NOAH18 Conference Overview

OVERVIEW ® CONNECTING LEADERS TO EMPOWER THE EUROPEAN DIGITAL ECOSYSTEM LONDON TEL AVIV BERLIN 30-31 OCT 2018 9-10 APR 2019 13-14 JUN 2019

Three Conferences, One Mission: Empower the European Digital Ecosystem Connecting Capital and Connecting Israel’s Startups with Connecting European Champions Entrepreneurs Large Corporates and Investors and Challengers 30-31 October 2018 9-10 April 2019 13-14 June 2019 Old Billingsgate, London Haoman 17, Tel Aviv STATION Berlin Mission To provide a physical marketplace Mission To promote Israel - European Mission To bring together future-shaping that facilitates funding of digital relationships and enable funding executives and investors active across European companies at all stages segments driven by digital revolution 1,500+ attendees – the “who is who” of ~800 selected attendees – 200 European ~3,500 attendees – executives, investors, digital European Internet corporates and 600 Israeli start-ups and service providers 100+ of Europe’s leading digital businesses leading executives Unique mix of CEOs from European traditional and 80+ handpicked top start-ups on stage Presentations by 60+ selected Israeli large caps and top-funded startups on stage New program focus: Investors and entrepreneurs investors and top start-ups Focus on emerging start-ups - 80+ handpicked tell their common success stories Company visits and events hosted by young companies on the Startup Stage Pre-event matchmaking – tell us who you start-ups on day 2 Partner dinners and satellite events throughout want to meet Casual networking events the city Totally revamped conference app and Conference app with top search and meeting Workshops and exhibitions by leading digital networking / matchmaking technology functionalities service providers Topical meeting areas to make new relevant Invitation only Totally revamped conference app and contacts Pre-event matchmaking – tell us who you networking / matchmaking technology want to meet Pre-event matchmaking – tell us who you want to meet 2

NOAH Conference Trailer ® 3

Eric Schmidt Robert Gentz Executive Chairman CEO Dr. Mathias Döpfner ® Dara Khosrowshahi CEO CEO Jose Neves Dr. Dieter Zetsche CEO Chairman of the Board of Management HIGH PROFILE Dr. Bernd Montag SPEAKERS CEO Henry Blodget Ralph Hamers CEO, Editor-In-Chief Riccardo Zacconi CEO London 2017 KPIs Founder & CEO 120+ Speakers Dr. Richard Lutz 36 Partners CEO 7 Workshops Niklas Östberg Arianna Huffington Co-Founder & CEO Oliver Samwer Co-Founder and Tel Aviv 2018 KPIs Founder & CEO Editor-in-Chief 70+ Speakers Thomas Ebeling 17 Partners CEO 200+ International Guests Herbert Hainer Hakan Koç CEO CEO Rolf Schrömgens Berlin 2018 KPIs Co-Founder & CEO Sir Martin Sorrell 120+ Speakers CEO 62 Partners Glenn Fogel 12 Workshops CEO Internet Dr. Klaus Hommels Julie Linn Teigland Founder & CEO MP EY Germany, Corporate Switzerland, Austria Rainer Maerkle Karel Dörner Philipp Freise General Partner Senior Partner Partner Karim Jalbout Head of the European Digital Practice Al Gore Pieter van der Does Chairman Alex Kayyal CEO Sonali De Rycker Head of Salesforce Partner Ventures Europe Service Provider Niklas Zennström Investor John Collison CEO President Mikkel Svane Mike Lynch CEO Founder & CEO 4

30 - 31 October 2018 OLD BILLINGSGATE 5

6,100+ Unique Attendees Senior Decision Makers to Date 49% C-Level 300+ Unique Speakers 21% Investment 500+ Company Financings and M&A Partner Transactions Originated @NOAH 8% Owner, Founder 1% Board Member 33% UK 21% Other 32% Germany ~80% senior decision makers 5% Switzerland 4% Spain Company Size (# employees) Launched in 2009, the NOAH Conference has 4% Poland grown into the preeminent European event where 4% USA 5% Over 10,000 over 4,000 senior executives and investors meet 18% Other to 10% 1001-10,000 • Gain insights into the latest proven concepts 3% 501-1,000 • Network and establish new business 47% Internet Entrepreneurs 6% 251-500 relationships and Executives 12% 101-250 • Find customers and top B2B service 25% Investors providers 14% Corporate Executives 10% 51-100 • Enjoy other events organized around the 9% Service Providers 33% 11-50 main conference (Speaker Dinner, NOAH 3% Press 20% 1-10 Party, satellite events) 2% Other 6

630 ATTENDING INVESTORS VENTURE CAPITAL 55% GROWTH CAPITAL 34% BUYOUT 11% VENTURE CAPITAL eventures GROWTH CAPITAL BUYOUT DEBT 7

VENUE & NETWORKING 8

THE NOAH STARTUP STAGE The NOAH18 Berlin Startup Competition Following an intense round of voting (with some close competition!), we’re excited to announce the winners of the NOAH Berlin 2018 Startup Stage! Congratulations to the voted winner KIDSORTED and runner-up Zana, as well as FinCompare that already wowed a jury during our special FinTech competition. They will all present their ventures on the main stage of our upcoming NOAH Conference in London on 30-31 October. MEET OUR WINNERS The NOAH18 London Startup Stage Want to meet relevant angels and VCs looking for early-stage opportu- nities and increase public awareness? Apply for the NOAH18 London Startup Stage now! APPLY FOR NOAH18 LONDON STARTUP STAGE 9

9 - 10 April 2019 HAOMAN 17 10

721 Attendees 70+ Speakers 68% Israel 10% Germany 5% UK 5% USA 2% Switzerland 9% Other Company Size (# employees) Senior Decision Makers 11% Over 10,000 11% 1001-10,000 36% C-Level 3% 501-1,000 20% Senior Executive 7% 251-500 15% Investment 11% 101-250 Partner 4% Owner, Founder 6% 51-100 2% Board Member 29% 11-50 24% Other 76% senior decision makers 21% 1-10 11

VENUE & NETWORKING 12

13 - 14 June 2019 STATION BERLIN 13

Senior Decision Makers 7,840 Unique Attendees to Date 28% Board Member 19% C-Level 200+ Unique Speakers 18% Owner, Founder 10% Investment 67% Germany Partner 9% UK 24% Other 5% Switzerland ~75% senior decision makers 2% US Other 18% Company Size (# employees) 13% Over 10,000 42% Internet Entrepreneurs 15% 1001-10,000 and Executives 5% 501-1,000 21% Investors 7% 251-500 17% Service Providers 11% 101-250 16% Corporate Executives 7% 51-100 4% Press 27% 11-50 1% Other 16% 1-10 14

B2B & Software Consumer Travel & Tourism Goods, Retail & Ecommerce Transportation Digital & TMT & Mobility Restaurants & Fintech Food Delivery The event is a unique platform for senior executives from old champions and new challengers to discuss disruption in 10+ industrial verticals. Payments Healthcare, Science & Education Over 100 CEOs to tell the story of their Company! Online Fashion Industrials & IoT Marketing Tech Lending Platforms 15

550 ATTENDING INVESTORS VENTURE CAPITAL 74% GROWTH CAPITAL 12% BUYOUT 9% DEBT 4% VENTURE CAPITAL eventures GROWTH CAPITAL BUYOUT DEBT 16

VENUE & NETWORKING 17

“ THIS IS NOAH CONFERENCE “It´s a very good conference, NOAH CONNECTS LEADERS AT ONE PLACE USING one can do business! BEST-IN-CLASS CONFERENCES AND TECHNOLOGY Oliver Samwer TO EMPOWER THE EUROPEAN DIGITAL ECOSYSTEM CEO, Rocket Internet SPEAKERS AT NOAH HEARING THE STORY OF EUROPEAN DIGITAL LEADERS TO LEARN MAIN STAGE: $100M MINIMUM VALUATIONVALUATION OF $100M+VALUATION OF $100M+ STARTUP STAGE FOR YOUNG OUR AUDIENCE IS OUR STAGE EUROPEAN COMPANIES 110+ speakers at NOAH18 Berlin main stage By invitation only 100 Firms on NOAH17 London Main Stage100 Firms on NOAH17 London Main Stage 12,000+ unique attendees to date at NOAH 640 companies presented since 2009 (37 digital [ ] Companies presented on Main Stage[ ] Companies presented on Main Stage Conferences unicorns) 90 x 6-min pitches at NOAH Berlin Of which [ ] UnicornsOf which [ ] Unicorns 23,000 viewers watch the recordings or live Speakers are CEOs and founders CEOs and founders from emerging companies less Of the top 100 Internet Exits in last 5 years in EuOf the top 100 Internet Exits in last 5 years in Eu-- streams Including: Adyen, BlaBlaCar, Check24, Criteo, than 4 years old rope by size, [%] passed through our stagerope by size, [%] passed through our stage Videos and presentations of all past conferences Deliveroo, Delivey Hero, Farfetch, Gett, HelloFresh, Live audience of 100 (Berlin) to 200 (London), video King.com, MoneySuperMarket, Scout24, Spotify, live stream and inclusion in NOAH media library Corporate champions attending regularly NOAH: Stripe, TransferWise, Trivago, UBER, WeWork, 3 winners (online voting) present on main stage at Credit Suisse, Daimler, Deutsche Bank, Digital Wix, Yandex, etc. next NOAH McKinsey, eBay, Facebook, Google, ING, Naspers, Porsche, Priceline, ProSiebenSat.1, TUI, etc. Unique track record of funding origination NOAH18 BERLIN ATTENDEES BY COUNTRY 67% Germany 9% UK NOAH18 BERLIN SPEAKER BOOK WNNERS TO DATE 5% Switzerland 2% US STARTUP STAGE 18% Other NOAH17 London: #1 The Work Crowd, #2 Misterporter, #3 Everdine ATTENDEES BY SENIORITY NOAH17 Berlin: #1 Lalafo, #2 Bitbond, #3 TravelPerk NOAH16 London: #1 Beezer, #2 CodeMonkey, #3 EyefitU 28% C-Level CLICK NOAH16 Berlin: #1 Fraugster, #2 123Sonography, 19% Investment Partner TO VIEW #3 adMingle, #4 Scalable Capital, #5 Webdata Solutions 18% Owner, Founder SEVENVENTURES PITCH DAY 10% Board Member NOAH15 London SnapCam 24% Other NOAH15 Berlin Withings NOAH14 London Cashboard ~75% senior decision makers NOAH13 London GetYourGuide 18

NOAH CONNECTS CAPITAL AND ENTREPRENEURS TO INVEST, RAISE MONEY AND BUILD LONG TERM INVESTOR RELATIOSHIPS INVESTORS AT NOAH VC PANEL INVESTOR BOOK NOAH hosts the top VC, Growth Capital and A classic session at NOAH since 2009 100 - 150 detailled investor profiles with Buyout investors interested in Internet Berlin 2018: Lakestar, Generation Investment contact details and the NOAH Investor Book We hosted on main stage 60% of the top 50 and Management, Insight Venture Partners, We do the NOAH Investor Book since 2013 56% of the top 80 digital M&A Exits in Europe Permira and Holtzbrinck Ventures over the last 7 years since the launch of NOAH Conference in Nov 2009 NOAH18 BERLIN INVESTOR BOOK 11 Investors present their portfolio Stars on NOAH18 Berlin Main Stage 700+ VC, Growth and Buyout investors at NOAH18 Berlin 500 unique investor funds attended NOAH to date CLICK TO VIEW TOP INVESTORS COME TO NOAH REGULARLY! - Total Attendees over the Last 8 Years 1. Lakestar 91 14. Macquarie Capital 32 27. Earlybird Venture Capital 23 40. Deutsche Telekom Capital 15 2. Index Ventures 76 15. MCI Capital 32 28. Atomico Ventures 22 Partners 3. Hellman & Friedman 74 16. e.ventures 30 29. NGP Capital 20 41. Advent International 14 4. Holtzbrinck Ventures 68 17. Acton Capital 30 30. Northzone 20 42. Balderton Capital 14 5. KKR 63 18. EQT Partners 29 31. Oakley Capital 20 43. Harbert Management 14 6. SevenVentures 61 19. TCV 29 32. HPE Growth Capital 19 Corporation 7. Target Global 49 20. Spectrum Equity Investors 25 33. Scottish Equity Partners 17 44. Permira 14 8. Vitruvian Partners 49 21. Maryland 25 34. Highland Capital Partners 17 45. Endeit 13 9. General Atlantic 46 22. Partech Ventures 25 35. Silver Lake Partners 16 46. Vulcan Capital 13 10. Accel Partners 42 23. Insight Venture Partners 25 36. DN Capital 16 47. Creathor Venture 13 11. TA Associates 37 24. Project A Ventures 24 37. TPG Capital 16 48. EMK Capital 13 12. Eight Roads 37 25. Goldman Sachs 24 38. InVenture Partners 15 49. Great Hill Partners 12 13. Summit Partners 33 26. HgCapital 23 39. Providence Equity 15 50. Finstar Financial Group 11 19

SERVICE PROVIDERS AT NOAH TO FIND NEW CUSTOMERS OR THE MOST PROVEN SOLUTIONS AND TOOLS PARTNERS SATELLITE EVENTS NOAH BIBLE 65 partners in 2017 25 satellite events in 2017 450 trading comparables across 40 sectors 50 exhibition stands Speakers Dinner 300+ most significant transactions 25 workshops Traffic analysis of key B2C sectors NOAH Disruptor List: hottest companies by funds raised Published since May 2015 Click here to sign up CLICK TO VIEW NETWORKING AT NOAH DO BUSINESS AND DON’T WASTE TIME AT CONFERENCES (WE ARE CURATING YOUR CONFERENCE VISIT) MATCHMAKING MEETING ROOMS AT NOAH BERLIN An introduction platform for the most relevant inves- Meeting spaces on site tors and companies ahead of NOAH London and Berlin: Over 9,000 messages and 7,000 meetings set up 12 meeting locations – easy to find, live and on Over 1,200 investor meetings requests about to at NOAH Berlin the floorplan get sent to 630 investors The app used by 75% of the conference attendees Meeting rooms bookable on demand 2,300 company meetings requests about to get NOAH Connect App Guide sent to 1,000 leading digital companies at all stages 630+ INVESTMENT FUNDS 1,000+ INTERNET COMPANIES 20

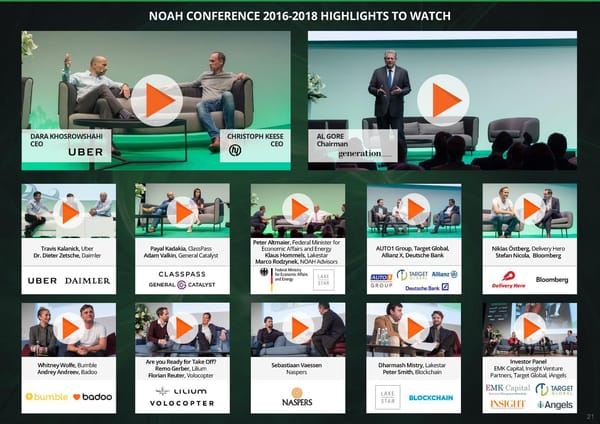

NOAH CONFERENCE 2016-2018 HIGHLIGHTS TO WATCH DARA KHOSROWSHAHI CHRISTOPH KEESE AL GORE CEO CEO Chairman Peter Altmaier, Federal Minister for Travis Kalanick, Uber Payal Kadakia, ClassPass Economic Affairs and Energy AUTO1 Group, Target Global, Niklas Östberg, Delivery Hero Dr. Dieter Zetsche, Daimler Adam Valkin, General Catalyst Klaus Hommels, Lakestar Allianz X, Deutsche Bank Stefan Nicola, Bloomberg Marco Rodzynek, NOAH Advisors Whitney Wolfe, Bumble Are you Ready for Take Off? Sebastiaan Vaessen Dharmash Mistry, Lakestar Investor Panel Andrey Andreev, Badoo Remo Gerber, Lilium Naspers Peter Smith, Blockchain EMK Capital, Insight Venture Florian Reuter, Volocopter Partners, Target Global, iAngels 21

NOAH IS A UNICORN BREEDING GROUND Challengers with a combined valuation of > $150bn and Champions with a combined market cap of > $3tn presented at NOAH since 2009 Speaking # of Times First Segment Founded Raised Current Status Speaking # of Times First Segment Founded Raised Current Status Company at NOAH Time ($m) Company at NOAH Time ($m) Challengers Challengers Adyen 11 2010 Payments 2006 266 $18.83bn market cap Uber 2 2016 Taxi Apps 2009 11,562 Reached unicorn status AUTO1 Group 6 2015 Classifieds - Cars 2012 880 Reached unicorn status Waze 3 2011 Navigation & Parking 2007 67 Sold to Google for $1.1 AutoTrader 4 2010 Classifieds - Cars 1977 - $4.74bn market cap WeWork 4 2015 Workspaces 2010 9,854 Valued at $20bn Avast 1 2012 Cybersecurity & Anti-Virus 1988 100 Reached unicorn status Wix.com 5 2012 Horizontal SaaS 2006 59 $4.45bn market cap AVG 2 2009 Cybersecurity & Anti-Virus 1991 252 Sold to Avast for $1.3bn after IPO Wooga 8 2011 Gaming 2009 32 Successful private company Babylon Health 2 2013 Health & MedTech 2013 85 Successful private company XING 9 2009 Content & Media 2003 7 $1.57bn market cap BlaBlaCar 8 2013 Rider Sharing & Car Pooling 2006 335 Reached unicorn status Yad2 6 2012 Classifieds - Horizontal 2005 - Sold to Axel Springer for $228m Careem 1 2017 Rider Sharing & Car Pooling 2012 571 Valued at $1.2bn Yandex 7 2012 Content & Media 2000 - $11.78bn market cap CHECK24 2 2015 Lead Generation Services 1999 - Reached unicorn status Zooplus 1 2011 Vertical E-Commerce 1999 - $1.05bn market cap Cloudflare 2 2016 Cybersecurity & Anti-Virus 2009 182 Valued at $3.2bn Zalando 7 2011 Fashion E-Commerce 2008 468 $12.10bn market cap CTS Eventim 7 2012 Marketplaces 1999 - $4.53bn market cap Zendesk 4 2012 Horizontal SaaS 2007 86 $5.70bn market cap Criteo 8 2009 Display & Retargeting 2005 63 $2.13bn market cap Deliveroo 1 2015 Meal Delivery 2013 860 Reached unicorn status Total Capital Raised: $34bn Total Valuation: > $150bn Delivery Hero 10 2010 Meal Delivery 2011 2,581 $10.34bn market cap Farfetch 2 2011 Fashion E-Commerce 2007 702 Reached unicorn status Champions Fotolia 10 2009 Marketplaces 2005 225 Sold to Adobe for $800m Gett 8 2012 Taxi Apps 2010 613 Reached unicorn status Adidas 1 2016 Consumer Goods 1949 - $44.88bn market cap GetYourGuide 8 2013 Travel 2008 96 Successful private company AXA 3 2015 Insurance & Finance 1982 - $60.20bn market cap HelloFresh 4 2013 Meal delivery 2012 365 $2.73bn market cap Axel Springer 11 2010 Digital & Media 1946 - $8.11bn market cap Immobiliare 3 2014 Travel 2005 - Successful private company Bayer 4 2015 Healthcare 1863 - $103.97n market cap Ironsource 2 2012 Developer Tools 2009 105 Reached unicorn status Bertelsmann 9 2010 Digital & Media 1835 - Private company iZettle 2 2013 Payments 2010 269 Successful private company BMW 3 2015 Automotive 1916 - $63.12bn market cap Just Eat 2 2014 Meal Delivery 2001 72 $7.04bn market cap Daimler 3 2015 Automotive 1998 - $74.06bn market cap Klarna 4 2012 Payments 2005 637 Valued at $2.5bn Deutsche Bahn 2 2015 Travel & Transportation 1994 - Government controlled company King.com 7 2010 Gaming 2003 84 Sold to EA for $5.9bn after IPO Deutsche Börse 7 2012 Finance & Banking 1992 - $24.40n market cap Kreditech 8 2010 Personal Loans 2012 497 Successful private company eBay 11 2010 Digital & Media 1995 - $33.10bn market cap Markafoni 2 2012 Fashion E-Commerce 2008 8 Sold to Naspers for $200m Facebook 13 2009 Digital & Media 2004 2.336 $498.28bn market cap Momondo Group 5 2011 Travel 1996 152 Sold to Priceline Group for $550m Google 11 2010 Digital & Media 1998 - $850.26bn market cap MoneySuperMarket 3 2011 Lead Generation Services 1993 - $2.21bn market cap Huffington Post 4 2012 Digital & Media 2005 - Acquired by AOL Photobox 3 2013 Marketplaces 2000 305 Sold to Exponent & Electra Hypoport 4 2014 Financial Services 2001 - $1.23bn market cap for $615m IAC 1 2015 Digital & Media 1995 - $12.32bn market cap Privalia 5 2011 Fashion E-Commerce 2006 219 Sold to Vente-Privee for $560 innogy 6 2014 Industrials 2015 - $24.76bn market cap Revolution Precrafted 1 2018 PropTech 2015 - Reached unicorn status Klöckner & Co 3 2016 Industrials 1906 - $1.10bn market cap Scout24 9 2011 Marketplaces 1998 - $5.67bn market cap Lufthansa 5 2015 Travel & Transportation 1953 - $13.31bn market cap SeLoger 7 2010 Classifieds - Real Estate 1992 - Sold to Axel Springer for $847 METRO Group 6 2011 Consumer Goods 1996 - $7.66bn market cap Showroomprive 8 2010 Fashion E-Commerce 2006 44 Sold to SRP Groupe after IPO Naspers 10 2010 Digital & Media 1915 - $106.81bn market cap Sigfox 2 2016 Internet of Things 2010 327 Valued at $708m Porsche 6 2015 Automotive 1931 - $20.93bn market cap SimilarWeb 6 2014 Analytics & Intelligence 2007 112 Successful private company Priceline Group 8 2011 Travel & Transportation 1997 - $97.86bn market cap Skrill 6 2009 Payments 2001 800 Sold to Optimal Payments ProSiebenSat.1 Media 10 2010 Digital & Media 2000 - $6.20bn market cap for $1.98bn RTL 10 2009 Digital & Media 1931 - $11.48bn market cap Skyscanner 3 2012 Travel 2003 197 Sold to Ctrip for $1.7bn Schibsted 7 2011 Digital & Media 1839 - $7.97bn market cap Spotify 5 2009 Music 2006 2,563 $32.87bn market cap Siemens 7 2013 Industrials 1847 - $117.92bn market cap Stripe 3 2015 Payments 2010 440 Valued at $9.2bn Tencent 1 2014 Digital & Media 1898 - $427.73bn market cap Taboola 2 2014 Content Advertising 2007 160 Reached unicorn status ThyssenKrupp 1 2017 Industrials 1999 - $16.63bn market cap tado° 7 2013 Internet of Things 2011 56 Successful private company TUI 1 2017 Travel & Transportation 1923 - $12.58bn market cap TeamViewer 5 2015 Communication & Collaboration 2005 - Sold to Permira for $1bn Vivendi 3 2012 Digital & Media 1853 - $32.89bn market cap TomTom 2 2015 Navigation & Parking 1991 - $2.02bn market cap VISA 2 2017 Insurance & Finance 1958 - $304.26n market cap Trainline 3 2011 Travel 1997 - Sold to KKR for $681 WPP 5 2012 Advertising 1971 - $19.72bn market cap Transferwise 4 2011 Banking Fintech 2010 116 Reached unicorn status Total Market Cap: $3tn trivago 5 2011 Travel 2005 54 $1.46bn market cap Unicorns Source: Unicorn definition actual reported data where available and NOAH estimates. 22

THE TOP 80 DIGITAL EUROPEAN M&A DEALS BY SIZE IN THE LAST 7 YEARS We hosted on main stage 56% of the top 80 digital M&A Exits (€45bn combined EV) in Europe since the launch of NOAH Conference in Nov 2009 Date Acquiror Target Target Country Adjusted EV Date Acquiror Target Target Country Adjusted EV (€m) (€m) Jun 16 Tencent Supercell (84%) Finland 9,687 Sep 10 Schibsted LeBoncoin (remaining 50%) France 400 Aug 15 Paddy Power Betfair Group (merger) UK 6,824 Jan 14 Zynga NaturalMotion UK 388 May 11 Microsoft Skype Luxemburg 5,899 Oct 14 Publicis Matomy (24.9%) Israel 383 Nov 15 Activision Blizzard King.com UK 4,539 Jan 14 Google DeepMind United Kingdom 365 Mar 15 YOOX Net-a-Porter (merger) UK 3,120 Jan 13 Ingenico Ogone Belgium 360 Oct 16 Cinven, Permira, Mid Europa Allegro Poland 3,033 Feb 12 Ahold Bol.com Netherlands 350 May 17 Moody’s Bureau van Dijk Netherlands 3,000 Aug 14 Delivery Hero Pizza.de Germany 300 Oct 15 Naspers Avito (50.6%) Russia 2,152 Aug 15 Ströer InteractiveMedia Germany 300 Jan 14 Apax Partners Trader Media Group UK 2,126 Jul 10 Permira eDreams Spain 300 Nov 13 Hellman & Friedman Scout24 Germany 2,000 Sep 16 ProSiebenSat.1 Parship (51%) Germany 300 Sep 14 Microsoft Mojang Sweden 1,932 Mar 17 Altice Teads.tv France 300 Dec 16 Go Daddy Host Europe Group Germany 1,690 Apr 16 Rakuten Cabify Spain 283 Dec 16 Ctrip Skyscanner UK 1,622 Feb 13 Partners Group Softonic (30%) Spain 275 Sep 14 mail.ru Vkontakte (remaining 48%) Russia 1,598 Jun 15 Vivendi DailyMotion (80%) France 271 Jul 17 Ingenico Bambora Sweden 1,500 Mar 16 Shandong Hongda Mining Co. Jagex UK 270 Jul 16 AVAST Software AVG Technologies Netherlands 1,170 Jun 15 7Commerce Verivox (80%) Germany 262 Mar 15 Optimal Payments Skrill UK 1,100 Jul 14 KKR Scout24 Schweiz & Omnimedia (49%) Switzerland 262 Jan 17 Zhejiang Jinke Entertainment Outfit7 Slovenia 1,000 Apr 15 Zoopla uSwitch UK 260 May 14 Permira Teamviewer Germany 870 May 17 MTG InnoGames (30%) Germany 260 Jun 13 Google Waze Israel 863 Dec 14 eSure Gocompare (50%) UK 241 Sep 14 Access Industries Perform Group UK 858 Jan 11 Amazon LoveFilm UK 236 Jul 14 Ingenico GlobalCollect Netherlands 820 Feb 17 Take-Two Social Point Spain 234 Dec 12 Expedia trivago (61.6%) Germany 774 Feb 15 Tamedia Ricardo Switzerland 228 Feb 14 CVC Capital Partners Avast Software Czech Republic 738 May 12 NTT DOCOMO Buongiorno Italy 223 Jul 15 Deutsche Boerse 360T Germany 725 Aug 12 AXA Private Equity Bestsecret.com Germany 223 Feb 14 Rakuten Viber Cyprus 658 Aug 15 Adidas Runtastic Austria 220 Dec 14 Adobe Fotolia Europe 645 May 15 Recruit Holdings Wahanda (70%) UK 218 Sep 10 Axel Springer Verlag SeLoger (87.6%) France 634 Mar 15 Recruit Holdings Quandoo (92.9%) Germany 213 Feb 15 Rocket Internet HelloFresh (51.7%) Germany 623 Jun 12 Naspers Netretail (79%) Netherlands 213 Jan 15 KKR thetrainline.com UK 595 Apr 16 AccorHotels OneFineStay UK 212 May 15 Delivery Hero Yemek Sepeti (88.6%) Turkey 594 Dec 14 Host Europe Intergenia Germany 210 Feb 17 Priceline Group Momondo Group UK 586 Dec 16 General Atlantic Hemnet (majority stake) Sweden 208 Oct 15 Exponent. Electra PhotoBox UK 546 May 11 LBO France Promovacances France 200 Jul 13 Cinven Host Europe UK 508 Jun 10 Rakuten PriceMinister France 200 Apr 16 Vente-Privée Privalia Spain 500 Jun 14 Bestseller M&M Direct UK 177 Feb 15 Rocket Internet Delivery Hero (30%) Germany 496 Mar 11 Privalia Dress for Less Germany 175 Mar 16 HgCapital Raet Netherlands 470 Apr 16 Nokia Withings France 170 Jul 13 TPG TSL Education UK 464 Sep 14 Neiman Marcus Mytheresa.com Germany 150 Mar 14 BC Partners CarTrawler Ireland 450 • Deal Value Top 80: EUR 77bn Feb 11 Odigeo (AXA and Permira) Opodo UK 450 Feb 15 Immowelt Immonet (merger) Germany 420 • Deal Value on NOAH Stage: EUR 45bn (59%) Apr 11 TA & Summit Bigpoint Germany 408 • 56% of Top 80 Deals presented at NOAH Note: Digital Companies trade sale exits (only one most recent deal counted per company). Green font denotes speaker at NOAH. 23

DATE COMPANY ON STAGE HEADQUARTERS BUYER VALUATION ($M) Jun-16 @ NOAH16 US Mega Fund Raise 62.500 A May-11 @ NOAH09 Luxembourg 8.000 & Nov-13 @ NOAH09 Sweden Multiple Mega Fund Raises 5.000 M Nov-15 @ NOAH15 UK 4.780 Ago-15 @ NOAH09 UK 3.667 May-17 @ NOAH16 Netherlands 3.270 Sep-14 @ NOAH16 Germany Various 3.000 May-17 @ NOAH17 Germany Mega Fund Raise 2.800 Ene-14 @ NOAH11 UK 2.800 Oct-15 @ NOAH13 Russia 2.729 Nov-13 @ NOAH16 Germany 2.500 Sep-17 @ NOAH16 UK Mega Fund Raise 2.000 Nov-12 @ NOAH10 US 1.800 Mar-15 @ NOAH09 UK 1.550 Ene-14 @ NOAH10 France (Minority) 1,500+ Dic-14 @ NOAH16 The Netherlands Multiple Fund Raises 1,500+ May-14 @ NOAH16 Germany 1.200 Jun-13 @ NOAH11 US 1.100 ® Dic-12 @ NOAH11 Germany 1.050 Sep-14 @ NOAH09 UK 1.000 Mar-14 @ NOAH13 Sweden Multiple Fund Raises 1.000 Mar-14 @ NOAH12 Czech Republic 1.000 Ene-11 @ NOAH11 France 846 Real Winners on Stage Dic-14 @ NOAH14 US 800 Feb-14 @ NOAH09 UK (Controlling) 800 Oct-13 @ NOAH12 UK (Undisclosed %) 800 Feb-15 @ NOAH15 Germany (51.7%) 706 The NOAH Conference consistently features Ene-15 @ NOAH11 UK 680 May-08 @ NOAH16 Germany 644 winners of the future, often before they are Mar-14 @ NOAH16 Ireland 620 Oct-15 @ NOAH17 UK 617 widely known. Over the last 8 years, companies Abr-11 @ NOAH15 Germany (60%) 600 May-15 @ NOAH14 Turkey 589 raised or were acquired for a total of well over Abr-16 @ NOAH13 Spain 570 $50 billion after presenting on the NOAH stage. Feb-17 @ NOAH16 UK 550 May-12 @ NOAH09 France (50%) 450 Sep-15 @ NOAH16 US 440 Feb-13 @ NOAH09 Spain (30%) 345 Sep-16 (50%) @ NOAH16 Germany 340 CURRENT Ene-11 @ NOAH10 UK 320 DATE COMPANY ON STAGE HEADQUARTERS MARKET CAP ($M) Oct-12 @ NOAH10 Germany 311 May-16 @ NOAH16 Israel 300 Jul-15 @ NOAH17 US 75,679 IPO Jul-12 @ NOAH11 CzechRepublic 250 Sep-14 @ NOAH16 Germany 11,956 Abr-16 @ NOAH15 UK 241 8,276 Ago-15 @ NOAH16 Austria 240 Oct-10 @ NOAH09 UK Jun-15 @ NOAH15 Germany 236 Jun-17 @ NOAH17 Germany 6,813 May-14 @ NOAH12 Israel 228 Abr-14 @ NOAH17 UK 6,072 Mar-15 @ NOAH14 Germany 219 Oct-15 @ NOAH16 Germany 4,367 Oct-14 @ NOAH11 UK 210 Jul-14 @ NOAH16 Switzerland Multiple Fund Raises 200 Oct-14 @ NOAH16 Germany 3,974 May-14 @ NOAH10 Turkey 200 Nov-13 @ NOAH12 Israel 3,020 Abr-17 @ NOAH17 US 200 May-14 @ NOAH17 US 2,743 Oct-14 @ NOAH12 Germany 190 May-16 @ NOAH15 Spain 166 Oct-13 @ NOAH11 France 2,741 Jun-16 @ NOAH16 US 148 Dic-16 @ NOAH12 Germany 2,681 Jun-12 @ NOAH16 UK 134 Sep-16 @ NOAH17 The Netherlands 1,902 Jun-17 @ NOAH16 Germany 120 1,319 Mar-15 @ NOAH16 UK 120 Ene-12 @ NOAH09 Czech Republic Sep-14 @ NOAH12 Italy 100+ Abr-14 @ NOAH13 Spain 324 NOAH Oct-14 @ NOAH10 Spain 100 Abr-14 @ NOAH12 Switzerland 204 Advisors was the Jun-14 @ NOAH13 Israel 100 Jul-14 @ NOAH12 Israel 123 Oct-13 @ NOAH12 Israel 100 sell-side advisor Sep-17 @ NOAH16 Germany 70 May-15 @ NOAH10 Germany 107 Oct-12 @ NOAH11 Germany 50

We are looking for strong partners You are in good company Past Event Partners & Sponsors NOAH London Past Event Partners & Sponsors NOAH Berlin Contact us: sponsorships@noah-conference.com 25

® ® NOAH BIBLE (Newsletter) Downloads (PDF) Edition: May 2015 Edition: March 2017 The NOAH Bible is a bi-monthly publication with a dedicated focus on European Internet Edition: July 2015 Edition: June 2017 companies. Here are a few highlights on what to expect. • State of the web: traffic benchmarking of the largest B2C sectors Edition: September 2015 Edition: September 2017 • Latest sector valuations and operational KPIs Edition: December 2017 • The most significant transactions in the last few years Edition: November 2015 • Recent developments and program for the NOAH Conference (London & Berlin) Edition: February 2016 Edition: March 2018 Edition: April 2016 Edition: June 2018 Edition: September 2016 Edition: December 2016 Click here to Sign up for the NOAH Bible NOAH DISRUPTOR LIST Overview of the hottest companies by funds raised. Downloads (PDF) Check our NOAH Disruptor List to see: • The companies that will change the future of entire industries Edition: May 2015 • Relative funding by industry vertical • Funding split Europe vs. US Edition: December 2016 • Most active investors by vertical Request Conference Invite NOAH Advisors Overview 26

® Foto: Gregor Fischer / dpa Die Noah-Konferenz – ein Eine Konferenz für die Gründer der Beinahe-Präsident und viele Female digitalen Welt Founders Selected Auf der Start-up-Konferenz Noah im Tem- Die Noah-Konferenz 2018 in Berlin wartete podrom berät die IT-Szene über die Zukunft mit einem besonderen Highlight auf — daher Press Europas. Gründergeist trifft dabei auf Kapital. beginnen wir den heutigen Bericht mit Im- Read more pressionen von Tag 1. Nicht, weil die Party Berliner Morgenpost 09.06.15 bis spät in die Nacht ging. Sondern weil als Clippings krönender Abschluss Al Gore die Bühne betrat.. Read more Munich Startup 06.06.18 6 Lektionen von der Digitalkonferenz NOAH 17 Bei dem Digital-Event der NOAH Advisors waren dieses Jahr so viele Einhörner ver- sammelt wie bei keiner anderen Konferenz. Tag 1 der wichtigsten IT-Konferenz Zum Beispiel der Online-Bezahldienst Stripe, Europas der einen seinen Gründer, John Collison, zum jüngsten Selfmade-Milliardär der Welt Die Highlights der NOAH. Read more Neben Mike Tyson und Peter machte. Oder das Lieferdienst-Portal Deliv- Altmaier: 3 Take-aways von der ery Hero, das Ende Juni an die Börse geht. Bild 08.06.16 NOAH 2018 Read more Sechs Dinge, die unser Reporter Seit 2009 bringt die NOAH „European Business Insider 24.06.17 über unsere Zukunft gelernt hat Champions und Challengers“ zusammen. Auf zwei Veranstaltungsbühnen (das große Col- Wir waren bei der diesjährigen Veranstaltung osseum, das kleinere Theater) stehen dabei die im Berliner Tempodrom dabei und haben Ideen, wie unser Leben, unser Bankgeschäfte, gelernt, warum Mike Tyson ein Strategie- unsere Mobilität oder Gesundheitsvorsorge in experte war, Peter Altmaier kein WhatsApp Zukunft aussehen werden. Read more nutzt und welche 3 Faktoren einen richtigen „Challenger“ ausmachen! Read more B.Z. 08.06.16 Gründer Daily 14.06.18 NOAH Conference London Attracts Größen der Mobilitätsbranche Almost 2,000 Participants to Old versammeln sich auf der Noah Billingsgate Conference 2018 in Berlin On 10 and 11 November 2016, the 8th Auf der Noah Conference Berlin, dem NOAH Conference London was held in Foto: REUTERS führenden Branchen-Event der europäischen Old Billingsgate with the motto “Leaders Noah lockt Google-Titan Eric Internet- und Digitalwirtschaft, kommt dieses Connected”. 1.850 participants gathered Schmidt nach Berlin Jahr am 6. und 7. Juni in Berlin die Elite der in Tower Hill, more than the year before, for Mobilitätsbranche zusammen. the European internet and digital economy’s Bei der Start-up-Konferenz Noah stehen Wenn Uber seinen neuen CEO, Dara Khos- largest industry event. These included cor- Start-ups gar nicht im Mittelpunkt, sondern Manager Magazin 11.15 rowshahi, nach Europa schickt und FlixBus porates such as Deutsche Börse Group, Firmen, die bereits Erfolge vorweisen kön- seinen Geschäftsführer entsendet, dann Credit Suisse and Porsche, and fast growing nen. Das lockt Manager wie Eric Schmidt, nicht ohne guten Grund. Read more companies such as N26, BlaBlaCar and Oliver Samwer oder Mathias Döpfner. Read Adyen. Read more more Business On 30.05.18 Fintech Finance 15.11.16 Die Welt 11.05.15 27

Pieter van der Does Yair Goldfinger Bruce Aust Nicolas Brusson Jacob Aqraou Oleg Tscheltzoff Dave Waiser CEO Founder & CEO Vice Chairman Co-Founder & CEO Vice Chairman Founder & CEO Founder & CEO SELECTED NOAH SPEAKERS Marco Pescarmona Lars Hinrichs Carl Shepherd Mike Lynch Tomer Bar-Zeev Niklas Adalberth Oskar Hartman Co-Founder & CEO Founder Co-Founder Founder & CEO Co-Founder & CEO Founder Founder & President Olivier Aizac Niklas Östberg Martin Varsavsky Dr. Christian Wegner Rolv Erik Ryssdal Jens Begemann Malte Siewert Founder & CEO Co-Founder & CEO Founder Member of Exec. Board Digital & Adj. CEO Co-Founder & CEO Managing Director 28

Henry Blodget Dr. Mathias Döpfner Sigmar Gabriel Arianna Huffington Olaf Koch Eric Schmidt Günther Oettinger CEO & Editor-in-Chief CEO Federal Minister for Econ. Co-Founder & Editor-in-Chief CEO Executive Chairman European Commissioner Affairs & Energy Digital Economy & Society SELECTED NOAH SPEAKERS Oliver Samwer Martin Schulz Riccardo Zacconi Niklas Zennström Peter Plumb Michelle Kennedy Branko Milutinovic Founder & CEO President European Parliament Founder & CEO CEO CEO Deputy CEO CEO Sina Afra Greg Ellis Uri Levine Errol Damelin Nilesh Pandya Pierre Kosciusko-Morizet Iñaki Ecenarro Former CEO CEO Former President CEO CEO Founder Founder & ex-CEO 29

Sonali De Rycker Glenn Fogel Dr. Klaus Hommels Zita Saurel Jörg Mohaupt Dom Vidal Thomas Ebeling Partner CEO Founder & CEO Managing Director Partner Partner CEO SELECTED NOAH SPEAKERS Dr. Jens Müffelmann Martin Sorrell Patrick Healy Deven Parekh Philipp Freise Bo Ilsoe Rainer Maerkle CEO CEO Deputy CEO Founding Partner Partner Managing Partner Partner Fabrice Grinda Michael Jackson Avishai Abrahami Dr. Stefan Glänzer Scott Collins Dr. Tim Sievers Jonathan Meeks Co-Founder Partner Founder & CEO Founding Partner Managing Director Founder & CEO Managing Director 30

Dr. Dieter Zetsche Rubin Ritter Jessica Federer Travis Kalanick Ralph Hamers Simone Menne Michiel Goris Chairman of the Board of Management Member of the Management Board Head of Digital Development Founder CEO Supervisory Board Member CEO of BMW, DPDHL, Springer Nature SELECTED NOAH SPEAKERS Peter Terium Herbert Hainer Hakan Koç Henrik Herr Johannes Reck Florian Gschwandtner Dr. Friedrich Schwandt CEO CEO Founder & MD Head Germany & Austria Founder & Co-CEO Co-Founder & CEO Founder & CEO International Wealth Management Dr. Markus Pertlwieser Rudolph W. Giuliani Jonas Drueppel Silvio Pagliani Lucas von Cranach Ragnar Sass Chris Morton CDO Private, Wealth & Global Chair Cybersecurity, Privacy & Crisis CEO Commercial Clients Co-Founder Management Practice CEO & Founder & CEO Co-Founder Founder & CEO Executive Chairman 31

Martin Ott Henrich Blase Jochen Engert Or Offer Chris Ohlund Adam Singolda Andreas Koenig VP, MD Central Europe CEO / Owner Founder & Managing Director CEO CEO Founder & CEO Former CEO SELECTED NOAH SPEAKERS Dror Efrat Valentin Stalf Nir Erez Michael Gross Alexander Graubner-Müller Julia Bösch Joey Levin Founder & CEO Founder & CEO Founder & CEO Vice Chairman Co-Founder & CEO Managing Director & Founder CEO Filip Engelbert Hans-Holger Albrecht Lucas Carne Dan Brody Robert Lang Pere Vallès Stan Laurent Co-Founder & CEO Co-Founder VP Business Development President & CEO CEO CEO Former CEO 32

Avid Larizadeh Duggan Markus Witte Carsten Kengeter Uwe Weiss Josh James Dr. Caren Ralf Reichert General Partner CEO CEO CEO Founder & CEO Genthner-Kappesz - CEO CEO SELECTED NOAH SPEAKERS Yoni Assia Reshma Sohoni Felix Plog Elodie Dupuy Joelle Frijters Marta Krupinska Fabio Cannavale Founder & CEO Founding Partner Co-Founder & COO Principal Co-Founder & CEO GM & Co-Founder Co-Founder Fabian Siegel JC Oliver Elicia Bravo Hugo Burge Boaz Yaari Alexandre Fontaine Andy Hancock Chief Strategy Officer Founder & CEO CEO Managing Director CEO Chief Creative Officer Co-Founder 33

Donata Hopfen John Collison Michelle Zatlyn Dr. Richard Lutz Mikkel Svane Whitney Wolfe Herd Jose Neves CEO Co-Founder & President Co-Founder CEO CEO Founder & CEO CEO SELECTED NOAH SPEAKERS Robert Gentz Clark Stacey Dr. Andreas Wiele Nico Gabriel Gisbert Rühl Dr. Ali Parsa Kevin H. Johnson CEO CEO President Marketing & Classified CEO CEO Founder & CEO CEO Ad Models Clare Gilmartin Peter Smith Oliver Dlouhy Rolf Schrömgens Jitse Groen Eugene Mizin Friedrich Joussen CEO CEO Co-Founder & CEO CEO CEO Co-Founder & CEO CEO 34

Remo Gerber Florian Reuter Andrey Andreev Sebastiaan Vaessen Dr. Carolin Gabor Carlo Koelzer Ankur Shah CCO CEO Founder Head of Strategy Managing Director CEO CFO SELECTED NOAH SPEAKERS Anne Boden Samir Desai Nikolay Storonsky Katharina Lueth Alan Mamedi Geoff Cook Carlota Pi Founder & CEO Co-Founder & CEO Founder & CEO Head of Europe Co-Founder & CEO CEO Co-Founder & CEO Alicia Navarro Jaidev Janardana Hendrik Klindworth Nimrod Lehavi Mike Hudack Philipp Man Ofer Vilenski CEO CTO CEO Founder & CEO CEO Founder & CEO Co-Founder & CEO 35

Payal Kadakia Dara Khosrowshahi Al Gore Robbie Antonio Peter Altmaier Dr. Bernd Montag John Suh Founder & Executive Chairman CEO Chairman CEO Federal Minister for Economic CEO CEO Affairs and Energy SELECTED NOAH SPEAKERS Claudia Nemat Dominik Richter Markus Villig Dr. Patrick Andrae Joanna Przetakiewicz Marc-Alexander Christ Julian Teicke CTO CEO Founder & CEO Co-Founder & CEO Founder & Creative Director Co-Founder CEO Rob Moffat David Avgi Erik Podzuweit Dr. Julian Hosp Harley Miller Philipp Pausder David Thevenon CEO Vice President Founder & Managing Director Partner Co-Founder & Co-CEO Partner Founder & CEO 36

The NOAH Team ® ® Banking Team Conference Team Marco Rodzynek Jan Brandes Justus Lumpe Dr. Gerhard Cromme Managing Director Managing Director Managing Director Chairman & Founder Nikhil Parmar Aleksander Skwarczek Marco Bombach Maria del Mar Pérez Gema Alba Paula García Director Analyst Creative Director CTO New Media Designer VP NOAH Lukas Schlund Marina Krolovich Daniel Wasowicz Analyst Andrea Lunelio Data Manager Senior Developer Head of Data Team www.noah-advisors.com www.noah-conference.com

NOAH Advisors provides corporate finance services to the digital sector in Europe July 2018 August 2017 December 2016 October 2016 September 2016 May 2016 Investment in Acquisition of a Majority Stake in Investment in Sale of 100% in Acquisition of a Majority Stake in Investment in by to by by by by from at a valuation of $200m 84% Ownership at a valuation of €300m Exclusive Financial Advisor to Financial Advisor to EMK Capital Financial Advisor to Silver Lake Exclusive Financial Advisor to Financial Advisor to Oakley Capital Exclusive Financial Advisor to PromoFarma and its shareholders KäuferPortal and its Shareholders 10Bis and its Shareholders September 2015 July 2015 December 2014 October 2014 September 2014 August 2014 Sale of a 70% stake in Primary funding for Sale of 100% of Sale of 100% of Sale of controlling stake in to from for $800m to to sale to for €80m to Exclusive Financial Advisor to Advisor to BIScience Exclusive Financial Advisor to Exclusive Financial Advisor to Exclusive Financial Advisor to Advisor to the Selling Shareholders Drushim and its Shareholders Fotolia and the Selling Shareholders Trovit and its Shareholders Facile.it and its Shareholders May 2014 February 2013 May 2012 April 2012 December 2011 November 2011 Sale of 100% in Sale of a majority stake in Fund raising for sold 100% of Growth equity investment from $150 million growth equity investment from to for $228m to a joint for a 30% stake to venture between alongside Softonic’s Founders for a 50% stake alongside Fotolia’s from various investors including and Angel Investors at a Founders and TA Associates Angel Investors Additional $150 million senior Quants Financial Services AG valuation of €275m debt financing Exclusive Financial Advisor to Yad2 Exclusive Financial Advisor to Financial Advisor to Fotolia and Financial Advisor to Toprural Advisor to Work4 Labs Exclusive Financial Advisor to and its Shareholders Softonic and its shareholders its Shareholders and its Shareholders grupfoni and its Shareholders