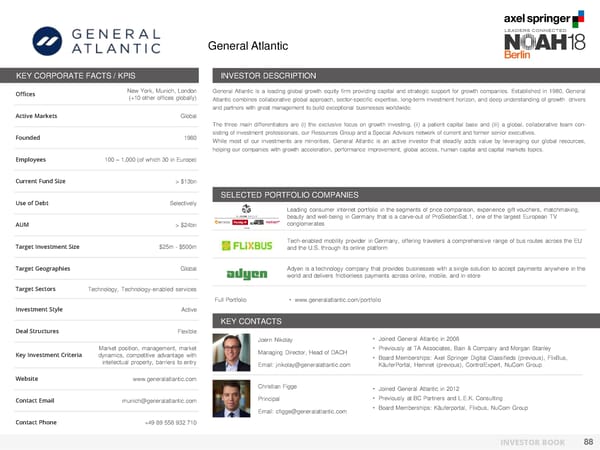

General Atlantic KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices New York, Munich, London General Atlantic is a leading global growth equity firm providing capital and strategic support for growth companies. Established in 1980, General (+10 other offices globally) Atlantic combines collaborative global approach, sector-specific expertise, long-term investment horizon, and deep understanding of growth drivers and partners with great management to build exceptional businesses worldwide. Active Markets Global The three main differentiators are (i) the exclusive focus on growth investing, (ii) a patient capital base and (iii) a global, collaborative team con- Founded 1980 sisting of investment professionals, our Resources Group and a Special Advisors network of current and former senior executives. While most of our investments are minorities, General Atlantic is an active investor that steadily adds value by leveraging our global resources, helping our companies with growth acceleration, performance improvement, global access, human capital and capital markets topics. Employees 100 – 1,000 (of which 30 in Europe) Current Fund Size > $13bn SELECTED PORTFOLIO COMPANIES Use of Debt Selectively Leading consumer internet portfolio in the segments of price comparison, experience gift vouchers, matchmaking, beauty and well-being in Germany that is a carve-out of ProSiebenSat.1, one of the largest European TV AUM > $24bn conglomerates … Tech-enabled mobility provider in Germany, offering travelers a comprehensive range of bus routes across the EU Target Investment Size $25m - $500m and the U.S. through its online platform Target Geographies Global Adyen is a technology company that provides businesses with a single solution to accept payments anywhere in the world and delivers frictionless payments across online, mobile, and in-store Target Sectors Technology, Technology-enabled services Full Portfolio • www.generalatlantic.com/portfolio Investment Style Active KEY CONTACTS Deal Structures Flexible Joern Nikolay • Joined General Atlantic in 2008 Market position, management, market Managing Director, Head of DACH • Previously at TA Associates, Bain & Company and Morgan Stanley Key Investment Criteria dynamics, competitive advantage with • Board Memberships: Axel Springer Digital Classifieds (previous), FlixBus, intellectual property, barriers to entry Email: jnikolay@generalatlantic.com KäuferPortal, Hemnet (previous), ControlExpert, NuCom Group Website www.generalatlantic.com Christian Figge • Joined General Atlantic in 2012 Contact Email munich@generalatlantic.com Principal • Previously at BC Partners and L.E.K. Consulting Email: cfigge@generalatlantic.com • Board Memberships: Käuferportal, Flixbus, NuCom Group Contact Phone +49 89 558 932 710 INVESTOR BOOK 88

NOAH Berlin 2018 - Investor Book Page 88 Page 90

NOAH Berlin 2018 - Investor Book Page 88 Page 90