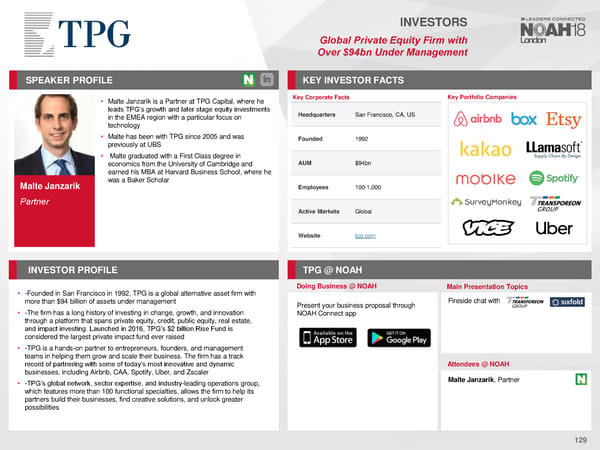

INVESTORS Global Private Equity Firm with Over $94bn Under Management SPEAKER PROFILE KEY INVESTORFACTS • Malte Janzarik is a Partner at TPG Capital, where he Key Corporate Facts Key Portfolio Companies leads TPG’s growth and later stage equity investments Headquarters San Francisco, CA, US in the EMEA region with a particular focus on technology • Malte has been with TPG since 2005 and was Founded 1992 previously at UBS • Malte graduated with a First Class degree in economics from the University of Cambridge and AUM $94bn earned his MBA at Harvard Business School, where he Malte Janzarik was a Baker Scholar Employees 100-1,000 Partner Active Markets Global Website tpg.com INVESTORPROFILE TPG @ NOAH Doing Business @ NOAH Main Presentation Topics • -Founded in San Francisco in 1992, TPG is a global alternative asset firm with more than $94 billion of assets under management Present your business proposal through Fireside chat with • -The firm has a long history of investing in change, growth, and innovation NOAH Connect app through a platform that spans private equity, credit, public equity, real estate, and impact investing. Launched in 2016, TPG’s $2 billion Rise Fund is considered the largest private impact fund ever raised • -TPG is a hands-on partner to entrepreneurs, founders, and management teams in helping them grow and scale their business. The firm has a track record of partnering with some of today’s most innovative and dynamic Attendees @NOAH businesses, including Airbnb, CAA, Spotify, Uber, and Zscaler • -TPG’s global network, sector expertise, and industry-leading operations group, Malte Janzarik, Partner which features more than 100 functional specialties, allows the firm to help its partners build their businesses, find creative solutions, and unlock greater possibilities 129

NOAH18 London Speaker Book Page 127 Page 129

NOAH18 London Speaker Book Page 127 Page 129