAH estimates. 24

THE TOP 80 DIGITAL EUROPEAN M&A DEALS BY SIZE IN THE LAST 7 YEARS We hosted on main stage 56% of the top 80 digital M&A Exits (€45bn combined EV) in Europe since the launch of NOAH Conference in Nov 2009 Date Acquiror Target Target Country Adjusted EV Date Acquiror Target Target Country Adjusted EV (€m) (€m) Jun 16 Tencent Supercell (84%) Finland 9,687 Sep 10 Schibsted LeBoncoin (remaining 50%) France 400 Aug 15 Paddy Power Betfair Group (merger) UK 6,824 Jan 14 Zynga NaturalMotion UK 388 May 11 Microsoft Skype Luxemburg 5,899 Oct 14 Publicis Matomy (24.9%) Israel 383 Nov 15 Activision Blizzard King.com UK 4,539 Jan 14 Google DeepMind United Kingdom 365 Mar 15 YOOX Net-a-Porter (merger) UK 3,120 Jan 13 Ingenico Ogone Belgium 360 Oct 16 Cinven, Permira, Mid Europa Allegro Poland 3,033 Feb 12 Ahold Bol.com Netherlands 350 May 17 Moody’s Bureau van Dijk Netherlands 3,000 Aug 14 Delivery Hero Pizza.de Germany 300 Oct 15 Naspers Avito (50.6%) Russia 2,152 Aug 15 Ströer InteractiveMedia Germany 300 Jan 14 Apax Partners Trader Media Group UK 2,126 Jul 10 Permira eDreams Spain 300 Nov 13 Hellman & Friedman Scout24 Germany 2,000 Sep 16 ProSiebenSat.1 Parship (51%) Germany 300 Sep 14 Microsoft Mojang Sweden 1,932 Mar 17 Altice Teads.tv France 300 Dec 16 Go Daddy Host Europe Group Germany 1,690 Apr 16 Rakuten Cabify Spain 283 Dec 16 Ctrip Skyscanner UK 1,622 Feb 13 Partners Group Softonic (30%) Spain 275 Sep 14 mail.ru Vkontakte (remaining 48%) Russia 1,598 Jun 15 Vivendi DailyMotion (80%) France 271 Jul 17 Ingenico Bambora Sweden 1,500 Mar 16 Shandong Hongda Mining Co. Jagex UK 270 Jul 16 AVAST Software AVG Technologies Netherlands 1,170 Jun 15 7Commerce Verivox (80%) Germany 262 Mar 15 Optimal Payments Skrill UK 1,100 Jul 14 KKR Scout24 Schweiz & Omnimedia (49%) Switzerland 262 Jan 17 Zhejiang Jinke Entertainment Outfit7 Slovenia 1,000 Apr 15 Zoopla uSwitch UK 260 May 14 Permira Teamviewer Germany 870 May 17 MTG InnoGames (30%) Germany 260 Jun 13 Google Waze Israel 863 Dec 14 eSure Gocompare (50%) UK 241 Sep 14 Access Industries Perform Group UK 858 Jan 11 Amazon LoveFilm UK 236 Jul 14 Ingenico GlobalCollect Netherlands 820 Feb 17 Take-Two Social Point Spain 234 Dec 12 Expedia trivago (61.6%) Germany 774 Feb 15 Tamedia Ricardo Switzerland 228 Feb 14 CVC Capital Partners Avast Software Czech Republic 738 May 12 NTT DOCOMO Buongiorno Italy 223 Jul 15 Deutsche Boerse 360T Germany 725 Aug 12 AXA Private Equity Bestsecret.com Germany 223 Feb 14 Rakuten Viber Cyprus 658 Aug 15 Adidas Runtastic Austria 220 Dec 14 Adobe Fotolia Europe 645 May 15 Recruit Holdings Wahanda (70%) UK 218 Sep 10 Axel Springer Verlag SeLoger (87.6%) France 634 Mar 15 Recruit Holdings Quandoo (92.9%) Germany 213 Feb 15 Rocket Internet HelloFresh (51.7%) Germany 623 Jun 12 Naspers Netretail (79%) Netherlands 213 Jan 15 KKR thetrainline.com UK 595 Apr 16 AccorHotels OneFineStay UK 212 May 15 Delivery Hero Yemek Sepeti (88.6%) Turkey 594 Dec 14 Host Europe Intergenia Germany 210 Feb 17 Priceline Group Momondo Group UK 586 Dec 16 General Atlantic Hemnet (majority stake) Sweden 208 Oct 15 Exponent. Electra PhotoBox UK 546 May 11 LBO France Promovacances France 200 Jul 13 Cinven Host Europe UK 508 Jun 10 Rakuten PriceMinister France 200 Apr 16 Vente-Privée Privalia Spain 500 Jun 14 Bestseller M&M Direct UK 177 Feb 15 Rocket Internet Delivery Hero (30%) Germany 496 Mar 11 Privalia Dress for Less Germany 175 Mar 16 HgCapital Raet Netherlands 470 Apr 16 Nokia Withings France 170 Jul 13 TPG TSL Education UK 464 Sep 14 Neiman Marcus Mytheresa.com Germany 150 Mar 14 BC Partners CarTrawler Ireland 450 • Deal Value Top 80: EUR 77bn Feb 11 Odigeo (AXA and Permira) Opodo UK 450 Feb 15 Immowelt Immonet (merger) Germany 420 • Deal Value on NOAH Stage: EUR 45bn (59%) Apr 11 TA & Summit Bigpoint Germany 408 • 56% of Top 80 Deals presented at NOAH Note: Digital Companies trade sale exits (only one most recent deal counted per company). Green font denotes speaker at NOAH. 25

® INTRODUCTION TO SELECT COMPLETED TRANSACTIONS CASE STUDIES NOAH ADVISORS 26

EMK Capital Acquires a Majority Stake in Luminati NOAH Advisors provided financial advice to EMK Capital Transaction Summary August 2017 Acquisition of a Majority Stake in On 11 August 2017 EMK Capital agreed to acquire a majority stake in Luminati at an enterprise value of $200m Luminati‘s enterprise proxy solutions were separated from Hola Networks in 2014, which will now conti- nue to operate as a standalone company The founders will retain a significant stake in the company and Ofer Vilenski (Co-Founder) will continue to by serve as CEO of Luminati Horizons Ventures, DFJ Tamir Fishman, Trilogy Partners, DFJ, Magma Ventures, Iris Ventures, and others are selling their interests in Luminati as part of this transaction at a valuation of $200m Overview of Luminati Financial Advisor to EMK Capital Luminati is the world’s leading enterprise IP proxy network which allows businesses to see the internet from the consumers’ point of view Today’s websites are dynamic - showing different content, advertisements and prices based on viewers’ identifying information ® Luminati brings back transparency, enabling its enterprise customers to analyse websites through its proprietary network of over 30 million IP addresses Deal Teams The company serves corporate clients (including Fortune 500) across many different sectors for ad veri- fication, brand protection, price comparison, fraud prevention, data collection, cyber security, application performance measurement and more Mark Joseph, Simon Dexter, The company was founded by Ofer Vilenski and Derry Shribman who together earlier founded Jungo Daniel Rix-Standing (acquired by NDS in 2006) NOAH Advisors’ Role Marco Rodzynek, Jan Brandes, NOAH Advisors provided financial advice to EMK Capital, working with the team to review the opportunity ® Nikhil Parmar, Guglielmo Tognon based on in-depth knowledge of the B2B internet space and specialized intelligence on growth avenues for the years ahead 27

Silver Lake Makes a Strategic Investment in FlixBus NOAH Advisors acted as financial advisor to Silver Lake Transaction Summary December 2016 On 16 December 2016 Silver Lake announced that it has made a strategic investment in FlixBus, one of Investment in Europe’s leading innovators in travel technology Existing investors General Atlantic, Holtzbrinck Ventures and Daimler also participated in the new round The company has completed a number of acquisitions in recent years, and is well positioned to continue expansion through M&A with the support of Silver Lake by Overview of FlixBus FlixBus is the intercity bus travel company connecting large and medium-sized cities through its European-wide service network Works with more than 250 independent bus partners to offer a comprehensive network in Germany, Financial Advisor to Silver Lake France, Italy, Austria, and the Netherlands, as well as cross-border services to countries including Scandinavia, Spain, and the UK Roughly 60m travelers since inception Currently connects nearly 1,000 destination cities in 20 countries – with around 100k trips daily, often ® departing every 30 minutes International team of nearly 1,000 employees throughout Munich, Berlin, Paris, Milan and Zagreb as well NOAH Deal Team as thousands of bus drivers based all over Europe Founded in 2011 and officially launched in 2013 by Jochen Engert, André Schwämmlein and Daniel Krauss Marco Rodzynek Jan Brandes NOAH Advisors’ Role Nikhil Parmar ® Aleksander Skwarczek NOAH Advisors acted as financial advisor to Silver Lake Guglielmo Tognon Jochen Engert (Founder & MD) recently presented the company on the main stage at NOAH Berlin 2016 Aicha Fakhir CEOs from over 70% of Europe’s largest internet exits have presented on the NOAH stage at some point 28

ProSiebenSat.1 and General Atlantic Invest in KäuferPortal NOAH Advisors acted as exclusive financial advisor to KäuferPortal and its shareholders Transaction Summary October 2016 On 12 October 2016 KäuferPortal announced an investment from ProSiebenSat.1 Media SE and General Investment in Atlantic Each party acquires a 42 percent stake, buying out all non-management shareholders All other shares will remain with the company’s founders Robin Behlau and Mario Kohle Both of the founders will remain at KäuferPortal in their current functions; Robin Behlau as CEO, Mario by Kohle as chairman of the advisory board Overview of KäuferPortal 84% Ownership KäuferPortal is the market leading online portal in Germany that connects customers with a vendor network for consulting-intensive products and services for home improvement and financial services Exclusive Financial Advisor to KäuferPortal and its Shareholders Matches sellers advertising mostly regionally but offline with buyers researching online KäuferPortal helps consumers obtain and compare offers from regional companies before making a major purchase Received more than 1.2 million customer requests in the last 12 months ® Strong financial performance and ongoing profitability The top 10 product categories account for majority of revenues and are all profitable Deal Teams Founded in 2008 and headquartered in Berlin, Germany Robin Behlau, Mario Kohle, Mathias Klement, Jochen Ziervogel, Robert Schleusener NOAH Advisors’ Role Claas van Delden, Florian Tappeiner, NOAH Advisors acted as an exclusive financial advisor to KäuferPortal and its shareholders Sebastian Gschwender, Daniel Frechen NOAH Advisors worked closely with Käuferportal for around a year, exploring a number of strategic Jörn Nikolay, Christian Figge, options to position the company for the next phase in its growth story Christian Osterland Chairman Mario Kohle presented at NOAH Conference London main stage in November 2015 Marco Rodzynek, Jan Brandes, CEOs of over 70% of Europe’s largest Internet exits in the last years have presented on the NOAH Justus Lumpe, Nikhil Parmar, stage at some point ® Aleksander Skwarczek 29

Oakley Capital Sells Majority Stake in Parship Elite Group to ProSiebenSat.1 NOAH Advisors acted as financial advisor to Oakley Capital Transaction Summary September 2016 Acquisition of a Majority Stake in On 5 September 2016 Oakley Capital announced the sale of a majority stake in Parship Elite Group to ProSiebenSat.1 Media SE by The transaction values Parship Elite Group at €300m ProSiebenSat.1 will acquire 50% plus 1 share for an investment of €100m and will replace loans worth €100m with preferred capital from Oakley Capital and the existing management will keep just under 50% of the shares in the group Overview of Parship Elite Group at a valuation of €300m Launched in 2001 PARSHIP is the category inventor of online matchmaking in Europe Financial Advisor to Oakley Capital Since its launch in 2004, ElitePartner has been the #1 matchmaking service for academics and sophisticated singles After years of competition, PARSHIP and ElitePartner were merged as PARSHIP ELITE Group in 2015, ® forming the leading matchmaking group in Europe with significant growth potential With a market leading position in the online dating market in DACH PARSHIP ELITE Group is the largest Deal Teams online matchmaking player in Europe and number four in online dating worldwide Tim Schiffers, Henning Rönneberg, PARSHIP’s and ElitePartner’s well-known brands and strong customer focus have attracted 15m+ Marc Schachtel registered members to date, fueling the database with >1m new registered members every year Rebecca Gibson, Tom Twiney, Simon Dexter NOAH Advisors’ Role Daniel Havercroft, Marc Jones NOAH Advisors acted as financial advisor to Oakley Capital Marco Rodzynek, Jan Brandes, This marks NOAH Advisor’s 2nd transaction involving Oakley Capital, following Oakley’s purchase of Justus Lumpe, Aleksander Skwarczek, Facile.it in September 2014 where NOAH advised the seller ® Guglielmo Tognon 30

TA Associates Invests in Israeli Online Food Marketplace 10Bis NOAH Advisors acted as exclusive financial advisor to 10Bis and its shareholders Transaction Summary May 2016 Investment in On 23rd of May 2016, 10Bis (www.10bis.co.il) – #1 online platform in the Israeli restaurant and food ordering market – announced an investment by TA Associates 10Bis Financial details of the transaction were not disclosed TA Associates will help 10Bis to execute its multi-layered growth strategy, with the Israeli B2C market opportunity as its main focus in the short-term Overview of 10Bis by In the B2B market in Israel, 10bis operates a leading online food marketplace that allows businesses to provide employee meal benefits programs The 10bis platform is integrated into a company’s human resources and accounting systems, with employees’ allowances made available through a dedicated 10bis account Exclusive Financial Advisor to 10Bis and its shareholders 10bis clients include leading Israeli corporates as well as large multinational corporations Employees can make restaurant purchases via the 10bis mobile app or website, or by using a 10bis card in person at participating restaurants. Individuals can also use the 10bis platform to order personal meals from the comfort of their home ® In 2015, 10bis entered the B2C market with the launch of its direct-to-consumer offering The rapidly growing platform provides quick and easy access to thousands of restaurant menus, reviews and ratings, while offering discounts, special promotions and other benefits Deal Teams 10bis processes more than one million orders per month across a network of more than 3,500 Tamir Carmel, Tomer Fefer, restaurants in 20 cities in Israel Nurit Shaked Founded in 2000, 10bis is headquartered in Tel Aviv Naveen Wadhera, Morgan Seigler, NOAH Advisors’ Role Stefan Dandl, Max Cancre NOAH Advisors acted as exclusive financial advisor to 10Bis and its shareholders Rami Sofer, Veran Vistanetzky This marks NOAH Advisors’ 4th transaction in Israel in the last 24 months: Sell-side advisor to Drushim and its shareholders in its 70% stake sell to Yad2 in September 2015, advisor to BiScience in its minority Marco Rodzynek, Jan Brandes, deal with WPP in July 2015, and advisor to Yad2 and its shareholder Walla! in its 100% sale to Axel Nikhil Parmar, Aleksander Skwarczek Springer in May 2014 ® 31

Majority Stake in Israeli Jobs Portal Drushim Sold to Yad2 NOAH Advisors acted as exclusive financial advisor to Drushim and its shareholders Transaction Summary September 2015 Sale of a 70% stake in On 3rd of September 2015, Drushim (www.drushim.co.il) - one of the leading job classifieds sites in Israel - announced the acquisition of a 70% stake by Yad2, a subsidiary of Axel Springer Digital Classifieds Drushim (“ASDC”) The acquisition of Drushim accelerates Yad2’s strategy of building the largest jobs classifieds offering in Israel, the only segment in which it is not already market leader ASDC has a portfolio of leading online classifieds brands across Europe, including SeLoger, StepStone and Immonet to Terms of the transaction were not disclosed Overview of Drushim Launched in 2006, Drushim is a leader in Israeli online job classifieds with ~1.5m monthly visits Exclusive Financial Advisor to Drushim and its Shareholders (Similarweb, June 2015) Drushim is a key source of job candidates for many large companies in Israel, with over 10,000 active job listings Drushim’s market leading technology allows for efficient job matching while offering outstanding ® usability, features and a high-level of customer service Hundreds of blue chip and SME clients; household names such as Coca Cola, Intel, SanDisk, GAP and Orange among others Deal Teams The Tel Aviv based company has 37 employees and is led by its founding co-CEOs Dror Epstein and Yair Cohen Dror Epstein, Yair Cohen Andrea Sixt, Philipp Raidt, NOAH Advisors’ Role Ansgar Schönborn, Jan Philipp Gräfe NOAH Advisors acted as exclusive financial advisor to Drushim and its shareholders Yavin Gill-More, Ariel Kessel A steadfast execution was facilitated based on previous deal experience in the region and in-depth knowledge of the company, the industry, and intelligence around the best potential acquirers Marco Rodzynek, Jan Brandes, NOAH Advisors had acted as exclusive financial advisor to Yad2 and its shareholder Walla! in its 100% Nikhil Parmar, Marija Sevcenko sale to Axel Springer in May 2014 for $228m ® 32

Adobe Pays $800m For Fotolia, #1 EU Stock Photo Marketplace NOAH Advisors acted as the exclusive financial advisor to Fotolia and its selling shareholders Transaction Summary December 2014 Announcement of the sale of 100% of On 11th of December 2014, leading stock photography website Fotolia (www.fotolia.com) announced the 100% acquisition by Adobe Systems Inc. (NASDAQ:ADBE) for a cash consideration of $800 million The transaction will enable Adobe to further integrate a key resource for users of its flagship ‘Creative Cloud’ subscription software for professionals which includes Photoshop, Illustrator, InDesign, Dreamweaver and much more to Overview of Fotolia for $800m Launched in 2005, Fotolia is Europe’s leading stock photography website, providing its members with access to an ever-expanding library of creative content including images, vectors, illustrations and video clips Exclusive Financial Advisor to Fotolia and the Selling Shareholders Fotolia has over 500,000 photographers contributing images to the platform and 7 million users with a truly global presence through availability in 15 different languages Buyers can access a bank of over 34 million royalty-free files which can be used for any design project or document, without time limits ® The company is run by a highly experienced management team led by its founding CEO Oleg Tscheltzoff Deal Teams NOAH Advisors’ Role Oleg Tscheltzoff NOAH Advisors acted as the exclusive financial advisor to Fotolia and its selling shareholders Philipp Freise, Lucian Schonefelder, Fotolia has been a close relationship of NOAH Advisors for over 5 years and has presented at the NOAH Renald Kappel Conference since the first event in 2009 in London Previously, NOAH Advisors acted as Fotolia’s exclusive financial advisor in the $300m growth capital deal John Meeks with KKR in May 2012. The deal represented KKR’s first growth equity deal. KKR is investing from USD 30 million upwards to help entrepreneurs to scale their businesses globally In April 2009, NOAH Advisors was the exclusive financial advisor to Fotolia in the sale of a majority stake Marco Rodzynek, Jan Brandes, to TA Associates. This was the first transaction of NOAH Advisors ® Nikhil Parmar, Marija Sevcenko 33

Leading Classifieds Aggregator Trovit Sold to NEXT for €80 Million NOAH Advisors acted as the exclusive advisor to Trovit and its shareholders Transaction Summary October 2014 Announcement of the sale of 100% of On 7 October 2014, 100% of leading classifieds aggregator Trovit (www.trovit.com) announced the acquisition by publicly listed Japanese real estate information services provider NEXT (www.next-group.jp) Closing is subject to conditions precedent and expected for November 2014 Trovit will allow NEXT to build a massive platform offering real estate and lifestyle information from across to the world Overview of Trovit for €80m (JPY11.0bn) Launched in 2006 in Barcelona, Trovit is the world’s leading classifieds aggregator, providing its users with access to listings in real estate, cars, jobs, products and other segments Exclusive Financial Advisor to Trovit and its Shareholders Trovit has expertise in successfully operating websites worldwide, 20k content partnerships in 40 countries, and a base of 47m unique monthly visitors Trovit’s proprietary search engine technology allows users to swiftly find most relevant classifieds ads and narrow them down with enhanced and easy-to-use functionalities ® Trovit generated revenues of €17.6m and EBIT of €5.9m in 2013 Deal Teams The company is run by a highly experienced management team led by CEO Iñaki Ecenarro, who will join NEXT and continue to manage Trovit Iñaki Ecenarro, Daniel Giménez, Raúl Puente, Luis Martín Cabiedes, Jesús Monleón NOAH Advisors’ Role José María de Paz, Iñaki Frías NOAH Advisors acted as the exclusive financial advisor to Trovit and its shareholders, exploring options Takashi Inoue, Keizo Tsutsui with a number of strategic and financial investors Trovit has been in a close relationship with NOAH Advisors for a number of years and has presented at Marco Rodzynek, Jan Brandes, the NOAH Conference 2010, 2011 and 2012 ® Nikhil Parmar, Marija Sevcenko 34

Sale of Facile.it’s Controlling Stake to Oakley Capital Private Equity NOAH Advisors acted as the exclusive sell-side advisor to Facile.it and its shareholders in the majority stake sale of Italy’s leading price comparison website Transaction Summary September 2014 Sale of controlling stake in On 19 September 2014, controlling stake in Italy’s top price comparison website Facile.it was sold to Oakley Capital Private Equity (“OCPE”) OCPE will help Facile.it expand its operations and accelerate business development Facile.it joins Oakley’s portfolio of leading online brands which already includes German price comparison website Verivox to Overview of Facile.it Founded in April 2008, Facile.it is Italy’s #1 destination for consumers to make informed decisions about their motor insurance, household expenses and personal finance With a portfolio of gross written premia of €260m and over 580k clients Facile.it is by far the country’s largest (online and offline) motor insurance broker Exclusive Financial Advisor to Facile.it and its Shareholders Its strong insurance position is increasingly leveraged in other related verticals like ADSL, Gas & Power, Bank Accounts and, from mid-2014, also Cellular contracts Well-known household brand with 80% (prompted) brand recognition and 20% “top of mind” (twice that of the nearest competitor) ® Average of 1.4m unique visitors and 2.1m visits per month Expects to achieve over €35m of revenues and over €8m of EBITDA in 2014E Deal Teams Milan-based company employs 126 people and is run by a highly experienced management team led by Alberto Genovese, Andrea Piccioni, CEO Mauro Giacobbe Silvio Pagliani, Luigi Berlusconi, Angel Investors NOAH Advisors’ Role Mark Joseph, David Keech NOAH Advisors acted as the exclusive financial advisor to Facile.it and its shareholders, exploring options Luca Fossati, Patrizia Liguti, with a number of strategic and financial investors Christopher J. Mullen Facile.it has been in a close relationship of NOAH Advisors for a number of years and has presented at the NOAH Conference 2012 & 2013 Marco Rodzynek, Jan Brandes, Nikhil Parmar, Marija Sevcenko Chiomenti Studio Legale (Milan and London offices) acted as legal advisor to Facile.it’s shareholders ® 35

Walla! Sells Yad2 to Axel Springer Digital Classifieds for $228m NOAH Advisors acts as exclusive sell-side advisor to Bezeq, Walla! and Yad2 in the sale of Israel’s leading classifieds website Transaction Summary May 2014 On 6 May 2014, Walla!, Israel’s leading portal and fully owned subsidiary of telecommunications giant Bezeq, sold 100% of the shares in Coral-Tell Ltd, operator of the leading classifieds and advertising portal sold 100% of Yad2 (Yad2.co.il) to Axel Springer Digital Classifieds (ASDC) for USD 228 million in an all-cash transaction Bezeq and Walla! will use the proceeds to invest in strategic growth areas and de-leverage Yad2 will join ASDC’s portfolio of leading online classifieds brands which include SeLoger, StepStone and Immonet among others for $228m to Overview of Yad2 a joint venture between and Yad2 (Yad2.co.il) is the leading classifieds and advertising portal in Israel, with local brand awareness of almost 100%, built through wide presence across TV, radio, print, online and large scale fairs Exclusive Financial Advisor to Yad2 and its Shareholders Around 10,000 new ads are placed on the site daily from the strong user base of 3.8 million monthly unique visitors Yad2 became the dominant brand in Israeli classifieds across its broad offering in real-estate, vehicles, se- cond hand goods and more, despite having just been founded in 2005 by serial entrepreneur Shone Tell ® Yad2 solidified its market leadership under the ownership of Walla! Communications, which acquired 75% in July 2010 and the remainder in November 2013 The Tel Aviv based company has around 100 employees and is run by a strong management team under Deal Teams the leadership of CEO Yavin Gill-More and Chairman Ilan Yeshua Ilan Yeshua, CEO (Chairman Yad2) Gil Benyamini, CFO NOAH Advisors’ Role Yavin Gill-More, CEO NOAH Advisors acted as exclusive financial advisor to Yad2 and its shareholders, exploring options with a number of strategic and financial investors Ariel Kessel, CFO Yad2 has been a close relationship of NOAH Advisors for over 2 years and presented as one of the “Ri- sing Stars” at the NOAH Conference 2012 Marco Rodzynek, Jan Brandes, A steadfast execution was facilitated based on in-depth knowledge of the company, the industry, and Nikhil Parmar, Marija Sevcenko intelligence around the best potential acquirers ® 36

Softonic valued at €275m in a Growth Equity Investment NOAH Advisors advised Softonic on the deal, following a prior successful transaction completed in Dec 2009 Transaction Summary February 2013 Tomás Diago and Partners Group make up the majority of the shareholders team and lead Softonic together. However, Partners Group acquired 30% of Softonic and is the biggest single shareholder Partners Group will help Softonic to expand internationally, accelerate business development, and fund future acquisitions Growth equity investment from Overview of Softonic Softonic is the globally leading online consumer guide for software and apps, that helps people discover and enjoy software on any platform Tomás Diago created the concept behind Softonic in July 1997 and has since built the Company into a top-40 website worldwide with well over 140M users across various types of devices and platforms. for a 30% stake alongside Softonic’s Founders Softonic is also the #1 worldwide technology website and leading European-based internet company by traffic and Angel Investors at a valuation of €275m Following a successful global expansion, Softonic has become the worldwide #1 platform for software authors to market, distribute and monetize their products in more than 10 languages Exclusive Financial Advisor to Softonic and its shareholders With well over 160 million monthly downloads, Softonic has unrivalled global distribution power, enabling it to provide a unique one-stop-shop for various types of software advertising Over 160,000 software titles are available on Softonic with expert reviews, articles and videos Softonic has a global organization of about 350 employees, half of which are engineers and expert editors ® The $150 billion consumer software market has seen a shift away from license fees and software in boxes, towards freemium online/SaaS distribution models, which has been favorable for Softonic Mass-adoption of smartphones, tablets and app stores have led to a proliferation of software and apps Deal Teams These favorable market developments, along with Softonic’s attractive high margin business model and consistent growth track-record, make Softonic a highly attractive investment opportunity that moreover has a healthy pipeline of further growth opportunities for Partners Group Tomás Diago, Emilio Moreno NOAH Advisors’ Role Walter Keller, Stephan Seissl, Softonic has been a close relationship of NOAH Advisors for over 3 years Eugenio Marschner, Carlos Sanz In December 2009, NOAH Advisors advised Softonic on its sale of a minority stake to Digital River NOAH had worked intensively with Softonic and its shareholders on various strategic opportunities and discussed a future collaboration between Softonic and Partners Group Marco Rodzynek, Yoram Wijngaarde, NOAH Advisors acted as exclusive financial advisor to Softonic and its shareholders, and facilitated a Jan Brandes, Nikhil Parmar steadfast execution based on in-depth knowledge of the company, the industry, and intelligence around ® the best potential investor candidates 37

$300m Fotolia Investment is EU’s Largest Internet LBO in 2012 NOAH Advisors has been working with Fotolia since early 2009 and introduced KKR to the deal opportunity Transaction Summary May 2012 KKR is making a $150 million growth equity investment in Fotolia for a 50% stake. In addition, KKR, TA Associates and Management worked with KKR Capital Markets, who acted as sole arranger, HSBC, Llo- yds, GE Capital, IKB and Mizuho to put in place a senior $150 million senior financing for the Company. $150 million growth equity investment from KKR’s ability to raise this amount of debt in a challenging European financing market, clearly differentiated KKR in this transaction Although Fotolia is not raising new funds as part of the deal, the new partners will help it to expand inter- nationally, accelerate business development, and fund future acquisitions for a 50% stake alongside Fotolia’s Founders and Fotolia received is first growth investment from TA Associates in April 2009 Overview of Fotolia Fotolia is the leading European crowd-sourced market place for microstock images and video content Additional $150 million senior debt financing where over 3 million members to buy and license micro-stock images Total $300 million investment The Company was founded in October 2005 by Oleg Tscheltzoff and Thibaud Elziere. Management self-funded the company to become a major internet player, with market leading positions across Europe, Exclusive Financial Advisor to Fotolia and its shareholders and strong brand recognition (known as leader and creator of micro-stock in Europe) Over 145,000 professional and amateur photographers license their images via Fotolia With over 17 million digital images and videos to choose from, Fotolia offers one of the largest image databases of quality, for SMEs, individuals, graphical professionals, and corporates. Fotolia websites are ® operated in 15 countries in 11 languages (English, French, German, Spanish, Italian, Portuguese, Polish, Russian, Japanese, Turkish, and Korean) High structural market growth, attractive B2B online marketplace characteristics, predictable revenue Deal Teams streams and strong Fotolia leadership position driven by best-in-class management team make Fotolia a highly attractive growth investment for KKR Oleg Tscheltzoff, Thibaud Elziere The company has a global organization of about 80 employees, headquartered in New York NOAH Advisors’ Role John Meeks, Timo Kienle Fotolia has been a close relationship of NOAH Advisors for over 3 years Philipp Freise, Lucian Schonefelder, In April 2009, NOAH Advisors advised the Fotolia founders in their sale of a majority stake to TA Associates Vania Schlogel, Thijs van Remmen, NOAH had worked intensively with Fotolia and its shareholders on various strategic opportunities and Justin Lewis-Oakes, Valeria Rebulla introduced the deal to KKR, with whom NOAH has as long-standing institutional relationship NOAH Advisors acted as exclusive M&A financial advisor to Fotolia and its shareholders, and facilitated a Marco Rodzynek, Yoram Wijngaarde, fast execution based on in-depth knowledge the company, and intelligence around the best potential inves- ® Jan Brandes tor candidates 38

Toprural Transaction Case Study NOAH Advisors advised on the sale of the leading Spanish vacation rental website Transaction Summary April 2012 Sale of 100% in On 2 April 2012, HomeAway Inc., the world’s largest online marketplace for vacation rentals based in Aus- tin, Texas, USA, acquired a 100% of Toprural for an undisclosed amount in an all-cash transaction The acquisition broadens HomeAway’s reach in Europe and adds inventory that appeals to a seekers of long weekend getaways to small towns or countryside destinations Following the acquisition, COO Rafael Pérez-Olivares Hoepfl will serve as General Manager and replace to François Derbaix, who will stay on as a consultant during the transition. Toprural is the 18th acquisition for HomeAway Overview of Toprural Financial Advisor to Toprural and its Shareholders Toprural is a rural accommodation search engine focused on independently owned rental properties in rural France, Spain, Italy and Portugal Clear market leadership in Spain ® The company has ~12k paid and ~30k free listings for bed-and-breakfast properties and vacation rentals The Toprural website operates in 8 languages, including English Spanish, Portuguese, French, Catalan Deal Teams and Dutch and features accommodations varying from farmhouses in Tuscany to fincas in Mallorca The company was founded in 2000, has 46 employees and is based in Madrid Francois Derbaix, Founder and CEO Rafael Pérez-Olivares Hoepfl, COO NOAH Advisors’ Role NOAH Advisors has been working with Toprural and its shareholders since early 2010 Marco Rodzynek Toprural and NOAH Advisors worked together intensively, exploring options with a number of strategic Yoram Wijngaarde and financial investors ® Jan Brandes NOAH Advisors acted as financial advisor to Toprural and its selling shareholders 39

grupfoni Transaction Case Study NOAH Advisors advised on the majority sale of the market leading group buying company in Turkey Transaction Summary November 2011 Sale of a majority stake in On 9 November 2011, Quants Financial Services AG, a Swiss investment company acquired a majority stake in grupfoni for an undisclosed amount For majority shareholder Group Buying Global (GBG), a Zurich-based holding company run by Klaus Hommels and Oliver Jung, the transaction represents the latest in a series of highly successful exits from its portfolio of global group buying and private sales operators, following e.g. Markafoni and DeinDeal Management shareholders will continue to lead the company, backed by its new investors to Overview of grupfoni Quants Financial Services AG The company operates Turkey’s leading group buying site with 1.4 million members, over 300k followers on Facebook and up to 150k daily visitors To date, the company has sold over 1.4 million coupons in over 7,000 deals in the categories restaurants, Exclusive Financial Advisor to grupfoni and its Shareholders beauty, travel, nightlife amongst others grupfoni was founded in June 2010 in Istanbul by Burak Hatipo lu and Münteha Mangan grupfoni has established a market leading position in the Turkish group buying market despite competi- tion, mainly from Grupanya and SehirFirsati (Groupon) ® Turkey is one of the most exciting e-commerce markets in Europe with Internet penetration of ~45% and e-commerce usage only 5% of the population the last 12 months Deal Teams Young, emerging Internet population (40% are below 24, over 70% under 34) with relatively low, but increasing purchasing power Burak Hatipoglu, Co-founder and CEO Münteha Mangan, Co-founder and CSO NOAH Advisors’ Role GBG: Klaus Hommels, Oliver Jung, NOAH Advisors has maintained a close relationship with Group Buying Global for two years and has SELLERS Manu Gupta worked with Klaus Hommels and Oliver Jung on multiple occasions AlterInvest: Samih Toukan, Hussam NOAH Advisors was mandated following inbound interest to acquire the grupfoni Khouri grupfoni and NOAH Advisors worked together intensively, exploring options with a number of strategic Marco Rodzynek, Jan Brandes, and financial investors ® Yoram Wijngaarde NOAH Advisors acted as exclusive financial advisor to grupfoni and its selling shareholders 40

EnGrande Transaction Case Study NOAH Advisors partnered with EnGrande, exploring a range of strategic alternatives, resulting in a highly successful outcome for all parties Transaction Rationale July 2011 Sale of a majority stake in The online accommodation bookings market has proven to be a massive opportunity. Gross bookings of the European hotel sector are estimated to total about €85 billion per annum, of which online bookings currently account for around €14 billion The European budget accommodation sector itself is currently worth approximately €15 billion per annum and is rapidly growing, in part due to the expansion of low cost carriers the owner of The fragmented nature of accommodation suppliers and their low online penetration presents EnGrande with a strong opportunity to accelerate the growth of its network of providers A key part of the growth plan is a shared commitment to grow the platform to become the leader in the to budget accommodation category Palamon Capital Partners is a leading European mid-market private equity firm The terms of the transaction were not disclosed at a valuation of €40m Overview of EnGrande Exclusive Financial Advisor to EnGrande S.L. EnGrande S.L. (“EnGrande” or “the Company”) was established in 2003 by founder and CEO John Erceg to generate bookings for budget hotels and apartments Following a period of rapid expansion across Europe and selected cities in America and Asia-Pacific, the Company now has more than 7,000 establishments worldwide directly contracted to its service and ® processes more than €80 million of bookings per annum EnGrande’s websites, which include www.budgetplaces.com, and a network of dedicated 30’s city websites, such as www.london30.com and www.amsterdam30.com, are aimed at cost-conscious, Deal Teams mostly European leisure and business travellers The Company employs 85 staff and is headquartered in Barcelona with offices in New York and Dublin John Erceg (founder and CEO) The EnGrande team is passionate about finding new well-located, cheap and clean establishments, partnering with hoteliers to fill their rooms profitably with a unique easy-to-use backoffice system which offers maximum administrative efficiency Fabio Massimo Giuseppetti, Jaime-Enrique Hugas, Ricardo Caupers NOAH Advisors’ Role Sponsor: Louis Elson EnGrande decided to partner with NOAH Advisors, following inbound interest to acquire the Company Marco Rodzynek, Yoram Wijngaarde, EnGrande and NOAH Advisors worked together intensively on exploring a wide range of strategic alternatives, while the Company grew from strength to strength was able to scale its platform rapidly ® Jan Brandes NOAH Advisors acted as exclusive M&A financial advisor to EnGrande 41

® www.noah-advisors.com INTRODUCTION TO www.noah-conference.com NOAH ADVISORS