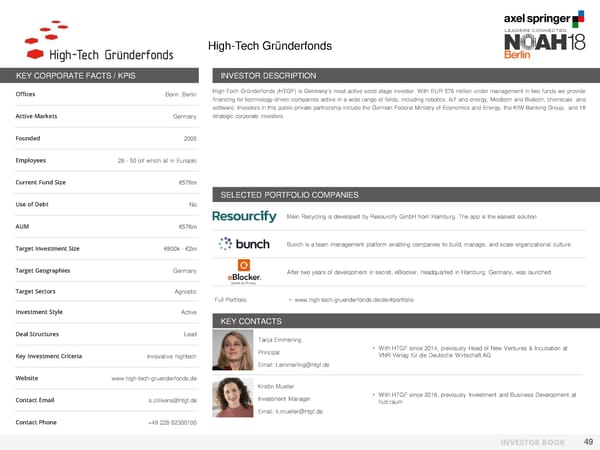

High-Tech Gründerfonds KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices Bonn. Berlin High-Tech Gründerfonds (HTGF) is Germany’s most active seed stage investor. With EUR 576 million under management in two funds we provide financing for technology-driven companies active in a wide range of fields, including robotics, IoT and energy, Medtech and Biotech, chemicals and software. Investors in this public-private partnership include the German Federal Ministry of Economics and Energy, the KfW Banking Group, and 18 Active Markets Germany strategic corporate investors. Founded 2005 Employees 26 - 50 (of which all in Europe) Current Fund Size €576m SELECTED PORTFOLIO COMPANIES Use of Debt No Mein Recycling is developed by Resourcify GmbH from Hamburg. The app is the easiest solution AUM €576m Target Investment Size €600k - €2m Bunch is a team management platform enabling companies to build, manage, and scale organizational culture Target Geographies Germany After two years of development in secret, eBlocker, headquarted in Hamburg, Germany, was launched Target Sectors Agnostic Full Portfolio • www.high-tech-gruenderfonds.de/de/#portfolio Investment Style Active KEY CONTACTS Deal Structures Lead Tanja Emmerling Principal • With HTGF since 2014, previously Head of New Ventures & Incubation at Key Investment Criteria Innovative hightech VNR Verlag für die Deutsche Wirtschaft AG Email: t.emmerling@htgf.de Website www.high-tech-gruenderfonds.de Kristin Mueller Contact Email s.zillikens@htgf.de Investment Manager • With HTGF since 2016, previously Investment and Business Development at hub:raum Email: k.mueller@htgf.de Contact Phone +49 228 82300100 INVESTOR BOOK 49

NOAH Berlin 2018 - Investor Book Page 49 Page 51

NOAH Berlin 2018 - Investor Book Page 49 Page 51