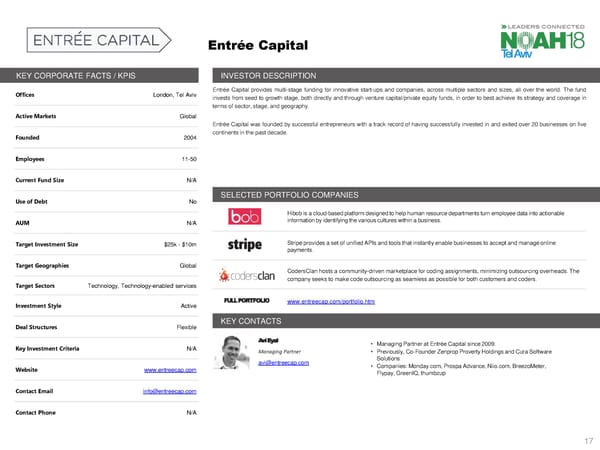

Entrée Capital KEY CORPORATE FACTS /KPIS INVESTORDESCRIPTION KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices London, Tel Aviv Entrée Capital provides multi-stage funding for innovative start-ups and companies, across multiple sectors and sizes, all over the world. The fund invests from seed to growth stage, both directly and through venture capital/private equity funds, in order to best achieve its strategy and coverage in termsof sector,stage,andgeography. Active Markets Global Entrée Capital was founded by successful entrepreneurs with a track record of having successfully invested in and exited over 20 businesses on five Founded 2004 continentsin the past decade. Employees 11-50 Current Fund Size N/A SELECTED PORTFOLIOCOMPANIES Use of Debt No SELECTED PORTFOLIO COMPANIES Hibobis a cloud-based platform designed to help human resource departments turn employee data into actionable AUM N/A information by identifying the various cultures within a business. Target Investment Size $25k - $10m Stripe provides a set of unified APIs and tools that instantly enable businesses to accept and manage online payments. Target Geographies Global CodersClan hosts a community-driven marketplace for coding assignments, minimizing outsourcing overheads. The Target Sectors Technology, Technology-enabled services company seeks to make code outsourcing as seamless as possible for both customers and coders. Investment Style Active FULLPORTFOLIO www.entreecap.com/portfolio.htm KEYCONTACTS Deal Structures Flexible KEY CONTACTS Avi Eyal • ManagingPartneratEntrée Capital since2009. Key Investment Criteria N/A Managing Partner • Previously, Co-FounderZenpropProvertyHoldings and CuraSoftware avi@entreecap.com Solutions Website www.entreecap.com • Companies: Monday.com, ProspaAdvance, Niio.com, BreezoMeter, Flypay, GreenIQ, thumbzup Contact Email info@entreecap.com Contact Phone N/A 17

NOAH 18 Tel Aviv Investor Book Page 16 Page 18

NOAH 18 Tel Aviv Investor Book Page 16 Page 18