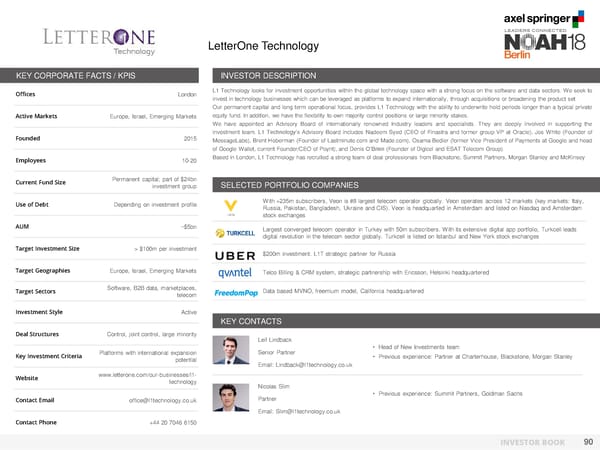

LetterOne Technology KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices London L1 Technology looks for investment opportunities within the global technology space with a strong focus on the software and data sectors. We seek to invest in technology businesses which can be leveraged as platforms to expand internationally, through acquisitions or broadening the product set Our permanent capital and long term operational focus, provides L1 Technology with the ability to underwrite hold periods longer than a typical private Active Markets Europe, Israel, Emerging Markets equity fund. In addition, we have the flexibility to own majority control positions or large minority stakes. We have appointed an Advisory Board of internationally renowned Industry leaders and specialists. They are deeply involved in supporting the investment team. L1 Technology’s Advisory Board includes Nadeem Syed (CEO of Finastra and former group VP at Oracle), Jos White (Founder of Founded 2015 MessageLabs), Brent Hoberman (Founder of Lastminute.com and Made.com), Osama Bedier (former Vice President of Payments at Google and head of Google Wallet, current Founder/CEO of Poynt), and Denis O’Brien (Founder of Digicel and ESAT Telecom Group). Employees 10-20 Based in London, L1 Technology has recruited a strong team of deal professionals from Blackstone, Summit Partners, Morgan Stanley and McKinsey Current Fund Size Permanent capital; part of $24bn SELECTED PORTFOLIO COMPANIES investment group Use of Debt Depending on investment profile With+235m subscribers, Veon is #8 largest telecom operator globally. Veon operates across 12 markets (key markets: Italy, Russia, Pakistan, Bangladesh, Ukraine and CIS). Veon is headquarted in Amsterdam and listed on Nasdaq and Amsterdam stock exchanges AUM ~$5bn Largest converged telecom operator in Turkey with 50m subscribers. Withits extensive digital app portfolio, Turkcell leads digital revolution in the telecom sector globally. Turkcell is listed on Istanbul and New York stock exchanges Target Investment Size > $100m per investment $200m investment. L1T strategic partner for Russia Target Geographies Europe, Israel, Emerging Markets Telco Billing & CRM system, strategic partnership with Ericsson, Helsinki headquartered Target Sectors Software, B2B data, marketplaces, Data based MVNO, freemium model, California headquartered telecom Investment Style Active KEY CONTACTS Deal Structures Control, joint control, large minority Leif Lindback Platforms with international expansion [Photo] Senior Partner • Head of New Investments team Key Investment Criteria potential • Previous experience: Partner at Charterhouse, Blackstone, Morgan Stanley Email: Lindback@l1technology.co.uk Website www.letterone.com/our-businesses/l1- technology Nicolas Slim [Photo] Partner • Previous experience: Summit Partners, Goldman Sachs Contact Email office@l1technology.co.uk Email: Slim@l1technology.co.uk Contact Phone +44 20 7046 6150 INVESTOR BOOK 90

NOAH Berlin 2018 - Investor Book Page 90 Page 92

NOAH Berlin 2018 - Investor Book Page 90 Page 92