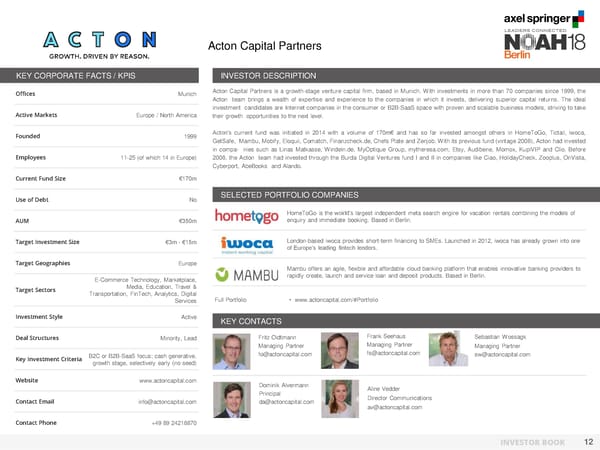

Acton Capital Partners KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices Munich Acton Capital Partners is a growth-stage venture capital firm, based in Munich. With investments in more than 70 companies since 1999, the Acton team brings a wealth of expertise and experience to the companies in which it invests, delivering superior capital returns. The ideal investment candidates are Internet companies in the consumer or B2B-SaaS space with proven and scalable business models, striving to take Active Markets Europe / North America their growth opportunities to the next level. Founded 1999 Acton’s current fund was initiated in 2014 with a volume of 170m€ and has so far invested amongst others in HomeToGo, Tictail, iwoca, GetSafe, Mambu, Mobify, Eloquii, Comatch, Finanzcheck.de, Chefs Plate and Zenjob. With its previous fund (vintage 2008), Acton had invested in compa- nies such as Linas Matkasse, Windeln.de, MyOptique Group, mytheresa.com, Etsy, Audibene, Momox, KupiVIP and Clio. Before Employees 11-25 (of which 14 in Europe) 2008, the Acton team had invested through the Burda Digital Ventures fund I and II in companies like Ciao, HolidayCheck, Zooplus, OnVista, Cyberport, AbeBooks and Alando. Current Fund Size €170m Use of Debt No SELECTED PORTFOLIO COMPANIES HomeToGo is the woirld’s largest independent meta search engine for vacation rentals combining the models of AUM enquiry and immediate booking. Based in Berlin. €350m Target Investment Size €3m - €15m London-based iwoca provides short-term financing to SMEs. Launched in 2012, iwoca has already grown into one of Europe’s leading fintech lenders. Target Geographies Europe Mambu offers an agile, flexible and affordable cloud banking platform that enables innovative banking providers to E-Commerce Technology, Marketplace, rapidly create, launch and service loan and deposit products. Based in Berlin. Target Sectors Media, Education, Travel & Transportation, FinTech, Analytics, Digital Services Full Portfolio • www.actoncapital.com/#Portfolio Investment Style Active KEY CONTACTS Deal Structures Minority, Lead Fritz Oidtmann Frank Seehaus Sebastian Wossagk Managing Partner Managing Partner Managing Partner B2C or B2B-SaaS focus; cash generative, fo@actoncapital.com fs@actoncapital.com sw@actoncapital.com Key Investment Criteria growth stage, selectively early (no seed) Website www.actoncapital.com Dominik Alvermann Principal Aline Vedder Contact Email info@actoncapital.com da@actoncapital.com Director Communications av@actoncapital.com Contact Phone +49 89 24218870 INVESTOR BOOK 12

NOAH Berlin 2018 - Investor Book Page 12 Page 14

NOAH Berlin 2018 - Investor Book Page 12 Page 14