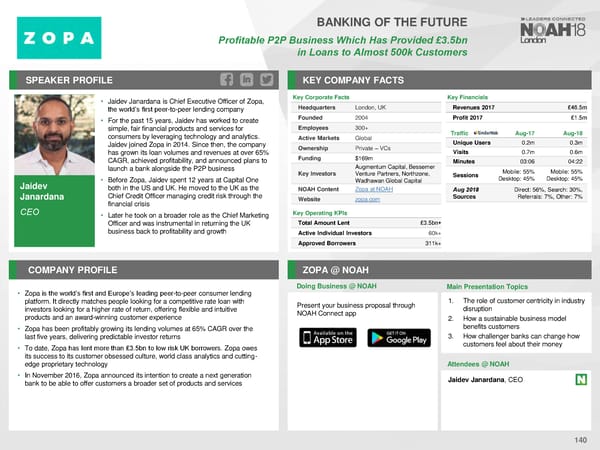

BANKING OF THE FUTURE Profitable P2P Business Which Has Provided £3.5bn in Loans to Almost 500k Customers SPEAKER PROFILE KEY COMPANY FACTS • Jaidev Janardana is Chief Executive Officer of Zopa, Key Corporate Facts Key Financials the world’s first peer-to-peer lending company Headquarters London, UK Revenues 2017 £46.5m • For the past 15 years, Jaidev has worked to create Founded 2004 Profit 2017 £1.5m simple, fair financial products and services for Employees 300+ Traffic Aug-17 Aug-18 consumers by leveraging technology and analytics. Active Markets Global Unique Users 0.2m 0.3m Jaidev joined Zopa in 2014. Since then, the company Ownership Private – VCs has grown its loan volumes and revenues at over 65% Visits 0.7m 0.6m CAGR, achieved profitability, and announced plans to Funding $169m Minutes 03:06 04:22 launch a bank alongside the P2P business Augmentum Capital, Bessemer Mobile: 55% Mobile: 55% • Before Zopa, Jaidev spent 12 years at Capital One Key Investors Venture Partners, Northzone, Sessions Desktop: 45% Desktop: 45% Jaidev Wadhawan Global Capital both in the US and UK. He moved to the UK as the NOAHContent Zopa at NOAH Aug 2018 Direct: 56%, Search: 30%, Janardana Chief Credit Officer managing credit risk through the Website zopa.com Sources Referrals: 7%, Other: 7% financial crisis CEO • Later he took on a broader role as the Chief Marketing Key Operating KPIs Officer and was instrumental in returning the UK Total Amount Lent £3.5bn+ business back to profitability and growth Active Individual Investors 60k+ Approved Borrowers 311k+ COMPANY PROFILE ZOPA @ NOAH Doing Business @ NOAH Main Presentation Topics • Zopa is the world’s first and Europe’s leading peer-to-peer consumer lending platform. It directly matches people looking for a competitive rate loan with Present your business proposal through 1. The role of customer centricity in industry investors looking for a higher rate of return, offering flexible and intuitive NOAH Connect app disruption products and an award-winning customer experience 2. How a sustainable business model • Zopa has been profitably growing its lending volumes at 65% CAGR over the benefits customers last five years, delivering predictable investor returns 3. How challenger banks can change how • To date, Zopa has lent more than £3.5bn to low risk UK borrowers. Zopa owes customers feel about their money its success to its customer obsessed culture, world class analytics and cutting- edge proprietary technology Attendees @NOAH • In November 2016, Zopa announced its intention to create a next generation Jaidev Janardana, CEO bank to be able to offer customers a broader set of products and services 140

NOAH18 London Speaker Book Page 138 Page 140

NOAH18 London Speaker Book Page 138 Page 140