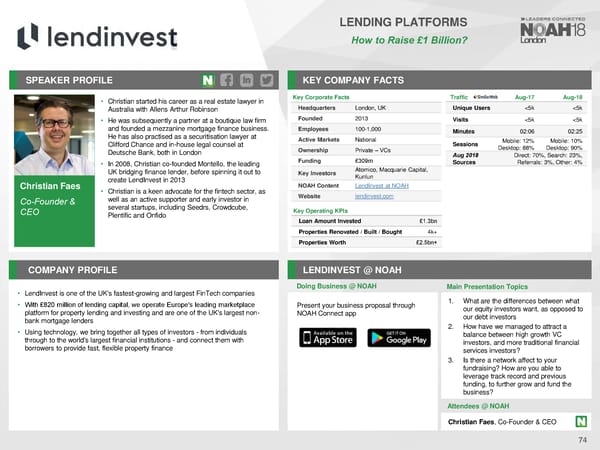

LENDING PLATFORMS How to Raise £1 Billion? SPEAKER PROFILE KEY COMPANY FACTS • Christian started his career as a real estate lawyer in Key Corporate Facts Traffic Aug-17 Aug-18 Australia with Allens Arthur Robinson Headquarters London, UK Unique Users <5k <5k • He was subsequently a partner at a boutique law firm Founded 2013 Visits <5k <5k and founded a mezzanine mortgage finance business. Employees 100-1,000 Minutes 02:06 02:25 He has also practised as a securitisation lawyer at Active Markets National Mobile: 12% Mobile: 10% Clifford Chance and in-house legal counsel at Ownership Private – VCs Sessions Desktop: 88% Desktop: 90% Deutsche Bank, both in London Aug 2018 Direct: 70%, Search: 23%, • In 2008, Christian co-founded Montello, the leading Funding £309m Sources Referrals: 3%, Other: 4% UK bridging finance lender, before spinning it out to Key Investors Atomico, Macquarie Capital, create LendInvest in 2013 Kunlun Christian Faes • Christian is a keen advocate for the fintech sector, as NOAH Content LendInvest at NOAH well as an active supporter and early investor in Website lendinvest.com Co-Founder & several startups, including Seedrs, Crowdcube, Key Operating KPIs CEO Plentific and Onfido Loan Amount Invested £1.3bn Properties Renovated / Built / Bought 4k+ Properties Worth £2.5bn+ COMPANY PROFILE LENDINVEST @ NOAH Doing Business @ NOAH Main Presentation Topics • LendInvest is one of the UK's fastest-growing and largest FinTech companies 1. What are the differences between what • With £820 million of lending capital, we operate Europe's leading marketplace Present your business proposal through our equity investors want, as opposed to platform for property lending and investing and are one of the UK's largest non- NOAH Connect app our debt investors bank mortgage lenders 2. How have we managed to attract a • Using technology, we bring together all types of investors - from individuals balance between high growth VC through to the world's largest financial institutions - and connect them with investors, and more traditional financial borrowers to provide fast, flexible property finance services investors? 3. Is there a network affect to your fundraising? How are you able to leverage track record and previous funding, to further grow and fund the business? Attendees @NOAH Christian Faes, Co-Founder & CEO 74

NOAH18 London Speaker Book Page 72 Page 74

NOAH18 London Speaker Book Page 72 Page 74