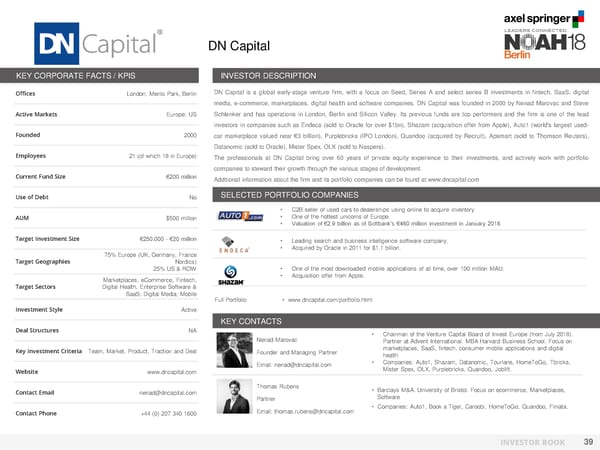

DN Capital KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices London, Menlo Park, Berlin DN Capital is a global early-stage venture firm, with a focus on Seed, Series A and select series B investments in fintech, SaaS, digital media, e-commerce, marketplaces, digital health and software companies. DN Capital was founded in 2000 by Nenad Marovac and Steve Active Markets Europe; US Schlenker and has operations in London, Berlin and Silicon Valley. Its previous funds are top performers and the firm is one of the lead investors in companies such as Endeca (sold to Oracle for over $1bn), Shazam (acquisition offer from Apple), Auto1 (world's largest used- Founded 2000 car marketplace valued near €3 billion), Purplebricks (IPO London), Quandoo (acquired by Recruit), Apsmart (sold to Thomson Reuters), Datanomic (sold to Oracle), Mister Spex, OLX (sold to Naspers). Employees 21 (of which 18 in Europe) The professionals at DN Capital bring over 60 years of private equity experience to their investments, and actively work with portfolio companies to steward their growth through the various stages of development. Current Fund Size €200 million Additional information about the firm and its portfolio companies can be found at www.dncapital.com Use of Debt No SELECTED PORTFOLIO COMPANIES • C2B seller of used cars to dealerships using online to acquire inventory. AUM $500 million • One of the hottest unicorns of Europe. • Valuation of €2.9 billion as of Softbank’s €460 million investment in January 2018. Target Investment Size €250,000 - €20 million • Leading search and business intelligence software company. • Acquired by Oracle in 2011 for $1.1 billion. 75% Europe (UK, Germany, France Target Geographies Nordics) 25% US & ROW • One of the most downloaded mobile applications of all time, over 100 million MAU. Marketplaces, eCommerce, Fintech, • Acquisition offer from Apple. Target Sectors Digital Health, Enterprise Software & SaaS; Digital Media; Mobile Full Portfolio • www.dncapital.com/portfolio.html Investment Style Active KEY CONTACTS Deal Structures NA • Chairman of the Venture Capital Board of Invest Europe (from July 2018). Nenad Marovac Partner at Advent International. MBA Harvard Business School. Focus on Key Investment Criteria Team, Market, Product, Traction and Deal [Photo] Founder and Managing Partner marketplaces, SaaS, fintech, consumer mobile applications and digital health Email: nenad@dncapital.com • Companies: Auto1, Shazam, Datanomic, Tourlane, HomeToGo, Tbricks, Website www.dncapital.com Mister Spex, OLX, Purplebricks, Quandoo, Joblift. Thomas Rubens • Barclays M&A. University of Bristol. Focus on ecommerce, Marketplaces, Contact Email nenad@dncapital.com [Photo] Software Partner Email: thomas.rubens@dncapital.com • Companies: Auto1, Book a Tiger, Caroobi, HomeToGo, Quandoo, Finiata. Contact Phone +44 (0) 207 340 1600 INVESTOR BOOK 39

NOAH Berlin 2018 - Investor Book Page 39 Page 41

NOAH Berlin 2018 - Investor Book Page 39 Page 41