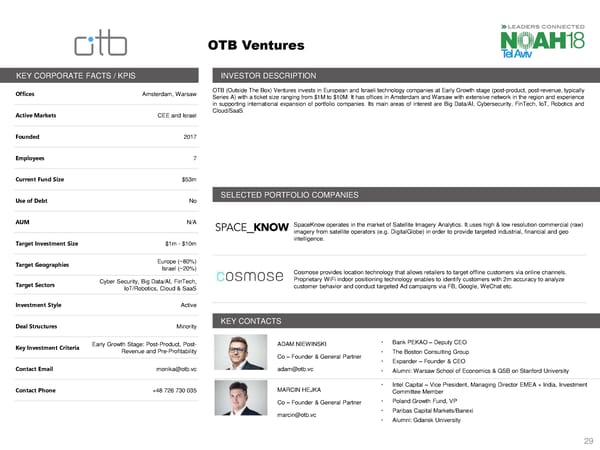

OTB Ventures KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices Amsterdam, Warsaw OTB(Outside The Box) Ventures invests in European and Israeli technology companies at Early Growth stage (post-product, post-revenue, typically Series A) with a ticket size ranging from $1M to $10M. It has offices in Amsterdam and Warsaw with extensive network in the region and experience in supporting international expansion of portfolio companies. Its main areas of interest are Big Data/AI, Cybersecurity, FinTech, IoT, Robotics and Active Markets CEE and Israel Cloud/SaaS. Founded 2017 Employees 7 Current Fund Size $53m Use of Debt No SELECTED PORTFOLIO COMPANIES AUM N/A SpaceKnowoperates in the market of Satellite Imagery Analytics. It uses high & low resolution commercial (raw) imagery from satellite operators (e.g. DigitalGlobe) in order to provide targeted industrial, financial and geo Target Investment Size $1m-$10m intelligence. Target Geographies Europe (~80%) Israel (~20%) Cosmoseprovides location technology that allows retailers to target offline customers via online channels. Target Sectors Cyber Security, Big Data/AI, FinTech, Proprietary WiFi indoor positioning technology enables to identify customers with 2m accuracy to analyze IoT/Robotics, Cloud & SaaS customer behavior and conduct targeted Ad campaigns via FB, Google, WeChat etc. Investment Style Active Deal Structures Minority KEY CONTACTS Key Investment Criteria Early Growth Stage: Post-Product, Post- ADAM NIEWINSKI • Bank PEKAO – Deputy CEO Revenue and Pre-Profitability [Photo] Co – Founder & General Partner • The Boston Consulting Group • Expander – Founder & CEO Contact Email monika@otb.vc adam@otb.vc • Alumni: Warsaw School of Economics & GSB on Stanford University Contact Phone +48 726 730 035 MARCIN HEJKA • Intel Capital – Vice President, Managing Director EMEA + India, Investment Committee Member [Photo] Co – Founder & General Partner • Poland Growth Fund, VP marcin@otb.vc • Paribas Capital Markets/Banexi • Alumni: Gdansk University 29

NOAH 18 Tel Aviv Investor Book Page 28 Page 30

NOAH 18 Tel Aviv Investor Book Page 28 Page 30