NOAH Conference Infographic

Graphic Summary of Noah Conference

“ THIS IS NOAH CONFERENCE “It´s a very good conference, NOAH CONNECTS LEADERS AT ONE PLACE USING one can do business! BEST-IN-CLASS CONFERENCES AND TECHNOLOGY Oliver Samwer TO EMPOWER THE EUROPEAN DIGITAL ECOSYSTEM CEO, Rocket Internet SPEAKERS AT NOAH HEARING THE STORY OF EUROPEAN DIGITAL LEADERS TO LEARN MAIN STAGE: $100M MINIMUM VALUATIONVALUATION OF $100M+VALUATION OF $100M+ STARTUP STAGE FOR YOUNG OUR AUDIENCE IS OUR STAGE EUROPEAN COMPANIES 110+ speakers at NOAH18 Berlin main stage By invitation only 100 Firms on NOAH17 London Main Stage100 Firms on NOAH17 London Main Stage 12,000+ unique attendees to date at NOAH 640 companies presented since 2009 (37 digital [ ] Companies presented on Main Stage[ ] Companies presented on Main Stage Conferences unicorns) 90 x 6-min pitches at NOAH Berlin Of which [ ] UnicornsOf which [ ] Unicorns 23,000 viewers watch the recordings or live Speakers are CEOs and founders CEOs and founders from emerging companies less Of the top 100 Internet Exits in last 5 years in EuOf the top 100 Internet Exits in last 5 years in Eu-- streams Including: Adyen, BlaBlaCar, Check24, Criteo, than 4 years old rope by size, [%] passed through our stagerope by size, [%] passed through our stage Videos and presentations of all past conferences Deliveroo, Delivey Hero, Farfetch, Gett, HelloFresh, Live audience of 100 (Berlin) to 200 (London), video King.com, MoneySuperMarket, Scout24, Spotify, live stream and inclusion in NOAH media library Corporate champions attending regularly NOAH: Stripe, TransferWise, Trivago, UBER, WeWork, 3 winners (online voting) present on main stage at Credit Suisse, Daimler, Deutsche Bank, Digital Wix, Yandex, etc. next NOAH McKinsey, eBay, Facebook, Google, ING, Naspers, Porsche, Priceline, ProSiebenSat.1, TUI, etc. Unique track record of funding origination NOAH17 BERLIN ATTENDEES BY COUNTRY 70% Germany 8% UK NOAH18 BERLIN SPEAKER BOOK WNNERS TO DATE 4% Switzerland 2% US STARTUP STAGE 16% Other NOAH17 London: #1 The Work Crowd, #2 Misterporter, #3 Everdine ATTENDEES BY SENIORITY NOAH17 Berlin: #1 Lalafo, #2 Bitbond, #3 TravelPerk NOAH16 London: #1 Beezer, #2 CodeMonkey, #3 EyefitU 28% C-Level CLICK NOAH16 Berlin: #1 Fraugster, #2 123Sonography, 21% Investment Partner TO VIEW #3 adMingle, #4 Scalable Capital, #5 Webdata Solutions 7% Owner, Founder SEVENVENTURES PITCH DAY 2% Board Member NOAH15 London SnapCam 42% Other NOAH15 Berlin Withings NOAH14 London Cashboard ~60% senior decision makers NOAH13 London GetYourGuide

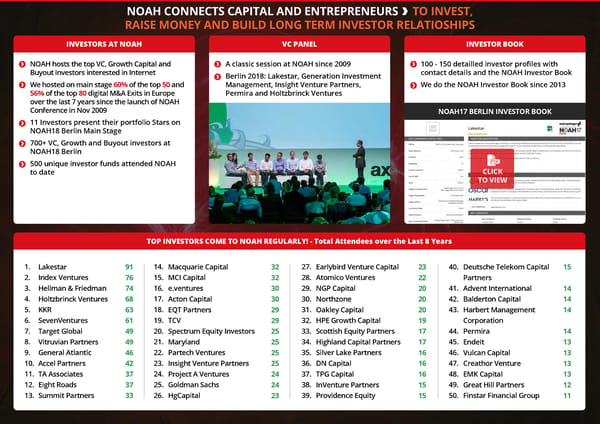

NOAH CONNECTS CAPITAL AND ENTREPRENEURS TO INVEST, RAISE MONEY AND BUILD LONG TERM INVESTOR RELATIOSHIPS INVESTORS AT NOAH VC PANEL INVESTOR BOOK NOAH hosts the top VC, Growth Capital and A classic session at NOAH since 2009 100 - 150 detailled investor profiles with Buyout investors interested in Internet Berlin 2018: Lakestar, Generation Investment contact details and the NOAH Investor Book We hosted on main stage 60% of the top 50 and Management, Insight Venture Partners, We do the NOAH Investor Book since 2013 56% of the top 80 digital M&A Exits in Europe Permira and Holtzbrinck Ventures over the last 7 years since the launch of NOAH Conference in Nov 2009 NOAH17 BERLIN INVESTOR BOOK 11 Investors present their portfolio Stars on NOAH18 Berlin Main Stage 700+ VC, Growth and Buyout investors at NOAH18 Berlin 500 unique investor funds attended NOAH to date CLICK TO VIEW TOP INVESTORS COME TO NOAH REGULARLY! - Total Attendees over the Last 8 Years 1. Lakestar 91 14. Macquarie Capital 32 27. Earlybird Venture Capital 23 40. Deutsche Telekom Capital 15 2. Index Ventures 76 15. MCI Capital 32 28. Atomico Ventures 22 Partners 3. Hellman & Friedman 74 16. e.ventures 30 29. NGP Capital 20 41. Advent International 14 4. Holtzbrinck Ventures 68 17. Acton Capital 30 30. Northzone 20 42. Balderton Capital 14 5. KKR 63 18. EQT Partners 29 31. Oakley Capital 20 43. Harbert Management 14 6. SevenVentures 61 19. TCV 29 32. HPE Growth Capital 19 Corporation 7. Target Global 49 20. Spectrum Equity Investors 25 33. Scottish Equity Partners 17 44. Permira 14 8. Vitruvian Partners 49 21. Maryland 25 34. Highland Capital Partners 17 45. Endeit 13 9. General Atlantic 46 22. Partech Ventures 25 35. Silver Lake Partners 16 46. Vulcan Capital 13 10. Accel Partners 42 23. Insight Venture Partners 25 36. DN Capital 16 47. Creathor Venture 13 11. TA Associates 37 24. Project A Ventures 24 37. TPG Capital 16 48. EMK Capital 13 12. Eight Roads 37 25. Goldman Sachs 24 38. InVenture Partners 15 49. Great Hill Partners 12 13. Summit Partners 33 26. HgCapital 23 39. Providence Equity 15 50. Finstar Financial Group 11

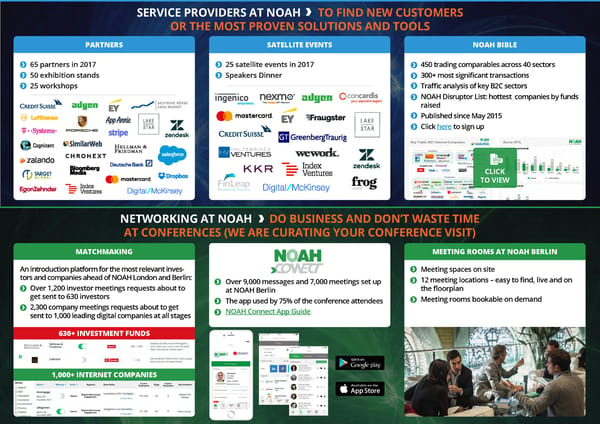

SERVICE PROVIDERS AT NOAH TO FIND NEW CUSTOMERS OR THE MOST PROVEN SOLUTIONS AND TOOLS PARTNERS SATELLITE EVENTS NOAH BIBLE 65 partners in 2017 25 satellite events in 2017 450 trading comparables across 40 sectors 50 exhibition stands Speakers Dinner 300+ most significant transactions 25 workshops Traffic analysis of key B2C sectors NOAH Disruptor List: hottest companies by funds raised Published since May 2015 Click here to sign up CLICK TO VIEW NETWORKING AT NOAH DO BUSINESS AND DON’T WASTE TIME AT CONFERENCES (WE ARE CURATING YOUR CONFERENCE VISIT) MATCHMAKING MEETING ROOMS AT NOAH BERLIN An introduction platform for the most relevant inves- Meeting spaces on site tors and companies ahead of NOAH London and Berlin: Over 9,000 messages and 7,000 meetings set up 12 meeting locations – easy to find, live and on Over 1,200 investor meetings requests about to at NOAH Berlin the floorplan get sent to 630 investors The app used by 75% of the conference attendees Meeting rooms bookable on demand 2,300 company meetings requests about to get NOAH Connect App Guide sent to 1,000 leading digital companies at all stages 630+ INVESTMENT FUNDS 1,000+ INTERNET COMPANIES

OUR MOST COMPELLING SESSION TRAVIS KALANICK DR. DIETER ZETSCHE Founder CEO NOAH CONFERENCE 2017 HIGHLIGHTS TO WATCH Whitney Wolfe, Bumble Are you Ready for Take Off? Sebastiaan Vaessen Dharmash Mistry, Lakestar Investor Panel Andrey Andreev, Badoo Remo Gerber, Lilium Naspers Peter Smith, Blockchain EMK Capital, Insight Venture Florian Reuter, Volocopter Partners, Target Global, iAngels Glenn Fogel Christian Sewing John Collison Online Food Delivery Panel Mobility Panel Priceline Group Deutsche Bank Stripe Takeaway.com, JUST EAT, BlaBlaCar, Drivy, FlixBus, Delivery Hero, 10bis DriveNow, car2go, Gett

NOAH IS A UNICORN BREEDING GROUND Challengers with a combined valuation of > $150bn and Champions with a combined market cap of > $2,800bn presented at NOAH since 2009 Speaking # of Times First Segment Founded Raised Current Status Speaking # of Times First Segment Founded Raised Current Status Company at NOAH Time ($m) Company at NOAH Time ($m) Challengers Challengers Adyen 11 2010 Payments 2006 266 Reached unicorn status Uber 1 2016 Taxi Apps 2009 11,562 Reached unicorn status AutoTrader 4 2010 Classifieds - Cars 1977 - $4.74bn market cap Waze 3 2011 Navigation & Parking 2007 67 Sold to Google for $1.1 Avast 1 2012 Cybersecurity & Anti-Virus 1988 100 Reached unicorn status WeWork 4 2015 Workspaces 2010 9,854 Valued at $20bn AVG 2 2009 Cybersecurity & Anti-Virus 1991 252 Sold to Avast for $1.3bn Wix.com 4 2012 Horizontal SaaS 2006 59 $3.07bn market cap after IPO Wooga 7 2011 Gaming 2009 32 Successful private company Babylon Health 2 2013 Health & MedTech 2013 85 Successful private company XING 9 2009 Content & Media 2003 7 $1.74bn market cap BlaBlaCar 7 2013 Rider Sharing & Car Pooling 2006 335 Reached unicorn status Yad2 6 2012 Classifieds - Horizontal 2005 - Sold to Axel Springer Careem 1 2017 Rider Sharing & Car Pooling 2012 571 Valued at $1.2bn for $228m CHECK24 2 2015 Lead Generation Services 1999 - Reached unicorn status Yandex 7 2012 Content & Media 2000 - $10.23bn market cap Cloudflare 2 2016 Cybersecurity & Anti-Virus 2009 182 Valued at $3.2bn Zooplus 1 2011 Vertical E-Commerce 1999 - $1.13bn market cap CTS Eventim 7 2012 Marketplaces 1999 - $4.11bn market cap Zalando 7 2011 Fashion E-Commerce 2008 468 $12.92bn market cap Criteo 8 2009 Display & Retargeting 2005 63 $2.89bn market cap Zendesk 4 2012 Horizontal SaaS 2007 86 $2.94bn market cap Deliveroo 1 2015 Meal Delivery 2013 860 Reached unicorn status Delivery Hero 9 2010 Meal Delivery 2011 2,581 $7.17bn market cap Total Capital Raised: $34bn Total Valuation: > $150bn Farfetch 2 2011 Fashion E-Commerce 2007 702 Reached unicorn status Fotolia 10 2009 Marketplaces 2005 225 Sold to Adobe for $800m Champions Gett 7 2012 Taxi Apps 2010 613 Reached unicorn status GetYourGuide 7 2013 Travel 2008 96 Successful private company Adidas 1 2016 Consumer Goods 1949 - $48.14bn market cap Immobiliare 3 2014 Travel 2005 - Successful private company AXA 3 2015 Insurance & Finance 1982 - $72.8bn market cap Ironsource 2 2012 Developer Tools 2009 105 Reached unicorn status Axel Springer 10 2010 Digital & Media 1946 - $7.17bn market cap iZettle 2 2013 Payments 2010 269 Successful private company Bayer 3 2015 Healthcare 1863 - $114.17bn market cap Just Eat 2 2014 Meal Delivery 2001 72 $6.16bn market cap Bertelsmann 9 2010 Digital & Media 1835 - Private company Klarna 4 2012 Payments 2005 637 Valued at $2.5bn BMW 3 2015 Automotive 1916 - $67.79bn market cap King.com 7 2010 Gaming 2003 84 Sold to EA for $5.9bn after IPO Daimler 3 2015 Automotive 1998 - $85.82bn market cap Kreditech 8 2010 Personal Loans 2012 497 Successful private company Deutsche Bahn 2 2015 Travel & Transportation 1994 - Government controlled company Markafoni 2 2012 Fashion E-Commerce 2008 8 Sold to Naspers for $200m Deutsche Börse 6 2012 Finance & Banking 1992 - $21.29bn market cap Momondo Group 5 2011 Travel 1996 152 Sold to Priceline Group eBay 11 2010 Digital & Media 1995 - $40.3bn market cap for $550m Facebook 12 2009 Digital & Media 2004 2.336 $498.65bn market cap MoneySuperMarket 3 2011 Lead Generation Services 1993 - $2.86bn market cap Google 10 2010 Digital & Media 1998 - $678.60bn market cap Photobox 3 2013 Marketplaces 2000 305 Sold to Exponent & Electra Huffington Post 4 2012 Digital & Media 2005 - Acquired by AOL for $615m IAC 1 2015 Digital & Media 1995 - $9.76bn market cap Privalia 5 2011 Fashion E-Commerce 2006 219 Sold to Vente-Privee for $560 innogy 6 2014 Industrials 2015 - $24.97bn market cap Scout24 9 2011 Marketplaces 1998 - $4.3bn market cap Klöckner & Co 3 2016 Industrials 1906 - $1.20bn market cap SeLoger 7 2010 Classifieds - Real Estate 1992 - Sold to Axel Springer for $847 Lufthansa 5 2015 Travel & Transportation 1953 - $13.64bn market cap Showroomprive 8 2010 Fashion E-Commerce 2006 44 $717m market cap METRO Group 6 2011 Consumer Goods 1996 - $7.33bn market cap Sigfox 2 2016 Internet of Things 2010 327 Valued at $708m Naspers 10 2010 Digital & Media 1915 - $103.4bn market cap SimilarWeb 5 2014 Analytics & Intelligence 2007 112 Successful private company Porsche 5 2015 Automotive 1931 - $9.88bn market cap Skrill 6 2009 Payments 2001 800 Sold to Optimal Payments Priceline Group 8 2011 Travel & Transportation 1997 - $94.18bn market cap for $1.98bn ProSiebenSat.1 Media 10 2010 Digital & Media 2000 - $8.16bn market cap Skyscanner 3 2012 Travel 2003 197 Sold to Ctrip for $1.7bn RTL 10 2009 Digital & Media 1931 - $11.74bn market cap Spotify 5 2009 Music 2006 2,563 Getting ready for $16bn Schibsted 7 2011 Digital & Media 1839 - $5.64bn market cap rumoured IPO Siemens 7 2013 Industrials 1847 - $127.19bn market cap Stripe 3 2015 Payments 2010 440 Valued at $9.2bn Tencent 1 2014 Digital & Media 1898 - $429.81bn market cap Taboola 2 2014 Content Advertising 2007 160 Reached unicorn status ThyssenKrupp 1 2017 Industrials 1999 - $17.00bn market cap tado° 6 2013 Internet of Things 2011 56 Successful private company TUI 1 2017 Travel & Transportation 1923 - $10.17bn market cap TeamViewer 4 2015 Communication & Collaboration 2005 - Sold to Permira for $1bn Vivendi 3 2012 Digital & Media 1853 - $32.50bn market cap TomTom 2 2015 Navigation & Parking 1991 - $2.55bn market cap VISA 1 2017 Insurance & Finance 1958 - $245.9bn market cap Trainline 3 2011 Travel 1997 - Sold to KKR for $681 WPP 5 2012 Advertising 1971 - $23.36bn market cap Transferwise 4 2011 Banking Fintech 2010 116 Reached unicorn status Total Market Cap: $3tn trivago 5 2011 Travel 2005 54 $3.17bn market cap Unicorns Source: Unicorn definition actual reported data where available and NOAH estimates.

THE TOP 80 DIGITAL EUROPEAN M&A DEALS BY SIZE IN THE LAST 7 YEARS We hosted on main stage 56% of the top 80 digital M&A Exits (€45bn combined EV) in Europe since the launch of NOAH Conference in Nov 2009 Date Acquiror Target Target Country Adjusted EV Date Acquiror Target Target Country Adjusted EV (€m) (€m) Jun 16 Tencent Supercell (84%) Finland 9,687 Sep 10 Schibsted LeBoncoin (remaining 50%) France 400 Aug 15 Paddy Power Betfair Group (merger) UK 6,824 Jan 14 Zynga NaturalMotion UK 388 May 11 Microsoft Skype Luxemburg 5,899 Oct 14 Publicis Matomy (24.9%) Israel 383 Nov 15 Activision Blizzard King.com UK 4,539 Jan 14 Google DeepMind United Kingdom 365 Mar 15 YOOX Net-a-Porter (merger) UK 3,120 Jan 13 Ingenico Ogone Belgium 360 Oct 16 Cinven, Permira, Mid Europa Allegro Poland 3,033 Feb 12 Ahold Bol.com Netherlands 350 May 17 Moody’s Bureau van Dijk Netherlands 3,000 Aug 14 Delivery Hero Pizza.de Germany 300 Oct 15 Naspers Avito (50.6%) Russia 2,152 Aug 15 Ströer InteractiveMedia Germany 300 Jan 14 Apax Partners Trader Media Group UK 2,126 Jul 10 Permira eDreams Spain 300 Nov 13 Hellman & Friedman Scout24 Germany 2,000 Sep 16 ProSiebenSat.1 Parship (51%) Germany 300 Sep 14 Microsoft Mojang Sweden 1,932 Mar 17 Altice Teads.tv France 300 Dec 16 Go Daddy Host Europe Group Germany 1,690 Apr 16 Rakuten Cabify Spain 283 Dec 16 Ctrip Skyscanner UK 1,622 Feb 13 Partners Group Softonic (30%) Spain 275 Sep 14 mail.ru Vkontakte (remaining 48%) Russia 1,598 Jun 15 Vivendi DailyMotion (80%) France 271 Jul 17 Ingenico Bambora Sweden 1,500 Mar 16 Shandong Hongda Mining Co. Jagex UK 270 Jul 16 AVAST Software AVG Technologies Netherlands 1,170 Jun 15 7Commerce Verivox (80%) Germany 262 Mar 15 Optimal Payments Skrill UK 1,100 Jul 14 KKR Scout24 Schweiz & Omnimedia (49%) Switzerland 262 Jan 17 Zhejiang Jinke Entertainment Outfit7 Slovenia 1,000 Apr 15 Zoopla uSwitch UK 260 May 14 Permira Teamviewer Germany 870 May 17 MTG InnoGames (30%) Germany 260 Jun 13 Google Waze Israel 863 Dec 14 eSure Gocompare (50%) UK 241 Sep 14 Access Industries Perform Group UK 858 Jan 11 Amazon LoveFilm UK 236 Jul 14 Ingenico GlobalCollect Netherlands 820 Feb 17 Take-Two Social Point Spain 234 Dec 12 Expedia trivago (61.6%) Germany 774 Feb 15 Tamedia Ricardo Switzerland 228 Feb 14 CVC Capital Partners Avast Software Czech Republic 738 May 12 NTT DOCOMO Buongiorno Italy 223 Jul 15 Deutsche Boerse 360T Germany 725 Aug 12 AXA Private Equity Bestsecret.com Germany 223 Feb 14 Rakuten Viber Cyprus 658 Aug 15 Adidas Runtastic Austria 220 Dec 14 Adobe Fotolia Europe 645 May 15 Recruit Holdings Wahanda (70%) UK 218 Sep 10 Axel Springer Verlag SeLoger (87.6%) France 634 Mar 15 Recruit Holdings Quandoo (92.9%) Germany 213 Feb 15 Rocket Internet HelloFresh (51.7%) Germany 623 Jun 12 Naspers Netretail (79%) Netherlands 213 Jan 15 KKR thetrainline.com UK 595 Apr 16 AccorHotels OneFineStay UK 212 May 15 Delivery Hero Yemek Sepeti (88.6%) Turkey 594 Dec 14 Host Europe Intergenia Germany 210 Feb 17 Priceline Group Momondo Group UK 586 Dec 16 General Atlantic Hemnet (majority stake) Sweden 208 Oct 15 Exponent. Electra PhotoBox UK 546 May 11 LBO France Promovacances France 200 Jul 13 Cinven Host Europe UK 508 Jun 10 Rakuten PriceMinister France 200 Apr 16 Vente-Privée Privalia Spain 500 Jun 14 Bestseller M&M Direct UK 177 Feb 15 Rocket Internet Delivery Hero (30%) Germany 496 Mar 11 Privalia Dress for Less Germany 175 Mar 16 HgCapital Raet Netherlands 470 Apr 16 Nokia Withings France 170 Jul 13 TPG TSL Education UK 464 Sep 14 Neiman Marcus Mytheresa.com Germany 150 Mar 14 BC Partners CarTrawler Ireland 450 • Deal Value Top 80: EUR 77bn Feb 11 Odigeo (AXA and Permira) Opodo UK 450 Feb 15 Immowelt Immonet (merger) Germany 420 • Deal Value on NOAH Stage: EUR 45bn (59%) Apr 11 TA & Summit Bigpoint Germany 408 • 56% of Top 80 Deals presented at NOAH Note: Digital Companies trade sale exits (only one most recent deal counted per company). Green font denotes speaker at NOAH.