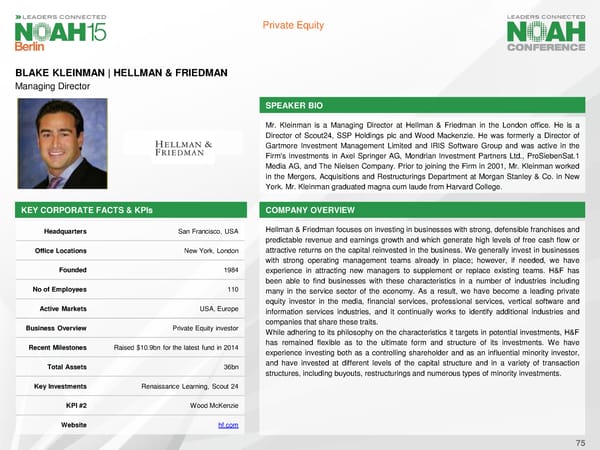

Private Equity BLAKE KLEINMAN | HELLMAN & FRIEDMAN Managing Director SPEAKER BIO Mr. Kleinman is a Managing Director at Hellman & Friedman in the London office. He is a Director of Scout24, SSP Holdings plc and Wood Mackenzie. He was formerly a Director of Gartmore Investment Management Limited and IRIS Software Group and was active in the Firm's investments in Axel Springer AG, Mondrian Investment Partners Ltd., ProSiebenSat.1 Media AG, and The Nielsen Company. Prior to joining the Firm in 2001, Mr. Kleinman worked in the Mergers, Acquisitions and Restructurings Department at Morgan Stanley & Co. in New York. Mr. Kleinman graduated magna cum laude from Harvard College. KEY CORPORATE FACTS& KPIs COMPANY OVERVIEW Headquarters San Francisco, USA Hellman & Friedman focuses on investing in businesses with strong, defensible franchises and predictable revenue and earnings growth and which generate high levels of free cash flow or Office Locations New York, London attractive returns on the capital reinvested in the business. We generally invest in businesses with strong operating management teams already in place; however, if needed, we have Founded 1984 experience in attracting new managers to supplement or replace existing teams. H&F has been able to find businesses with these characteristics in a number of industries including No of Employees 110 many in the service sector of the economy. As a result, we have become a leading private equity investor in the media, financial services, professional services, vertical software and Active Markets USA,Europe information services industries, and it continually works to identify additional industries and Business Overview Private Equity investor companiesthat share thesetraits. While adhering to its philosophy on the characteristics it targets in potential investments, H&F Recent Milestones Raised $10.9bn for the latest fund in 2014 has remained flexible as to the ultimate form and structure of its investments. We have experience investing both as a controlling shareholder and as an influential minority investor, Total Assets 36bn and have invested at different levels of the capital structure and in a variety of transaction structures, including buyouts, restructurings and numerous types of minority investments. Key Investments Renaissance Learning, Scout 24 KPI #2 Wood McKenzie Website hf.com 75

NOAH15 Berlin Speaker Book Page 83 Page 85

NOAH15 Berlin Speaker Book Page 83 Page 85