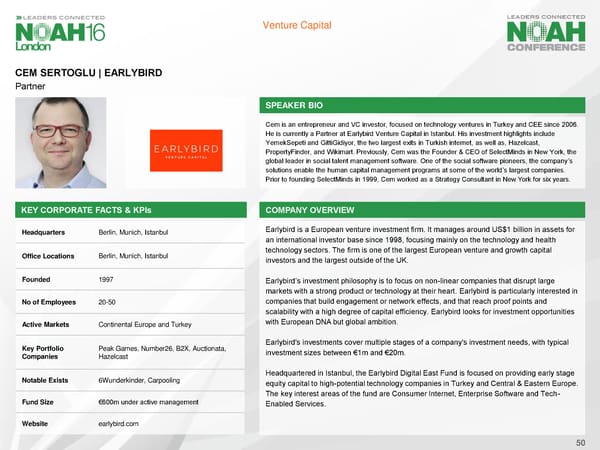

Venture Capital CEM SERTOGLU | EARLYBIRD Partner SPEAKER BIO Cemis an entrepreneur and VC investor, focused on technology ventures in Turkey and CEE since 2006. He is currently a Partner at Earlybird Venture Capital in Istanbul. His investment highlights include YemekSepeti and GittiGidiyor, the two largest exits in Turkish internet, as well as, Hazelcast, PropertyFinder, and Wikimart.Previously, Cem was the Founder & CEO of SelectMinds in New York, the global leader in social talent management software. One of the social software pioneers, the company’s solutions enable the human capital management programs at some of the world’s largest companies. Prior to founding SelectMinds in 1999, Cem worked as a Strategy Consultant in New York for six years. KEY CORPORATE FACTS & KPIs COMPANY OVERVIEW Headquarters Berlin, Munich, Istanbul Earlybird is a European venture investment firm. It manages around US$1 billion in assets for an international investor base since 1998, focusing mainly on the technology and health Office Locations Berlin, Munich, Istanbul technology sectors. The firm is one of the largest European venture and growth capital investors and the largest outside of the UK. Founded 1997 Earlybird’s investment philosophy is to focus on non-linear companies that disrupt large markets with a strong product or technology at their heart. Earlybird is particularly interested in No of Employees 20-50 companies that build engagement or network effects, and that reach proof points and scalability with a high degree of capital efficiency. Earlybird looks for investment opportunities Active Markets Continental Europe and Turkey with European DNA but global ambition. Key Portfolio Peak Games, Number26, B2X, Auctionata, Earlybird's investments cover multiple stages of a company's investment needs, with typical Companies Hazelcast investment sizes between €1m and €20m. Notable Exists 6Wunderkinder, Carpooling Headquartered in Istanbul, the Earlybird Digital East Fund is focused on providing early stage equity capital to high-potential technology companies in Turkey and Central & Eastern Europe. The key interest areas of the fund are Consumer Internet, Enterprise Software and Tech- FundSize €600m under active management Enabled Services. Website earlybird.com 50

NOAH London Speaker Book Page 133 Page 135

NOAH London Speaker Book Page 133 Page 135