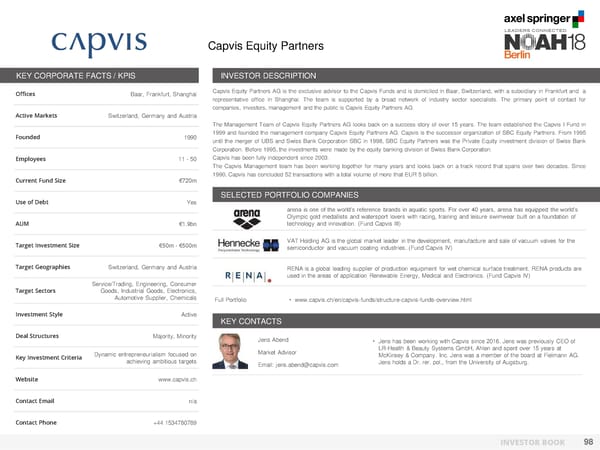

Capvis Equity Partners KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices Baar, Frankfurt, Shanghai Capvis Equity Partners AG is the exclusive advisor to the Capvis Funds and is domiciled in Baar, Switzerland, with a subsidiary in Frankfurt and a representative office in Shanghai. The team is supported by a broad network of industry sector specialists. The primary point of contact for companies, investors, management and the public is Capvis Equity Partners AG. Active Markets Switzerland, Germany and Austria The Management Team of Capvis Equity Partners AG looks back on a success story of over 15 years. The team established the Capvis I Fund in Founded 1990 1999 and founded the management company Capvis Equity Partners AG. Capvis is the successor organization of SBC Equity Partners. From 1995 until the merger of UBS and Swiss Bank Corporation SBC in 1998, SBC Equity Partners was the Private Equity investment division of Swiss Bank Corporation. Before 1995, the investments were made by the equity banking division of Swiss Bank Corporation. Employees 11 - 50 Capvis has been fully independent since 2003. The Capvis Management team has been working together for many years and looks back on a track record that spans over two decades. Since 1990,Capvis has concluded 52 transactions with a total volume of more that EUR 5 billion. Current Fund Size €720m SELECTED PORTFOLIO COMPANIES Use of Debt Yes arena is one of the world’s reference brands in aquatic sports. For over 40 years, arena has equipped the world’s Olympic gold medallists and watersport lovers with racing, training and leisure swimwear built on a foundation of AUM €1.9bn technology and innovation. (Fund Capvis III) Target Investment Size €50m - €500m VAT Holding AG is the global market leader in the development, manufacture and sale of vacuum valves for the semiconductor and vacuum coating industries. (Fund Capvis IV) Target Geographies Switzerland, Germany and Austria RENA is a global leading supplier of production equipment for wet chemical surface treatment. RENA products are used in the areas of application Renewable Energy, Medical and Electronics. (Fund Capvis IV) Service/Trading, Engineering, Consumer Target Sectors Goods, Industrial Goods, Electronics, Automotive Supplier, Chemicals Full Portfolio • www.capvis.ch/en/capvis-funds/structure-capvis-funds-overview.html Investment Style Active KEY CONTACTS Deal Structures Majority, Minority Jens Abend • Jens has been working with Capvis since 2016. Jens was previously CEO of Market Advisor LR-Health & Beauty Systems GmbH, Ahlen and spent over 15 years at Key Investment Criteria Dynamic entrepreneurialism focused on McKinsey & Company. Inc. Jens was a member of the board at Fielmann AG. achieving ambitious targets Email: jens.abend@capvis.com Jens holds a Dr. rer. pol., from the University of Augsburg. Website www.capvis.ch Contact Email n/a Contact Phone +44 1534780789 INVESTOR BOOK 98

NOAH Berlin 2018 - Investor Book Page 98 Page 100

NOAH Berlin 2018 - Investor Book Page 98 Page 100