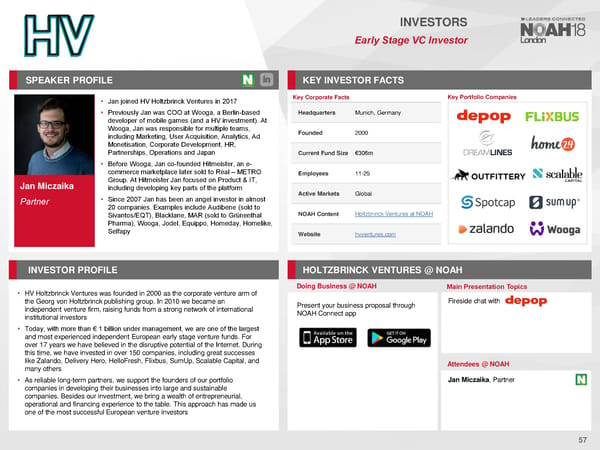

INVESTORS Early Stage VC Investor SPEAKER PROFILE KEY INVESTORFACTS Key Corporate Facts Key Portfolio Companies • Jan joined HV Holtzbrinck Ventures in 2017 • Previously Jan was COO at Wooga, a Berlin-based Headquarters Munich, Germany developer of mobile games (and a HV investment). At Wooga, Jan was responsible for multiple teams, Founded 2000 including Marketing, User Acquisition, Analytics, Ad Monetisation, Corporate Development, HR, Partnerships, Operations and Japan Current Fund Size €306m • Before Wooga, Jan co-founded Hitmeister, an e- commerce marketplace later sold to Real – METRO Employees 11-25 Jan Miczaika Group. At Hitmeister Jan focused on Product & IT, including developing key parts of the platform Active Markets Global • Since 2007 Jan has been an angel investor in almost Partner 20 companies. Examples include Audibene (sold to NOAHContent Holtzbrinck Ventures at NOAH Sivantos/EQT), Blacklane, MAR (sold to Grünenthal Pharma), Wooga, Jodel, Equippo, Homeday, Homelike, Selfapy Website hvventures.com INVESTORPROFILE HOLTZBRINCK VENTURES @ NOAH Doing Business @ NOAH Main Presentation Topics • HV Holtzbrinck Ventures was founded in 2000 as the corporate venture arm of the Georg von Holtzbrinck publishing group. In 2010 we became an Present your business proposal through Fireside chat with independent venture firm, raising funds from a strong network of international NOAH Connect app institutional investors • Today, with more than € 1 billion under management, we are one of the largest and most experienced independent European early stage venture funds. For over 17 years we have believed in the disruptive potential of the Internet. During this time, we have invested in over 150 companies, including great successes like Zalando, Delivery Hero, HelloFresh, Flixbus, SumUp, Scalable Capital, and Attendees @NOAH many others • As reliable long-term partners, we support the founders of our portfolio Jan Miczaika, Partner companies in developing their businesses into large and sustainable companies. Besides our investment, we bring a wealth of entrepreneurial, operational and financing experience to the table. This approach has made us one of the most successful European venture investors 57

NOAH18 London Speaker Book Page 55 Page 57

NOAH18 London Speaker Book Page 55 Page 57