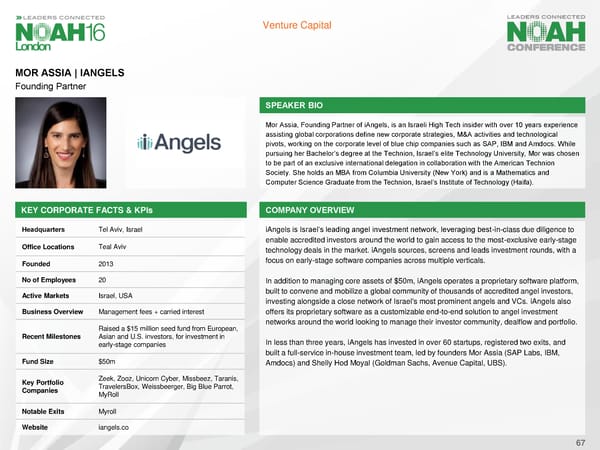

Venture Capital MOR ASSIA | IANGELS Founding Partner SPEAKER BIO Mor Assia, Founding Partner of iAngels, is an Israeli High Tech insider with over 10 years experience assisting global corporations define new corporate strategies, M&A activities and technological pivots, working on the corporate level of blue chip companies such as SAP, IBM and Amdocs. While pursuing her Bachelor’s degree at the Technion, Israel’s elite Technology University, Mor was chosen to be part of an exclusive international delegation in collaboration with the American Technion Society. She holds an MBA from Columbia University (New York) and is a Mathematics and Computer Science Graduate from the Technion, Israel’s Institute of Technology (Haifa). KEY CORPORATE FACTS & KPIs COMPANY OVERVIEW Headquarters Tel Aviv, Israel iAngels is Israel’s leading angel investment network, leveraging best-in-class due diligence to Office Locations Teal Aviv enable accredited investors around the world to gain access to the most-exclusive early-stage technology deals in the market. iAngels sources, screens and leads investment rounds, with a Founded 2013 focus on early-stage software companies across multiple verticals. No of Employees 20 In addition to managing core assets of $50m, iAngels operates a proprietary software platform, Active Markets Israel, USA built to convene and mobilize a global community of thousands of accredited angel investors, investing alongside a close network of Israel's most prominent angels and VCs. iAngels also Business Overview Management fees + carried interest offers its proprietary software as a customizable end-to-end solution to angel investment Raised a $15 million seed fund from European, networks around the world looking to manage their investor community, dealflow and portfolio. Recent Milestones Asian and U.S. investors, for investment in In less than three years, iAngels has invested in over 60 startups, registered two exits, and early-stage companies built a full-service in-house investment team, led by founders Mor Assia (SAP Labs, IBM, FundSize $50m Amdocs) and Shelly Hod Moyal (Goldman Sachs, Avenue Capital, UBS). Key Portfolio Zeek, Zooz, Unicorn Cyber, Missbeez, Taranis, Companies TravelersBox, Weissbeerger, Big Blue Parrot, MyRoll Notable Exits Myroll Website iangels.co 67

NOAH London Speaker Book Page 137 Page 139

NOAH London Speaker Book Page 137 Page 139