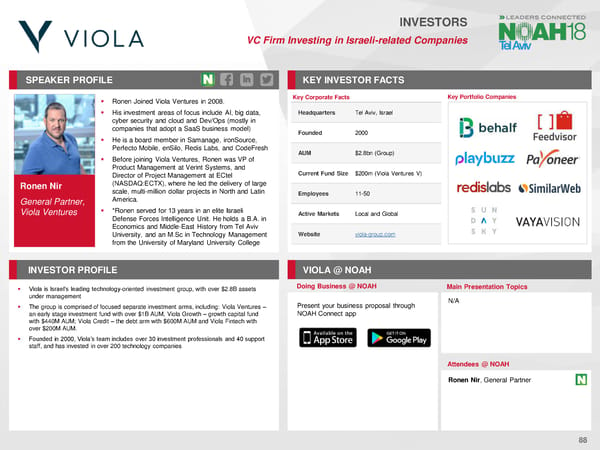

INVESTORS VC Firm Investing in Israeli-related Companies SPEAKER PROFILE KEY INVESTORFACTS ▪ Ronen Joined Viola Ventures in 2008. Key Corporate Facts Key Portfolio Companies ▪ His investment areas of focus include AI, big data, Headquarters Tel Aviv, Israel cyber security and cloud and Dev/Ops (mostly in companies that adopt a SaaS business model) Founded 2000 ▪ He is a board member in Samanage, ironSource, Perfecto Mobile, enSilo, Redis Labs, and CodeFresh AUM $2.8bn (Group) ▪ Before joining Viola Ventures, Ronen was VP of Product Management at Verint Systems, and Current Fund Size $200m (Viola Ventures V) Director of Project Management at ECtel Ronen Nir (NASDAQ:ECTX), where he led the delivery of large scale, multi-million dollar projects in North and Latin Employees 11-50 General Partner, America. Viola Ventures ▪ *Ronen served for 13 years in an elite Israeli Active Markets Local and Global Defense Forces Intelligence Unit. He holds a B.A. in Economics and Middle-East History from Tel Aviv University, and an M.Sc in Technology Management Website viola-group.com from the University of Maryland University College INVESTORPROFILE VIOLA @ NOAH ▪ Viola is Israel’s leading technology-oriented investment group, with over $2.8B assets Doing Business @ NOAH Main Presentation Topics under management N/A ▪ The group is comprised of focused separate investment arms, including: Viola Ventures – Present your business proposal through an early stage investment fund with over $1B AUM, Viola Growth – growth capital fund NOAH Connect app with $440M AUM; Viola Credit – the debt arm with $600M AUM and Viola Fintech with over $200M AUM. ▪ Founded in 2000, Viola’s team includes over 30 investment professionals and 40 support staff, and has invested in over 200 technology companies Attendees @ NOAH Ronen Nir, General Partner 88

NOAH18 Tel Aviv Speaker Book Page 87 Page 89

NOAH18 Tel Aviv Speaker Book Page 87 Page 89