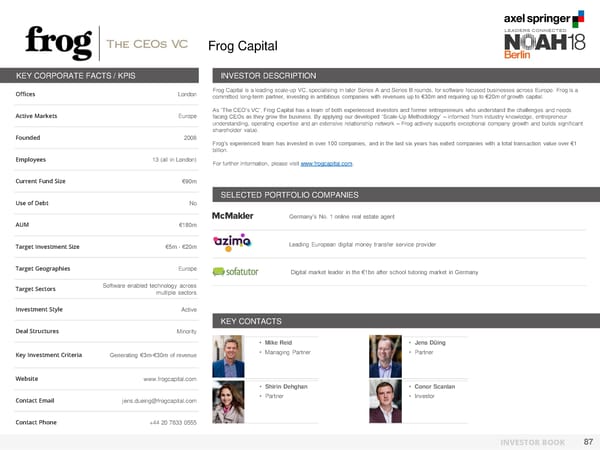

Frog Capital KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices London Frog Capital is a leading scale-up VC, specialising in later Series A and Series B rounds, for software focused businesses across Europe. Frog is a committed long-term partner, investing in ambitious companies with revenues up to €30m and requiring up to €20m of growth capital. As ‘The CEO’s VC’, Frog Capital has a team of both experienced investors and former entrepreneurs who understand the challenges and needs Active Markets Europe facing CEOs as they grow the business. By applying our developed ‘Scale-Up Methodology’ – informed from industry knowledge, entrepreneur understanding, operating expertise and an extensive relationship network – Frog actively supports exceptional company growth and builds significant shareholder value. Founded 2008 Frog’s experienced team has invested in over 100 companies, and in the last six years has exited companies with a total transaction value over €1 billion. Employees 13 (all in London) For further information, please visit www.frogcapital.com. Current Fund Size €90m SELECTED PORTFOLIO COMPANIES Use of Debt No Germany’s No. 1 online real estate agent AUM €180m Target Investment Size €5m - €20m Leading European digital money transfer service provider Target Geographies Europe Digital market leader in the €1bn after school tutoring market in Germany Target Sectors Software enabled technology across multiple sectors Investment Style Active KEY CONTACTS Deal Structures Minority • Mike Reid • Jens Düing Key Investment Criteria Generating €3m-€30m of revenue • Managing Partner • Partner Website www.frogcapital.com • Shirin Dehghan • Conor Scanlan Contact Email [email protected] • Partner • Investor Contact Phone +44 20 7833 0555 INVESTOR BOOK 87

NOAH Berlin 2018 - Investor Book Page 87 Page 89

NOAH Berlin 2018 - Investor Book Page 87 Page 89