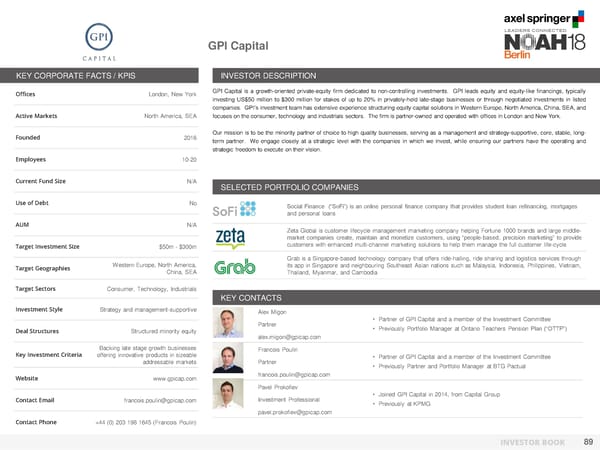

GPI Capital KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices London, New York GPI Capital is a growth-oriented private-equity firm dedicated to non-controlling investments. GPI leads equity and equity-like financings, typically investing US$50 million to $300 million for stakes of up to 20% in privately-held late-stage businesses or through negotiated investments in listed companies. GPI’s investment team has extensive experience structuring equity capital solutions in Western Europe, North America, China, SEA, and Active Markets North America, SEA focuses on the consumer, technology and industrials sectors. The firm is partner-owned and operated with offices in London and New York. Founded 2016 Our mission is to be the minority partner of choice to high quality businesses, serving as a management and strategy-supportive, core, stable, long- term partner. We engage closely at a strategic level with the companies in which we invest, while ensuring our partners have the operating and strategic freedom to execute on their vision. Employees 10-20 Current Fund Size N/A SELECTED PORTFOLIO COMPANIES Use of Debt No [ Logo ] Social Finance (“SoFi”) is an online personal finance company that provides student loan refinancing, mortgages and personal loans AUM N/A Zeta Global is customer lifecycle management marketing company helping Fortune 1000 brands and large middle- market companies create, maintain and monetize customers, using “people-based, precision marketing” to provide Target Investment Size $50m - $300m customers with enhanced multi-channel marketing solutions to help them manage the full customer life-cycle Grab is a Singapore-based technology company that offers ride-hailing, ride sharing and logistics services through Target Geographies Western Europe, North America, its app in Singapore and neighbouring Southeast Asian nations such as Malaysia, Indonesia, Philippines, Vietnam, China, SEA Thailand, Myanmar, and Cambodia Target Sectors Consumer, Technology, Industrials KEY CONTACTS Investment Style Strategy and management-supportive Alex Migon Partner • Partner of GPI Capital and a member of the Investment Committee Deal Structures Structured minority equity • Previously Portfolio Manager at Ontario Teachers Pension Plan (“OTTP”) alex.migon@gpicap.com Backing late stage growth businesses Francois Poulin Key Investment Criteria offering innovative products in sizeable • Partner of GPI Capital and a member of the Investment Committee addressable markets Partner • Previously Partner and Portfolio Manager at BTG Pactual Website www.gpicap.com francois.poulin@gpicap.com Pavel Prokofiev Investment Professional • Joined GPI Capital in 2014, from Capital Group Contact Email francois.poulin@gpicap.com • Previously at KPMG pavel.prokofiev@gpicap.com Contact Phone +44 (0) 203 198 1645 (Francois Poulin) INVESTOR BOOK 89

NOAH Berlin 2018 - Investor Book Page 89 Page 91

NOAH Berlin 2018 - Investor Book Page 89 Page 91