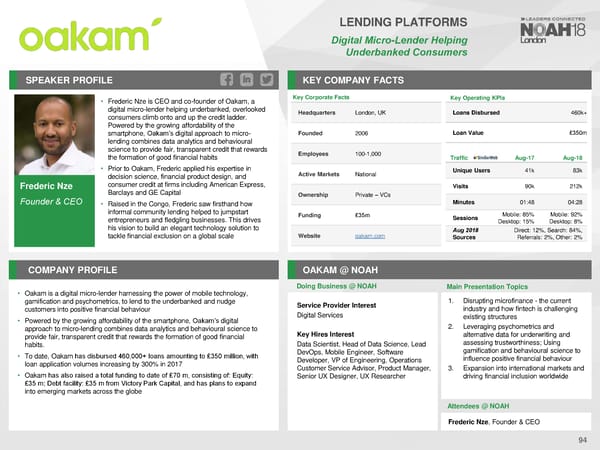

LENDING PLATFORMS Digital Micro-Lender Helping UnderbankedConsumers SPEAKER PROFILE KEY COMPANY FACTS • Frederic Nze is CEO and co-founder of Oakam, a Key Corporate Facts Key Operating KPIs digital micro-lender helping underbanked, overlooked Headquarters London, UK Loans Disbursed 460k+ consumers climb onto and up the credit ladder. Powered by the growing affordability of the smartphone, Oakam’sdigital approach to micro- Founded 2006 Loan Value £350m lending combines data analytics and behavioural science to provide fair, transparent credit that rewards Employees 100-1,000 the formation of good financial habits Traffic Aug-17 Aug-18 • Prior to Oakam, Frederic applied his expertise in Active Markets National Unique Users 41k 83k decision science, financial product design, and Frederic Nze consumer credit at firms including American Express, Visits 90k 212k Barclays and GE Capital Ownership Private – VCs Founder & CEO • Raised in the Congo, Frederic saw firsthand how Minutes 01:48 04:28 informal community lending helped to jumpstart Funding £35m Sessions Mobile: 85% Mobile: 92% entrepreneurs and fledgling businesses. This drives Desktop: 15% Desktop: 8% his vision to build an elegant technology solution to Aug 2018 Direct: 12%, Search: 84%, tackle financial exclusion on a global scale Website oakam.com Sources Referrals: 2%, Other: 2% COMPANY PROFILE OAKAM @ NOAH Doing Business @ NOAH Main Presentation Topics • Oakamis a digital micro-lender harnessing the power of mobile technology, gamification and psychometrics, to lend to the underbanked and nudge Service Provider Interest 1. Disrupting microfinance - the current customers into positive financial behaviour Digital Services industry and how fintech is challenging • Powered by the growing affordability of the smartphone, Oakam’s digital existing structures approach to micro-lending combines data analytics and behavioural science to 2. Leveraging psychometrics and provide fair, transparent credit that rewards the formation of good financial Key Hires Interest alternative data for underwriting and habits. Data Scientist, Head of Data Science, Lead assessing trustworthiness; Using • To date, Oakam has disbursed 460,000+ loans amounting to £350 million, with DevOps, Mobile Engineer, Software gamification and behavioural science to loan application volumes increasing by 300% in 2017 Developer, VP of Engineering, Operations influence positive financial behaviour Customer Service Advisor, Product Manager, 3. Expansion into international markets and • Oakamhas also raised a total funding to date of £70 m, consisting of: Equity: Senior UX Designer, UX Researcher driving financial inclusion worldwide £35 m; Debt facility: £35 m from Victory Park Capital, and has plans to expand into emerging markets across the globe Attendees @NOAH Frederic Nze, Founder & CEO 94

NOAH18 London Speaker Book Page 92 Page 94

NOAH18 London Speaker Book Page 92 Page 94