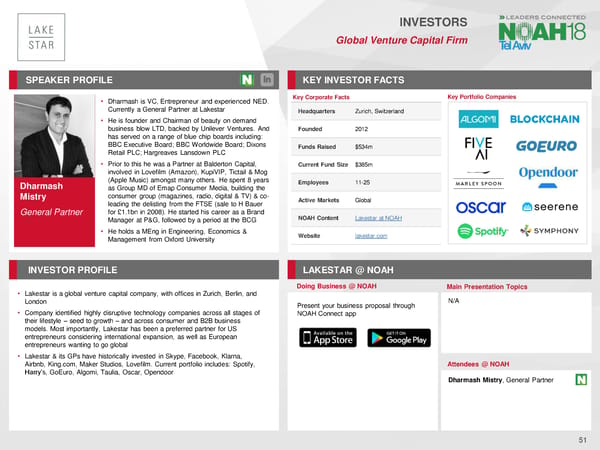

INVESTORS Global Venture Capital Firm SPEAKER PROFILE KEY INVESTORFACTS • Dharmash is VC, Entrepreneur and experienced NED. Key Corporate Facts Key Portfolio Companies Currently a General Partner at Lakestar Headquarters Zurich, Switzerland • He is founder and Chairman of beauty on demand business blow LTD, backed by Unilever Ventures. And Founded 2012 has served on a range of blue chip boards including: BBC Executive Board; BBC Worldwide Board; Dixons Funds Raised $534m Retail PLC; Hargreaves Lansdown PLC • Prior to this he was a Partner at Balderton Capital, Current Fund Size $385m involved in Lovefilm (Amazon), KupiVIP, Tictail & Mog Dharmash (Apple Music) amongst many others. He spent 8 years Employees 11-25 as Group MD of Emap Consumer Media, building the Mistry consumer group (magazines, radio, digital & TV) & co- Active Markets Global leading the delisting from the FTSE (sale to H Bauer General Partner for £1.1bn in 2008). He started his career as a Brand NOAH Content Lakestar at NOAH Manager at P&G, followed by a period at the BCG • He holds a MEng in Engineering, Economics & Website lakestar.com Management from Oxford University INVESTORPROFILE LAKESTAR @ NOAH Doing Business @ NOAH Main Presentation Topics • Lakestar is a global venture capital company, with offices in Zurich, Berlin, and London Present your business proposal through N/A • Company identified highly disruptive technology companies across all stages of NOAH Connect app their lifestyle – seed to growth – and across consumer and B2B business models. Most importantly, Lakestar has been a preferred partner for US entrepreneurs considering international expansion, as well as European entrepreneurs wanting to go global • Lakestar & its GPs have historically invested in Skype, Facebook, Klarna, Airbnb, King.com, Maker Studios, Lovefilm. Current portfolio includes: Spotify, Attendees @ NOAH Harry’s, GoEuro, Algomi, Taulia, Oscar, Opendoor Dharmash Mistry, General Partner 51

NOAH18 Tel Aviv Speaker Book Page 50 Page 52

NOAH18 Tel Aviv Speaker Book Page 50 Page 52