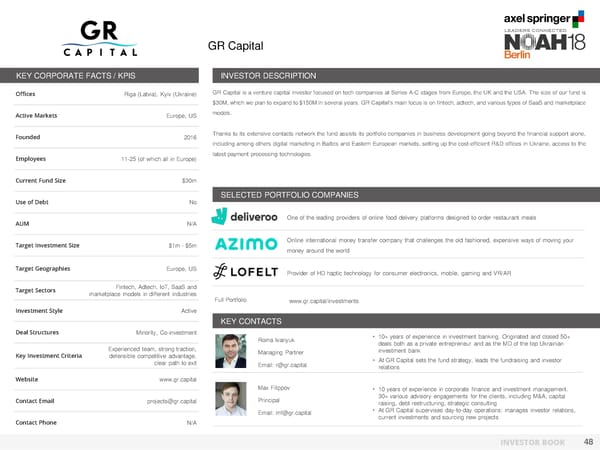

GR Capital KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices Riga (Latvia), Kyiv (Ukraine) GRCapital is a venture capital investor focused on tech companies at Series A-C stages from Europe, the UK and the USA. The size of our fund is $30M,which we plan to expand to$150M in several years. GR Capital’s main focus is on fintech, adtech, and various types of SaaS and marketplace Active Markets Europe, US models. Founded 2016 Thanks to its extensive contacts network the fund assists its portfolio companies in business development going beyond the financial support alone, including among others digital marketing in Baltics and Eastern European markets, setting up the cost-efficient R&D offices in Ukraine, access to the Employees 11-25 (of which all in Europe) latest payment processing technologies. Current Fund Size $30m SELECTED PORTFOLIO COMPANIES Use of Debt No Oneof the leading providers of online food delivery platforms designed to order restaurant meals AUM N/A Target Investment Size $1m - $5m Online international money transfer company that challenges the old fashioned, expensive ways of moving your money around the world Target Geographies Europe, US Provider of HD haptic technology for consumer electronics, mobile, gaming and VR/AR Target Sectors Fintech, Adtech, IoT, SaaS and marketplace models in different industries Full Portfolio www.gr.capital/investments Investment Style Active KEY CONTACTS Deal Structures Minority, Co-investment • 10+ years of experience in investment banking. Originated and closed 50+ Roma Ivanyuk deals both as a private entrepreneur and as the MD of the top Ukrainian Experienced team, strong traction, Managing Partner investment bank Key Investment Criteria defensible competitive advantage, • At GR Capital sets the fund strategy, leads the fundraising and investor clear path to exit Email: r@gr.capital relations Website www.gr.capital Max Filippov • 10 years of experience in corporate finance and investment management. Contact Email projects@gr.capital Principal 30+ various advisory engagements for the clients, including M&A, capital raising, debt restructuring, strategic consulting Email: mf@gr.capital • At GR Capital supervises day-to-day operations: manages investor relations, Contact Phone N/A current investments and sourcing new projects INVESTOR BOOK 48

NOAH Berlin 2018 - Investor Book Page 48 Page 50

NOAH Berlin 2018 - Investor Book Page 48 Page 50