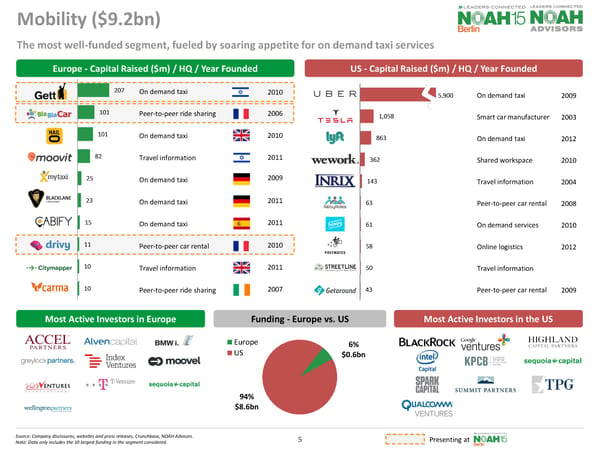

Ç√ Ç√ 5,900 1,058 863 362 143 63 61 58 50 43 Uber Tesla Lyft WeWork INRIX RelayRides Handy Postmates Streetline Getaround 207 101 101 82 25 23 15 11 10 10 gett BlaBlaCar Hailo Moovit mytaxi Blacklane Cabify Drivy Citymapper Carma The most well-funded segment, fueled by soaring appetite for on demand taxi services Mobility ($9.2bn) 2006 2010 2011 2011 2011 2009 2010 2011 2007 2009 2003 2012 2010 2004 2008 2009 2010 2012 Presenting at On demand taxi Peer-to-peer ride sharing On demand taxi Travel information On demand taxi On demand taxi On demand taxi Peer-to-peer car rental Travel information Peer-to-peer ride sharing On demand taxi Smart car manufacturer On demand taxi Shared workspace Travel information Peer-to-peer car rental On demand services Online logistics Travel information Peer-to-peer car rental 6% $0.6bn 94% $8.6bn Europe US 5 Source: Company disclosures, websites and press releases, Crunchbase, NOAH Advisors. Note: Data only includes the 10 largest funding in the segment considered. Europe - Capital Raised ($m) / HQ / Year Founded US - Capital Raised ($m) / HQ / Year Founded Funding - Europe vs. US Most Active Investors in Europe Most Active Investors in the US 2010

NOAH Disruptor List Page 5 Page 7

NOAH Disruptor List Page 5 Page 7