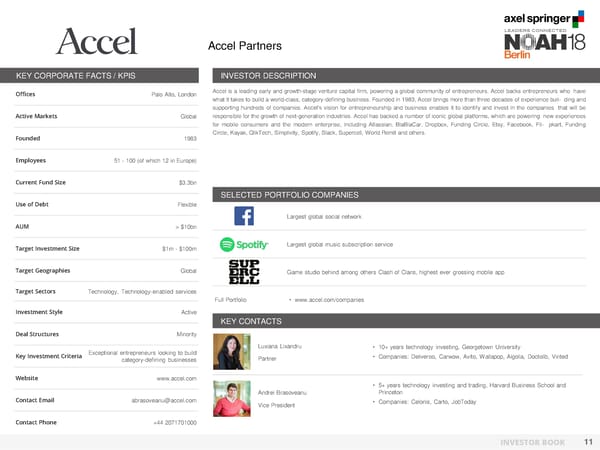

Accel Partners KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices Palo Alto, London Accel is a leading early and growth-stage venture capital firm, powering a global community of entrepreneurs. Accel backs entrepreneurs who have what it takes to build a world-class, category-defining business. Founded in 1983, Accel brings more than three decades of experience buil- ding and supporting hundreds of companies. Accel’s vision for entrepreneurship and business enables it to identify and invest in the companies that will be Active Markets Global responsible for the growth of next-generation industries. Accel has backed a number of iconic global platforms, which are powering new experiences for mobile consumers and the modern enterprise, including Atlassian, BlaBlaCar, Dropbox, Funding Circle, Etsy, Facebook, Fli- pkart, Funding Founded 1983 Circle, Kayak, QlikTech, Simplivity, Spotify, Slack, Supercell, World Remit and others. Employees 51 - 100 (of which 12 in Europe) Current Fund Size $3.3bn SELECTED PORTFOLIO COMPANIES Use of Debt Flexible Largest global social network AUM > $10bn Target Investment Size $1m - $100m Largest global music subscription service Target Geographies Global Game studio behind among others Clash of Clans, highest ever grossing mobile app Target Sectors Technology, Technology-enabled services Full Portfolio • www.accel.com/companies Investment Style Active KEY CONTACTS Deal Structures Minority Luxiana Lixandru • 10+ years technology investing, Georgetown University Key Investment Criteria Exceptional entrepreneurs looking to build Partner • Companies: Deliveroo, Carwow, Avito, Wallapop, Algolia, Doctolib, Vinted category-defining businesses Website www.accel.com • 5+ years technology investing and trading, Harvard Business School and Andrei Brasoveanu Princeton Contact Email abrasoveanu@accel.com Vice President • Companies: Celonis, Carto, JobToday Contact Phone +44 2071701000 INVESTOR BOOK 11

NOAH Berlin 2018 - Investor Book Page 11 Page 13

NOAH Berlin 2018 - Investor Book Page 11 Page 13