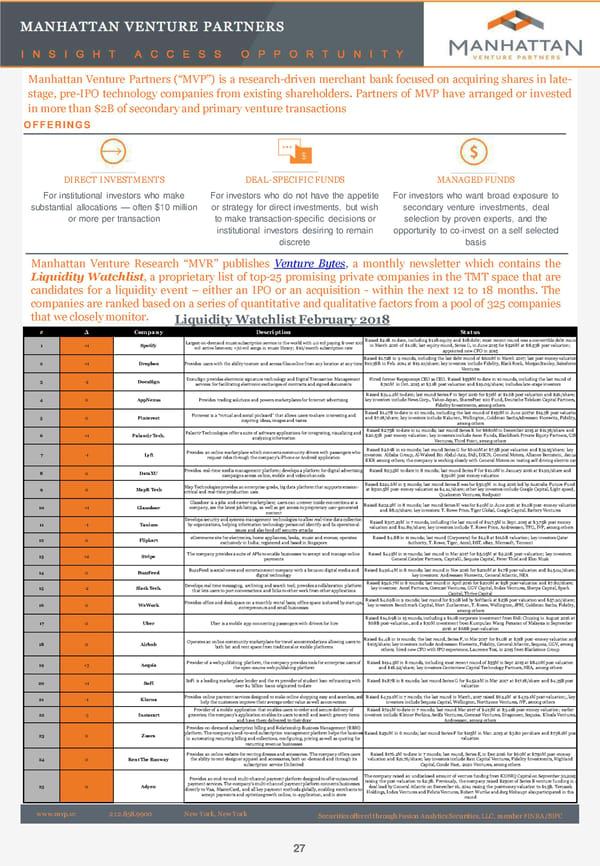

MANHATTAN VENTURE PARTNERS I N S I G H T A C C E S S O P P O R T U N I T Y ManhattanVenture Partners(“MVP”) is aresearch-driven merchant bank focused on acquiringshares in late- stage, pre-IPO technology companies from existing shareholders. Partners of MVP have arranged or invested inmorethan$2Bofsecondaryandprimaryventuretransactions OFFERINGS DIRECT INVESTMENTS DEAL-SPECIFIC FUNDS MANAGED FUNDS For institutional investors who make For investors who do not have the appetite For investors who want broad exposure to substantial allocations — often $10 million or strategy for direct investments, but wish secondary venture investments, deal or more per transaction to make transaction-specific decisions or selection by proven experts, and the institutional investors desiring to remain opportunity to co-invest on a self selected discrete basis Manhattan Venture Research “MVR” publishes Venture Bytes, a monthly newsletter which contains the Liquidity Watchlist, a proprietary list of top-25 promising private companies in the TMT space that are candidates for a liquidity event – either an IPO or an acquisition - within the next 12 to 18 months. The companies are rankedbasedonaseriesof quantitative andqualitativefactorsfrom a poolof 325 companies that wecloselymonitor. Liquidity Watchlist February 2018 # ∆ Company Description Status Largest on-demand music subscription service in the world with 40 mil paying & over 100 Raised $2.1B to date, including $1.1B equity and $1B debt; most recent round was a convertible debt round 1 +1 Spotify mil active listeners; +30 mil songs in music library; $10/month subscription rate in March 2016 of $1.0B; last equity round, Series G, in June 2015 for $526M at $8.53B post valuation; appointed new CFO in 2015 Raised $1.72B in 9 rounds, including the last debt round of $600M in March 2017; last post money valuation 2 +1 Dropbox Provides users with the ability to store and access files online from any location at any time $10.38B in Feb. 2014 at $19.10/share; key investors include Fidelity, Black Rock, MorganStanley, Salesforce Ventures 3 -2 DocuSign DocuSign provides electronic signature technology and Digital Transaction Management Hired former RepsponsysCEO as CEO. Raised $558M to date in 10 rounds, including the last round of services for facilitating electronic exchanges of contracts and signed documents $310M in Oct. 2015 at $3.1B post valuation and $19.09/share; includes late-stage investors Raised $344.2M to date; last round Series F in Sept 2016 for $31M at $1.6B post valuation and $26/share; 4 0 AppNexus Provides trading solutions and powers marketplaces for Internet advertising key investors include News Corp., Yahoo Japan, SharesPost 100 Fund, Deutsche Telekom Capital Partners, Fidelity Investments, among others Pinterest is a “virtual and social pinboard” that allows users to share interesting and Raised $1.47B to date in 10 rounds, including the last round of $150M in June 2017at $12.3B post valuation 5 0 Pinterest inspiring ideas, images and tastes and $7.18/share; key investors include Rakuten, Wellington, Goldman Sachs,A dreessen Horowitz, Fidelity, among others Palantir Technologies offer a suite of software applications for integrating, visualizing and Raised $2.75B to date in 14 rounds; last round Series K for $880M in December 2015 at $11.38/share and 6 +1 Palantir Tech. analyzing information $20.53B post money valuation; key investors include Aeon Funds, BlackRock Private Equity Partners, GSV Ventures, Third Point, among others Provides an online marketplace which connects community drivers with passengers who Raised $2.61B in 10 rounds; last round Series G for $600M at $7.5B post valuation and $32.15/share; key 7 -1 Lyft request rides through the company's iPhone or Android application investors: Alibaba Group, Al-Waleed Bin Abdul-Aziz, Didi, DSCN, General Motors, Alliance Bernstein, Janus, KKR among others; the company is working closely with General Motors on testing self driving electric cars 8 0 DataXU Provides real-time media management platform; develops a platform for digital advertising Raised $93.5M to date in 8 rounds; last round Series F for $10.0M in January 2016 at $1.99/share and campaigns across online, mobile and video channels $390M post money valuation Map Technologies provides an enterprise-grade, big data platform that supports mission- Raised $224.6M in 5 rounds; last round Series E was for $50.5M in Aug 2016 led by Australia Future Fund 9 0 MapRTech critical and real-time production uses at $500.5M post-money valuation as $4.14/share; other key investors include Google Capital, Light speed, Qualcomm Ventures, Redpoint Glassdoor is a jobs and career marketplace; users can uncover inside connections at a Raised $202.2M in 8 rounds; last round Series H was for $40M in June 2016 at $1.0B post-money valuation 10 +1 Glassdoor company, see the latest job listings, as well as get access to proprietary user-generated and $8.0/share; key investors: T. Rowe Price, Tiger Global, Google Capital, Battery Ventures content Develops security and systems management technologies to allow real-time data collection Raised $307.29M in 7 rounds, including the last round of $147.5M in Sept. 2015 at $3.75B post money 11 -1 Tanium by organizations, helping information technology personnel identify and fix operational valuation and $14.89/share; key investors include T. Rowe Price, Andreessen, TPG, IVP, among others issues and also fend off security attacks 12 0 Flipkart eCommerce site for electronics, home appliances, books, music and movies; operates Raised $4.8B in 11 rounds; last round (Corporate) for $1.4B at $11.6B valuation; key investors Qatar exclusively in India; registered and based in Singapore Authority, T. Rowe, Tiger, Accel, DST, eBay, Microsoft, Tencent 13 +2 Stripe The company provides a suite of APIs to enable businesses to accept and manage online Raised $445M in 11 rounds; last round in Mar 2017 for $5.05M at $9.20B post-valuation; key investors: payments General Catalyst Partners, CapitalG, Sequoia Capital, Peter Thiel and Elon Musk 14 0 BuzzFeed BuzzFeed is social news and entertainment company with a focus on digital media and Raised $496.4M in 8 rounds; last round in Nov 2016 for $200M at $1.7B post-valuation and $45.04/share; digital technology key investors: Andreessen Horowitz, General Atlantic, NEA Develops real time messaging, archiving and search tool; provides a collaboration platform Raised $546.7M in 8 rounds; last round in April 2016 for $200M at $5B post-valuation and $7.80/share; 15 -2 Slack Tech. that lets users to port conversations and links to other work from other applications key investors: Accel Partners, Comcast Ventures, GGV Capital, Index Ventures, Sherpa Capital, Spark Capital, Thrive Capital Provides office and desk space on a monthly rental basis; office space is shared by startups, Raised $4.69B in 9 rounds; last round for $3.0B led by Softbank at $23B post valuation and $57.90/share; 16 0 WeWork entrepreneurs and small businesses key investors Benchmark Capital, Mort Zuckerman, T. Rowe, Wellington, JPM, Goldman Sachs, Fidelity, among others Raised $14.69B in 15 rounds, including a $1.0B corporate investment from Didi Chuxing in August 2016 at 17 0 Uber Uber is a mobile app connecting passengers with drivers for hire $68B post-valuation, and a $30M investment from Kumpulan Wang Persaran of Malaysia in September 2016 at $68B post-valuation Operates an online community marketplace for travel accommodations allowing users to Raised $4.4B in 11 rounds; the last round, Series F, in Mar 2017 for $1.0B at $31B post-money valuation and 18 0 Airbnb both list and rent space from traditional or mobile platforms $105/share; key investors include Andreessen Horowitz, Fidelity, General Atlantic, Sequoia, GGV, among others; hired new CFO with IPO experience, Laurence Tosi, in 2015 from Blackstone Group 19 +3 Acquia Provider of a web publishing platform, the company provides tools for enterprise users of Raised $194.5M in 8 rounds, including most recent round of $55M in Sept 2015 at $840M post valuation the open-source web publishing platform and $18.92/share; key investors Centerview Capital Technology Partners, NEA, among others 20 +1 SoFi SoFi is a leading marketplace lender and the #1 provider of student loan refinancing with Raised $1.87B in 8 rounds; last round Series G for $452.9M in Mar 2017 at $17.18/share and $4.35B post over $4 billion loans originated to date valuation 21 -1 Klarna Provides online payment services designed to make online shopping easy and seamless, and Raised $439.1M in 7 rounds; the last round in March, 2017 raised $62.2M at $439.1M post-valuation;, key help the customers improve their average order value as well as conversion investors include Sequoia Capital, Wellington, Northzone Ventures, iVP, among others Provider of a mobile application that enables users to order and secure delivery of Raised $724M to date in 7 rounds; last round Mar 2017 of $413M at $3.41B post-money valuation; earlier 22 -3 Instacart groceries; the company's application enables its users to scroll and search grocery items investors include KleinerPerkins, AmEx Ventures, Comcast Ventures, Dragoneer, Sequoia, Khosla Ventures, and have them delivered to their door Andreessen, among others Provides on-demand subscription billing and Relationship Business Management (RBM) 23 0 Zuora platform. The company’s end-to-end subscription management platform helps the business Raised $250M in 6 rounds; last round Series F for $115M in Mar. 2015 at $3.80 per share and $738.1M post in automating recurring billing and collections, configuring, pricing as well as quoting for valuation recurring revenue businesses Provides an online website for renting dresses and accessories. The company offers users Raised $176.2M to date in 7 rounds; last round, Series E, in Dec 2016 for $60M at $750M post-money 24 0 Rent The Runway the ability to rent designer apparel and accessories, both on-demand and through its valuation and $21.76/share; key investors include Bain Capital Ventures, Fidelity Investments, Highland subscription service Unlimited Capital, Conde Nast, 2020 Ventures, among others Provides an end-to-end multi-channel payment platform designed to offer outsourced The company raised an undisclosed amount of venture funding from ICONIQ Capital on September 30,2015 payment services. The company's multi-channel payment platform connects businesses raising the post-valuation to $2.3B. Previously, the company raised $250m of Series B venture funding in a 25 0 Adyen directly to Visa, MasterCard, and all key payment methods globally, enabling merchants to deal lead by General Atlantic on December 16, 2014 raising the post-money valuation to $1.5B. Temasek accept payments and optimize growth online, in-application, and in store Holdings, Index Ventures and FelicisVentures, Robert Wuttke and Jorg Mohaupt also participated in this round www.mvp.vc 212.858.9900 New York, New York Securities offered through Fusion Analytics Securities, LLC, member FINRA/SIPC 27

NOAH Bible Page 26 Page 28

NOAH Bible Page 26 Page 28