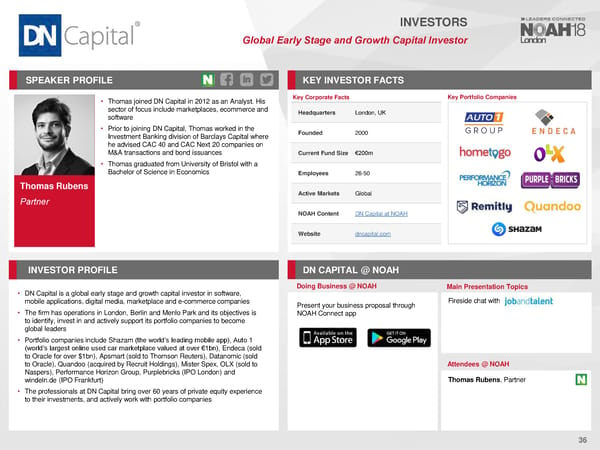

INVESTORS Global Early Stage and Growth Capital Investor SPEAKER PROFILE KEY INVESTORFACTS • Thomas joined DN Capital in 2012 as an Analyst. His Key Corporate Facts Key Portfolio Companies sector of focus include marketplaces, ecommerce and Headquarters London, UK software • Prior to joining DN Capital, Thomas worked in the Founded 2000 Investment Banking division of Barclays Capital where he advised CAC 40 and CAC Next 20 companies on M&A transactions and bond issuances Current Fund Size €200m • Thomas graduated from University of Bristol with a Bachelor of Science in Economics Employees 26-50 Thomas Rubens Active Markets Global Partner NOAHContent DN Capital at NOAH Website dncapital.com INVESTORPROFILE DN CAPITAL @ NOAH Doing Business @ NOAH Main Presentation Topics • DN Capital is a global early stage and growth capital investor in software, mobile applications, digital media, marketplace and e-commerce companies Present your business proposal through Fireside chat with • The firm has operations in London, Berlin and Menlo Park and its objectives is NOAH Connect app to identify, invest in and actively support its portfolio companies to become global leaders • Portfolio companies include Shazam (the world’s leading mobile app), Auto 1 (world’s largest online used car marketplace valued at over €1bn), Endeca (sold to Oracle for over $1bn), Apsmart (sold to Thomson Reuters), Datanomic (sold to Oracle), Quandoo (acquired by Recruit Holdings), Mister Spex, OLX (sold to Attendees @NOAH Naspers), Performance Horizon Group, Purplebricks (IPO London) and windeln.de (IPO Frankfurt) Thomas Rubens,Partner • The professionals at DN Capital bring over 60 years of private equity experience to their investments, and actively work with portfolio companies 36

NOAH18 London Speaker Book Page 35 Page 37

NOAH18 London Speaker Book Page 35 Page 37