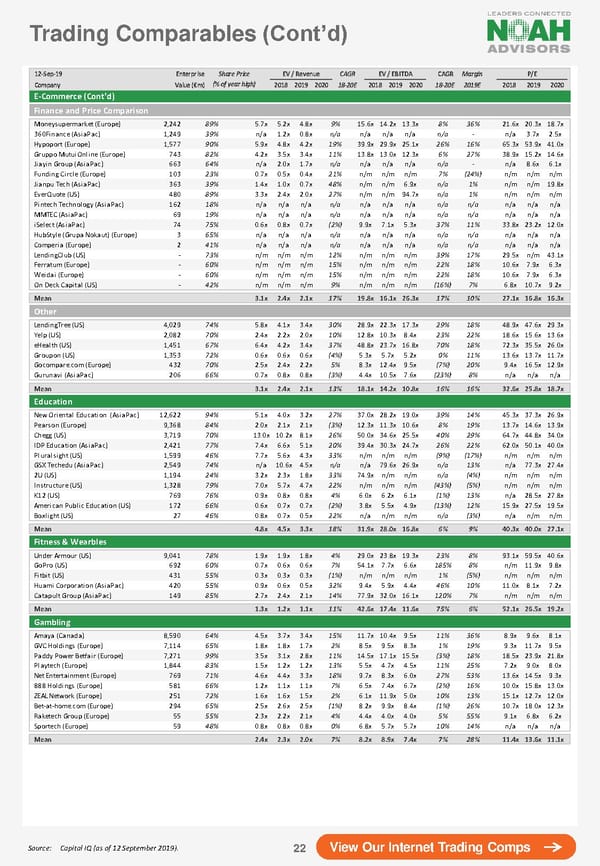

Trading Comparables(Cont’d) 12-Sep-19 Enterprise Share Price EV / Revenue CAGR EV / EBITDA CAGR Margin P/E Company Value (€m) (% of year high) 2018 2019 2020 18-20E 2018 2019 2020 18-20E 2019E 2018 2019 2020 E-Commerce (Cont'd) Finance and Price Comparison Moneysupermarket (Europe) 2,242 89% 5.7x 5.2x 4.8x 9% 15.6x 14.2x 13.3x 8% 36% 21.6x 20.3x 18.7x 360Finance (AsiaPac) 1,249 39% n/a 1.2x 0.8x n/a n/a n/a n/a n/a - n/a 3.7x 2.5x Hypoport (Europe) 1,577 90% 5.9x 4.8x 4.2x 19% 39.9x 29.9x 25.1x 26% 16% 65.3x 53.9x 41.0x Gruppo MutuiOnline (Europe) 743 82% 4.2x 3.5x 3.4x 11% 13.8x 13.0x 12.3x 6% 27% 38.9x 15.2x 14.6x Jiayin Group (AsiaPac) 663 64% n/a 2.0x 1.7x n/a n/a n/a n/a n/a - n/a 8.6x 6.1x Funding Circle (Europe) 103 23% 0.7x 0.5x 0.4x 21% n/m n/m n/m 7% (24%) n/m n/m n/m Jianpu Tech (AsiaPac) 363 39% 1.4x 1.0x 0.7x 48% n/m n/m 6.9x n/a 1% n/m n/m 19.8x EverQuote (US) 480 89% 3.3x 2.4x 2.0x 27% n/m n/m 94.7x n/a 1% n/m n/m n/m Pintech Technology (AsiaPac) 162 18% n/a n/a n/a n/a n/a n/a n/a n/a n/a n/a n/a n/a MMTEC (AsiaPac) 69 19% n/a n/a n/a n/a n/a n/a n/a n/a n/a n/a n/a n/a iSelect (AsiaPac) 74 75% 0.6x 0.8x 0.7x (2%) 9.9x 7.1x 5.3x 37% 11% 33.8x 23.2x 12.0x HubStyle (Grupa Nokaut) (Europe) 3 65% n/a n/a n/a n/a n/a n/a n/a n/a n/a n/a n/a n/a Comperia (Europe) 2 41% n/a n/a n/a n/a n/a n/a n/a n/a n/a n/a n/a n/a LendingClub (US) - 73% n/m n/m n/m 12% n/m n/m n/m 39% 17% 29.5x n/m 43.1x Ferratum (Europe) - 60% n/m n/m n/m 15% n/m n/m n/m 22% 18% 10.6x 7.9x 6.3x Weidai (Europe) - 60% n/m n/m n/m 15% n/m n/m n/m 22% 18% 10.6x 7.9x 6.3x On Deck Capital (US) - 42% n/m n/m n/m 9% n/m n/m n/m (16%) 7% 6.8x 10.7x 9.2x Mean 3.1x 2.4x 2.1x 17% 19.8x 16.1x 26.3x 17% 10% 27.1x 16.8x 16.3x Other LendingTree (US) 4,029 74% 5.8x 4.1x 3.4x 30% 28.9x 22.3x 17.3x 29% 18% 48.9x 47.6x 29.3x Yelp (US) 2,082 70% 2.4x 2.2x 2.0x 10% 12.8x 10.3x 8.4x 23% 22% 18.6x 15.6x 13.6x eHealth (US) 1,451 67% 6.4x 4.2x 3.4x 37% 48.8x 23.7x 16.8x 70% 18% 72.3x 35.5x 26.0x Groupon (US) 1,353 72% 0.6x 0.6x 0.6x (4%) 5.3x 5.7x 5.2x 0% 11% 13.6x 13.7x 11.7x Gocompare.com (Europe) 432 70% 2.5x 2.4x 2.2x 5% 8.3x 12.4x 9.5x (7%) 20% 9.4x 16.5x 12.9x Gurunavi (AsiaPac) 206 66% 0.7x 0.8x 0.8x (3%) 4.4x 10.5x 7.6x (23%) 8% n/a n/a n/a Mean 3.1x 2.4x 2.1x 13% 18.1x 14.2x 10.8x 16% 16% 32.6x 25.8x 18.7x Education New Oriental Education (AsiaPac) 12,622 94% 5.1x 4.0x 3.2x 27% 37.0x 28.2x 19.0x 39% 14% 45.3x 37.3x 26.9x Pearson (Europe) 9,368 84% 2.0x 2.1x 2.1x (3%) 12.3x 11.3x 10.6x 8% 19% 13.7x 14.6x 13.9x Chegg (US) 3,719 70% 13.0x 10.2x 8.1x 26% 50.0x 34.6x 25.5x 40% 29% 64.7x 44.8x 34.0x IDP Education (AsiaPac) 2,421 77% 7.4x 6.6x 5.1x 20% 39.4x 30.3x 24.7x 26% 22% 62.0x 50.1x 40.0x Pluralsight (US) 1,599 46% 7.7x 5.6x 4.3x 33% n/m n/m n/m (9%) (17%) n/m n/m n/m GSX Techedu (AsiaPac) 2,549 74% n/a 10.6x 4.5x n/a n/a 79.6x 26.9x n/a 13% n/a 77.3x 27.4x 2U (US) 1,194 24% 3.2x 2.3x 1.8x 33% 74.9x n/m n/m n/a (4%) n/m n/m n/m Instructure (US) 1,328 79% 7.0x 5.7x 4.7x 22% n/m n/m n/m (43%) (5%) n/m n/m n/m K12 (US) 769 76% 0.9x 0.8x 0.8x 4% 6.0x 6.2x 6.1x (1%) 13% n/a 28.5x 27.8x American Public Education (US) 172 66% 0.6x 0.7x 0.7x (2%) 3.8x 5.5x 4.9x (13%) 12% 15.9x 27.5x 19.5x Boxlight (US) 27 46% 0.8x 0.7x 0.5x 22% n/a n/m n/m n/a (3%) n/a n/m n/m Mean 4.8x 4.5x 3.3x 18% 31.9x 28.0x 16.8x 6% 9% 40.3x 40.0x 27.1x Fitness & Wearbles Under Armour (US) 9,041 78% 1.9x 1.9x 1.8x 4% 29.0x 23.8x 19.3x 23% 8% 93.1x 59.5x 40.6x GoPro (US) 692 60% 0.7x 0.6x 0.6x 7% 54.1x 7.7x 6.6x 185% 8% n/m 11.9x 9.8x Fitbit (US) 431 55% 0.3x 0.3x 0.3x (1%) n/m n/m n/m 1% (5%) n/m n/m n/m Huami Corporation (AsiaPac) 420 55% 0.9x 0.6x 0.5x 32% 9.4x 5.9x 4.4x 46% 10% 11.0x 8.1x 7.2x Catapult Group (AsiaPac) 149 85% 2.7x 2.4x 2.1x 14% 77.9x 32.0x 16.1x 120% 7% n/m n/m n/m Mean 1.3x 1.2x 1.1x 11% 42.6x 17.4x 11.6x 75% 6% 52.1x 26.5x 19.2x Gambling Amaya (Canada) 8,590 64% 4.5x 3.7x 3.4x 15% 11.7x 10.4x 9.5x 11% 36% 8.9x 9.6x 8.1x GVC Holdings (Europe) 7,114 65% 1.8x 1.8x 1.7x 2% 8.5x 9.5x 8.3x 1% 19% 9.3x 11.7x 9.5x Paddy Power Betfair (Europe) 7,271 99% 3.5x 3.1x 2.8x 11% 14.5x 17.1x 15.5x (3%) 18% 18.5x 23.9x 21.8x Playtech (Europe) 1,844 83% 1.5x 1.2x 1.2x 13% 5.5x 4.7x 4.5x 11% 25% 7.2x 9.0x 8.0x Net Entertainment (Europe) 769 71% 4.6x 4.4x 3.3x 18% 9.7x 8.3x 6.0x 27% 53% 13.6x 14.5x 9.3x 888 Holdings (Europe) 581 66% 1.2x 1.1x 1.1x 7% 6.5x 7.4x 6.7x (2%) 16% 10.0x 15.8x 13.0x ZEAL Network (Europe) 251 72% 1.6x 1.6x 1.5x 2% 6.1x 11.9x 5.0x 10% 13% 15.1x 12.7x 12.0x Bet-at-home.com (Europe) 294 65% 2.5x 2.6x 2.5x (1%) 8.2x 9.9x 8.4x (1%) 26% 10.7x 18.0x 12.3x Raketech Group (Europe) 55 55% 2.3x 2.2x 2.1x 4% 4.4x 4.0x 4.0x 5% 55% 9.1x 6.8x 6.2x Sportech (Europe) 59 48% 0.8x 0.8x 0.8x 0% 6.8x 5.7x 5.7x 10% 14% n/a n/a n/a Mean 2.4x 2.3x 2.0x 7% 8.2x 8.9x 7.4x 7% 28% 11.4x 13.6x 11.1x Source: Capital IQ (as of 12 September 2019). 22 View Our Internet Trading Comps

The NOAH Bible Page 21 Page 23

The NOAH Bible Page 21 Page 23