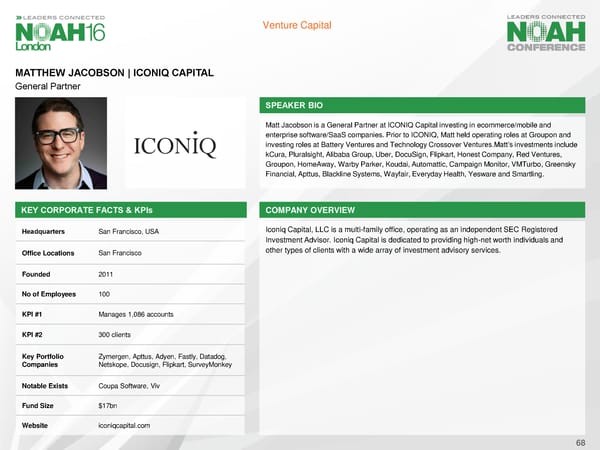

Venture Capital MATTHEW JACOBSON | ICONIQ CAPITAL General Partner SPEAKER BIO Matt Jacobson is a General Partner at ICONIQ Capital investing in ecommerce/mobile and enterprise software/SaaS companies. Prior to ICONIQ, Matt held operating roles at Groupon and investing roles at Battery Ventures and Technology Crossover Ventures.Matt’s investments include kCura, Pluralsight, Alibaba Group, Uber, DocuSign, Flipkart, Honest Company, Red Ventures, Groupon, HomeAway, WarbyParker, Koudai, Automattic, Campaign Monitor, VMTurbo, Greensky Financial, Apttus, Blackline Systems, Wayfair, Everyday Health, Yesware and Smartling. KEY CORPORATE FACTS & KPIs COMPANY OVERVIEW Headquarters SanFrancisco, USA Iconiq Capital, LLC is a multi-family office, operating as an independent SEC Registered Investment Advisor. Iconiq Capital is dedicated to providing high-net worth individuals and Office Locations San Francisco other types of clients with a wide array of investment advisory services. Founded 2011 No of Employees 100 KPI #1 Manages 1,086 accounts KPI #2 300 clients Key Portfolio Zymergen, Apttus, Adyen, Fastly, Datadog, Companies Netskope, Docusign, Flipkart, SurveyMonkey Notable Exists Coupa Software, Viv FundSize $17bn Website iconiqcapital.com 68

NOAH London Speaker Book Page 138 Page 140

NOAH London Speaker Book Page 138 Page 140