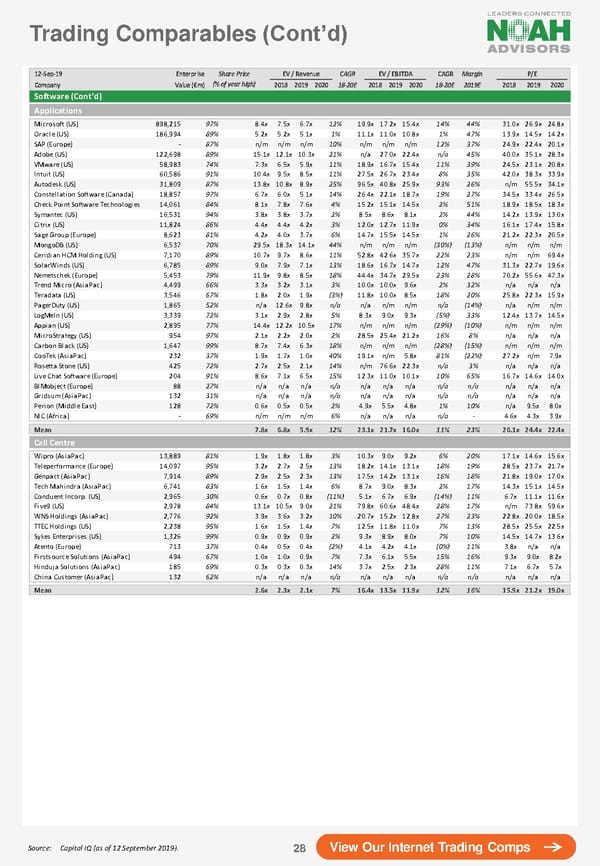

Trading Comparables(Cont’d) 12-Sep-19 Enterprise Share Price EV / Revenue CAGR EV / EBITDA CAGR Margin P/E Company Value (€m) (% of year high) 2018 2019 2020 18-20E 2018 2019 2020 18-20E 2019E 2018 2019 2020 Software (Cont'd) Applications Microsoft (US) 898,215 97% 8.4x 7.5x 6.7x 12% 19.9x 17.2x 15.4x 14% 44% 31.0x 26.9x 24.8x Oracle (US) 186,994 89% 5.2x 5.2x 5.1x 1% 11.1x 11.0x 10.8x 1% 47% 13.9x 14.5x 14.2x SAP (Europe) - 87% n/m n/m n/m 10% n/m n/m n/m 12% 37% 24.9x 22.4x 20.1x Adobe (US) 122,698 89% 15.1x 12.1x 10.3x 21% n/a 27.0x 22.4x n/a 45% 40.0x 35.1x 28.3x VMware (US) 58,983 74% 7.3x 6.5x 5.9x 11% 18.9x 16.7x 15.4x 11% 39% 24.5x 23.1x 20.8x Intuit (US) 60,586 91% 10.4x 9.5x 8.5x 11% 27.5x 26.7x 23.4x 8% 35% 42.0x 38.3x 33.9x Autodesk (US) 31,809 87% 13.8x 10.8x 8.9x 25% 96.5x 40.8x 25.9x 93% 26% n/m 55.5x 34.1x Constellation Software (Canada) 18,857 97% 6.7x 6.0x 5.1x 14% 26.4x 22.1x 18.7x 19% 27% 34.5x 33.4x 26.5x Check Point Software Technologies (Midd1le4 ,E0a6s1t) 84% 8.1x 7.8x 7.6x 4% 15.2x 15.1x 14.5x 2% 51% 18.9x 18.5x 18.3x Symantec (US) 16,531 94% 3.8x 3.8x 3.7x 2% 8.5x 8.6x 8.1x 2% 44% 14.2x 13.9x 13.0x Citrix (US) 11,824 86% 4.4x 4.4x 4.2x 3% 12.0x 12.7x 11.9x 0% 34% 16.1x 17.4x 15.8x Sage Group (Europe) 8,623 81% 4.2x 4.0x 3.7x 6% 14.7x 15.5x 14.5x 1% 26% 21.2x 22.3x 20.5x MongoDB (US) 6,537 70% 29.5x 18.3x 14.1x 44% n/m n/m n/m (30%) (13%) n/m n/m n/m Ceridian HCM Holding (US) 7,170 89% 10.7x 9.7x 8.6x 11% 52.8x 42.6x 35.7x 22% 23% n/m n/m 69.4x SolarWinds (US) 6,785 89% 9.0x 7.9x 7.1x 13% 18.6x 16.7x 14.7x 12% 47% 31.3x 22.7x 19.6x Nemetschek (Europe) 5,453 79% 11.9x 9.8x 8.5x 18% 44.4x 34.7x 29.5x 23% 28% 70.2x 55.6x 47.3x Trend Micro (AsiaPac) 4,499 66% 3.3x 3.2x 3.1x 3% 10.0x 10.0x 9.6x 2% 32% n/a n/a n/a Teradata (US) 3,546 67% 1.8x 2.0x 1.9x (3%) 11.8x 10.0x 8.5x 18% 20% 25.8x 22.3x 15.9x PagerDuty (US) 1,865 52% n/a 12.6x 9.8x n/a n/a n/m n/m n/a (14%) n/a n/m n/m LogMeIn (US) 3,339 72% 3.1x 2.9x 2.8x 5% 8.3x 9.0x 9.3x (5%) 33% 12.4x 13.7x 14.5x Appian (US) 2,895 77% 14.4x 12.2x 10.5x 17% n/m n/m n/m (29%) (10%) n/m n/m n/m MicroStrategy (US) 954 97% 2.1x 2.2x 2.0x 2% 28.5x 25.4x 21.2x 16% 8% n/a n/a n/a Carbon Black (US) 1,647 99% 8.7x 7.4x 6.3x 18% n/m n/m n/m (28%) (15%) n/m n/m n/m CooTek (AsiaPac) 232 37% 1.9x 1.7x 1.0x 40% 19.1x n/m 5.8x 81% (22%) 27.2x n/m 7.9x Rosetta Stone (US) 425 72% 2.7x 2.5x 2.1x 14% n/m 76.6x 22.3x n/a 3% n/a n/a n/a Live Chat Software (Europe) 204 91% 8.6x 7.1x 6.5x 15% 12.3x 11.0x 10.1x 10% 65% 16.7x 14.6x 14.0x BIMobject (Europe) 88 27% n/a n/a n/a n/a n/a n/a n/a n/a n/a n/a n/a n/a Gridsum (AsiaPac) 132 31% n/a n/a n/a n/a n/a n/a n/a n/a n/a n/a n/a n/a Perion (Middle East) 128 72% 0.6x 0.5x 0.5x 2% 4.9x 5.5x 4.8x 1% 10% n/a 9.5x 8.0x NIC (Africa) - 69% n/m n/m n/m 6% n/a n/a n/a n/a - 4.6x 4.3x 3.9x Mean 7.8x 6.8x 5.9x 12% 23.1x 21.7x 16.0x 11% 23% 26.1x 24.4x 22.4x Call Centre Wipro (AsiaPac) 13,889 81% 1.9x 1.8x 1.8x 3% 10.3x 9.0x 9.2x 6% 20% 17.1x 14.6x 15.6x Teleperformance (Europe) 14,097 95% 3.2x 2.7x 2.5x 13% 18.2x 14.1x 13.1x 18% 19% 28.5x 23.7x 21.7x Genpact (AsiaPac) 7,914 89% 2.9x 2.5x 2.3x 13% 17.5x 14.2x 13.1x 16% 18% 21.8x 19.0x 17.0x Tech Mahindra (AsiaPac) 6,741 83% 1.6x 1.5x 1.4x 6% 8.7x 9.0x 8.3x 2% 17% 14.3x 15.1x 14.5x Conduent Incorp. (US) 2,965 30% 0.6x 0.7x 0.8x (11%) 5.1x 6.7x 6.9x (14%) 11% 6.7x 11.1x 11.6x Five9 (US) 2,978 84% 13.1x 10.5x 9.0x 21% 79.8x 60.6x 48.4x 28% 17% n/m 73.8x 59.6x WNS Holdings (AsiaPac) 2,776 92% 3.9x 3.6x 3.2x 10% 20.7x 15.2x 12.8x 27% 23% 22.8x 20.0x 18.5x TTEC Holdings (US) 2,238 95% 1.6x 1.5x 1.4x 7% 12.5x 11.8x 11.0x 7% 13% 28.5x 25.5x 22.5x Sykes Enterprises (US) 1,326 99% 0.9x 0.9x 0.9x 2% 9.3x 8.9x 8.0x 7% 10% 14.5x 14.7x 13.6x Atento (Europe) 713 37% 0.4x 0.5x 0.4x (2%) 4.1x 4.2x 4.1x (0%) 11% 3.8x n/a n/a Firstsource Solutions (AsiaPac) 494 67% 1.0x 1.0x 0.9x 7% 7.3x 6.1x 5.5x 15% 16% 9.3x 9.0x 8.2x Hinduja Solutions (AsiaPac) 185 69% 0.3x 0.3x 0.3x 14% 3.7x 2.5x 2.3x 28% 11% 7.1x 6.7x 5.7x China Customer (AsiaPac) 132 62% n/a n/a n/a n/a n/a n/a n/a n/a n/a n/a n/a n/a Mean 2.6x 2.3x 2.1x 7% 16.4x 13.5x 11.9x 12% 16% 15.9x 21.2x 19.0x Source: Capital IQ (as of 12 September 2019). 28 View Our Internet Trading Comps

The NOAH Bible Page 27 Page 29

The NOAH Bible Page 27 Page 29