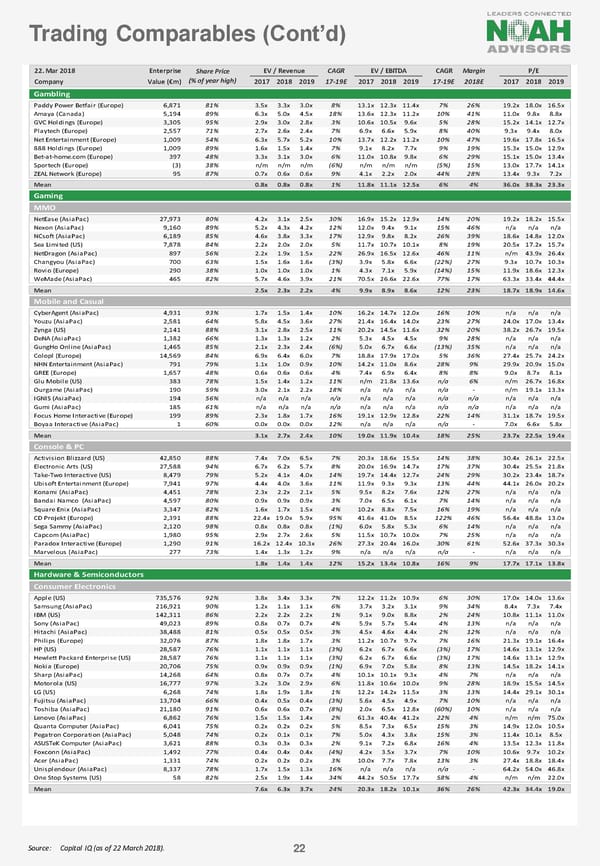

Trading Comparables (Cont’d) 22. Mar 2018 Enterprise Share Price EV / Revenue CAGR EV / EBITDA CAGR Margin P/E Company Value (€m) (% of year high) 2017 2018 2019 17-19E 2017 2018 2019 17-19E 2018E 2017 2018 2019 Gambling Paddy Power Betfair (Europe) 6,871 81% 3.5x 3.3x 3.0x 8% 13.1x 12.3x 11.4x 7% 26% 19.2x 18.0x 16.5x Amaya (Canada) 5,194 89% 6.3x 5.0x 4.5x 18% 13.6x 12.3x 11.2x 10% 41% 11.0x 9.8x 8.8x GVC Holdings (Europe) 3,305 95% 2.9x 3.0x 2.8x 3% 10.6x 10.5x 9.6x 5% 28% 15.2x 14.1x 12.7x Playtech (Europe) 2,557 71% 2.7x 2.6x 2.4x 7% 6.9x 6.6x 5.9x 8% 40% 9.3x 9.4x 8.0x Net Entertainment (Europe) 1,009 54% 6.3x 5.7x 5.2x 10% 13.7x 12.2x 11.2x 10% 47% 19.6x 17.8x 16.5x 888 Holdings (Europe) 1,009 89% 1.6x 1.5x 1.4x 7% 9.1x 8.2x 7.7x 9% 19% 15.3x 15.0x 12.9x Bet-at-home.com (Europe) 397 48% 3.3x 3.1x 3.0x 6% 11.0x 10.8x 9.8x 6% 29% 15.1x 15.0x 13.4x Sportech (Europe) (3) 38% n/m n/m n/m (6%) n/m n/m n/m (5%) 15% 13.0x 17.7x 14.1x ZEAL Network (Europe) 95 87% 0.7x 0.6x 0.6x 9% 4.1x 2.2x 2.0x 44% 28% 13.4x 9.3x 7.2x Mean 0.8x 0.8x 0.8x 1% 11.8x 11.1x 12.5x 6% 4% 36.0x 38.3x 23.3x Gaming MMO NetEase (AsiaPac) 27,973 80% 4.2x 3.1x 2.5x 30% 16.9x 15.2x 12.9x 14% 20% 19.2x 18.2x 15.5x Nexon (AsiaPac) 9,160 89% 5.2x 4.3x 4.2x 12% 12.0x 9.4x 9.1x 15% 46% n/a n/a n/a NCsoft (AsiaPac) 6,189 85% 4.6x 3.8x 3.3x 17% 12.9x 9.8x 8.2x 26% 39% 18.6x 14.8x 12.0x Sea Limited (US) 7,878 84% 2.2x 2.0x 2.0x 5% 11.7x 10.7x 10.1x 8% 19% 20.5x 17.2x 15.7x NetDragon (AsiaPac) 897 56% 2.2x 1.9x 1.5x 22% 26.9x 16.5x 12.6x 46% 11% n/m 43.9x 26.4x Changyou (AsiaPac) 700 63% 1.5x 1.6x 1.6x (3%) 3.9x 5.8x 6.6x (22%) 27% 9.3x 10.7x 10.3x Rovio (Europe) 290 38% 1.0x 1.0x 1.0x 1% 4.3x 7.1x 5.9x (14%) 15% 11.9x 18.6x 12.3x WeMade (AsiaPac) 465 82% 5.7x 4.6x 3.9x 21% 70.5x 26.6x 22.6x 77% 17% 63.3x 33.4x 44.4x Mean 2.5x 2.3x 2.2x 4% 9.9x 8.9x 8.6x 12% 23% 18.7x 18.9x 14.6x Mobile and Casual CyberAgent (AsiaPac) 4,931 93% 1.7x 1.5x 1.4x 10% 16.2x 14.7x 12.0x 16% 10% n/a n/a n/a Youzu (AsiaPac) 2,581 64% 5.8x 4.5x 3.6x 27% 21.4x 16.4x 14.0x 23% 27% 24.0x 17.0x 13.4x Zynga (US) 2,141 88% 3.1x 2.8x 2.5x 11% 20.2x 14.5x 11.6x 32% 20% 38.2x 26.7x 19.5x DeNA (AsiaPac) 1,382 66% 1.3x 1.3x 1.2x 2% 5.3x 4.5x 4.5x 9% 28% n/a n/a n/a GungHo Online (AsiaPac) 1,465 85% 2.1x 2.3x 2.4x (6%) 5.0x 6.7x 6.6x (13%) 35% n/a n/a n/a Colopl (Europe) 14,569 84% 6.9x 6.4x 6.0x 7% 18.8x 17.9x 17.0x 5% 36% 27.4x 25.7x 24.2x NHN Entertainment (AsiaPac) 791 79% 1.1x 1.0x 0.9x 10% 14.2x 11.0x 8.6x 28% 9% 29.9x 20.9x 15.0x GREE (Europe) 1,657 48% 0.6x 0.6x 0.6x 4% 7.4x 6.9x 6.4x 8% 8% 9.0x 8.7x 8.1x Glu Mobile (US) 383 78% 1.5x 1.4x 1.2x 11% n/m 21.8x 13.6x n/a 6% n/m 26.7x 16.8x Ourgame (AsiaPac) 190 59% 3.0x 2.1x 2.2x 18% n/a n/a n/a n/a - n/m 19.1x 13.3x IGNIS (AsiaPac) 194 56% n/a n/a n/a n/a n/a n/a n/a n/a n/a n/a n/a n/a Gumi (AsiaPac) 185 61% n/a n/a n/a n/a n/a n/a n/a n/a n/a n/a n/a n/a Focus Home Interactive (Europe) 199 89% 2.3x 1.8x 1.7x 16% 19.1x 12.9x 12.8x 22% 14% 31.1x 18.7x 19.5x Boyaa Interactive (AsiaPac) 1 60% 0.0x 0.0x 0.0x 12% n/a n/a n/a n/a - 7.0x 6.6x 5.8x Mean 3.1x 2.7x 2.4x 10% 19.0x 11.9x 10.4x 18% 25% 23.7x 22.5x 19.4x Console & PC Activision Blizzard (US) 42,850 88% 7.4x 7.0x 6.5x 7% 20.3x 18.6x 15.5x 14% 38% 30.4x 26.1x 22.5x Electronic Arts (US) 27,588 94% 6.7x 6.2x 5.7x 8% 20.0x 16.9x 14.7x 17% 37% 30.4x 25.5x 21.8x Take-Two Interactive (US) 8,479 79% 5.2x 4.1x 4.0x 14% 19.7x 14.4x 12.7x 24% 29% 30.2x 23.4x 18.7x Ubisoft Entertainment (Europe) 7,941 97% 4.4x 4.0x 3.6x 11% 11.9x 9.3x 9.3x 13% 44% 44.1x 26.0x 20.2x Konami (AsiaPac) 4,451 78% 2.3x 2.2x 2.1x 5% 9.5x 8.2x 7.6x 12% 27% n/a n/a n/a Bandai Namco (AsiaPac) 4,597 80% 0.9x 0.9x 0.9x 3% 7.0x 6.5x 6.1x 7% 14% n/a n/a n/a Square Enix (AsiaPac) 3,347 82% 1.6x 1.7x 1.5x 4% 10.2x 8.8x 7.5x 16% 19% n/a n/a n/a CD Projekt (Europe) 2,391 88% 22.4x 19.0x 5.9x 95% 41.6x 41.0x 8.5x 122% 46% 56.4x 48.8x 13.0x Sega Sammy (AsiaPac) 2,120 98% 0.8x 0.8x 0.8x (1%) 6.0x 5.8x 5.3x 6% 14% n/a n/a n/a Capcom (AsiaPac) 1,980 95% 2.9x 2.7x 2.6x 5% 11.5x 10.7x 10.0x 7% 25% n/a n/a n/a Paradox Interactive (Europe) 1,290 91% 16.2x 12.4x 10.3x 26% 27.3x 20.4x 16.0x 30% 61% 52.6x 37.3x 30.3x Marvelous (AsiaPac) 277 73% 1.4x 1.3x 1.2x 9% n/a n/a n/a n/a - n/a n/a n/a Mean 1.8x 1.4x 1.4x 12% 15.2x 13.4x 10.8x 16% 9% 17.7x 17.1x 13.8x Hardware & Semiconductors Consumer Electronics Apple (US) 735,576 92% 3.8x 3.4x 3.3x 7% 12.2x 11.2x 10.9x 6% 30% 17.0x 14.0x 13.6x Samsung (AsiaPac) 216,921 90% 1.2x 1.1x 1.1x 6% 3.7x 3.2x 3.1x 9% 34% 8.4x 7.3x 7.4x IBM (US) 142,311 86% 2.2x 2.2x 2.2x 1% 9.1x 9.0x 8.8x 2% 24% 10.8x 11.1x 11.0x Sony (AsiaPac) 49,023 89% 0.8x 0.7x 0.7x 4% 5.9x 5.7x 5.4x 4% 13% n/a n/a n/a Hitachi (AsiaPac) 38,488 81% 0.5x 0.5x 0.5x 3% 4.5x 4.6x 4.4x 2% 12% n/a n/a n/a Philips (Europe) 32,076 87% 1.8x 1.8x 1.7x 3% 11.2x 10.7x 9.7x 7% 16% 21.3x 19.1x 16.4x HP (US) 28,587 76% 1.1x 1.1x 1.1x (3%) 6.2x 6.7x 6.6x (3%) 17% 14.6x 13.1x 12.9x Hewlett Packard Enterprise (US) 28,587 76% 1.1x 1.1x 1.1x (3%) 6.2x 6.7x 6.6x (3%) 17% 14.6x 13.1x 12.9x Nokia (Europe) 20,706 75% 0.9x 0.9x 0.9x (1%) 6.9x 7.0x 5.8x 8% 13% 14.5x 18.2x 14.1x Sharp (AsiaPac) 14,268 64% 0.8x 0.7x 0.7x 4% 10.1x 10.1x 9.3x 4% 7% n/a n/a n/a Motorola (US) 16,777 97% 3.2x 3.0x 2.9x 6% 11.8x 10.6x 10.0x 9% 28% 18.9x 15.5x 14.5x LG (US) 6,268 74% 1.8x 1.9x 1.8x 1% 12.2x 14.2x 11.5x 3% 13% 14.4x 29.1x 30.1x Fujitsu (AsiaPac) 13,704 66% 0.4x 0.5x 0.4x (3%) 5.6x 4.5x 4.9x 7% 10% n/a n/a n/a Toshiba (AsiaPac) 21,180 91% 0.6x 0.6x 0.7x (8%) 2.0x 6.5x 12.8x (60%) 10% n/a n/a n/a Lenovo (AsiaPac) 6,862 76% 1.5x 1.5x 1.4x 2% 61.3x 40.4x 41.2x 22% 4% n/m n/m 75.0x Quanta Computer (AsiaPac) 6,041 75% 0.2x 0.2x 0.2x 5% 8.5x 7.3x 6.5x 15% 3% 14.9x 12.0x 10.5x Pegatron Corporation (AsiaPac) 5,048 74% 0.2x 0.1x 0.1x 7% 5.0x 4.3x 3.8x 15% 3% 11.4x 10.1x 8.5x ASUSTeK Computer (AsiaPac) 3,621 88% 0.3x 0.3x 0.3x 2% 9.1x 7.2x 6.8x 16% 4% 13.5x 12.3x 11.8x Foxconn (AsiaPac) 1,492 77% 0.4x 0.4x 0.4x (4%) 4.2x 3.5x 3.7x 7% 10% 10.6x 9.7x 10.2x Acer (AsiaPac) 1,331 74% 0.2x 0.2x 0.2x 3% 10.0x 7.7x 7.8x 13% 3% 27.4x 18.8x 18.4x Unisplendour (AsiaPac) 8,337 78% 1.7x 1.5x 1.3x 16% n/a n/a n/a n/a - 64.2x 54.0x 46.8x One Stop Systems (US) 58 82% 2.5x 1.9x 1.4x 34% 44.2x 50.5x 17.7x 58% 4% n/m n/m 22.0x Mean 7.6x 6.3x 3.7x 24% 20.3x 18.2x 10.1x 36% 26% 42.3x 34.4x 19.0x Source: Capital IQ (as of 22 March 2018). 22

NOAH Bible Page 21 Page 23

NOAH Bible Page 21 Page 23