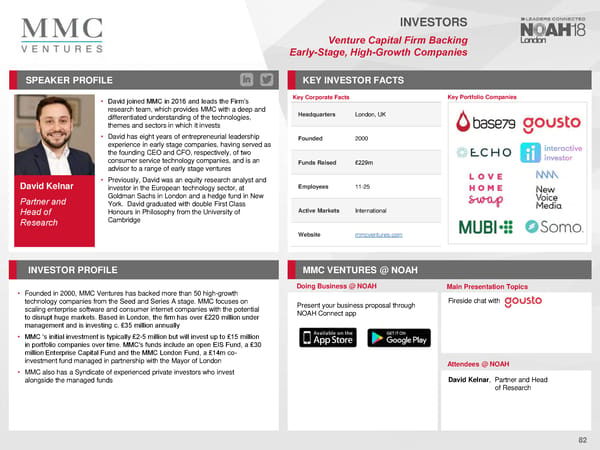

INVESTORS Venture Capital Firm Backing Early-Stage, High-Growth Companies SPEAKER PROFILE KEY INVESTORFACTS Key Corporate Facts Key Portfolio Companies • David joined MMC in 2016 and leads the Firm’s research team, which provides MMC with a deep and Headquarters London, UK differentiated understanding of the technologies, themes and sectors in which it invests • David has eight years of entrepreneurial leadership Founded 2000 experience in early stage companies, having served as the founding CEO and CFO, respectively, of two consumer service technology companies, and is an Funds Raised £229m advisor to a range of early stage ventures • Previously, David was an equity research analyst and David Kelnar investor in the European technology sector, at Employees 11-25 Goldman Sachs in London and a hedge fund in New Partner and York. David graduated with double First Class Honours in Philosophy from the University of Active Markets International Head of Cambridge Research Website mmcventures.com INVESTORPROFILE MMC VENTURES @ NOAH Doing Business @ NOAH Main Presentation Topics • Founded in 2000, MMC Ventures has backed more than 50 high-growth technology companies from the Seed and Series A stage. MMC focuses on Present your business proposal through Fireside chat with scaling enterprise software and consumer internet companies with the potential NOAH Connect app to disrupt huge markets. Based in London, the firm has over £220 million under management and is investing c. £35 million annually • MMC 's initial investment is typically £2-5 million but will invest up to £15 million in portfolio companies over time. MMC's funds include an open EIS Fund, a £30 million Enterprise Capital Fund and the MMC London Fund, a £14m co- investment fund managed in partnership with the Mayor of London Attendees @NOAH • MMC also has a Syndicate of experienced private investors who invest alongside the managed funds David Kelnar, Partner and Head of Research 82

NOAH18 London Speaker Book Page 80 Page 82

NOAH18 London Speaker Book Page 80 Page 82