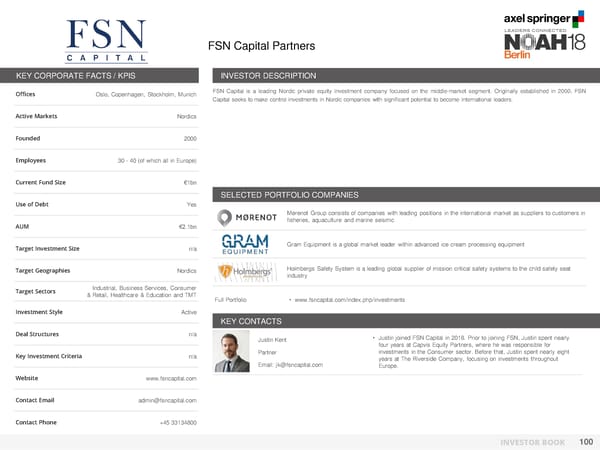

FSN Capital Partners KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices Oslo, Copenhagen, Stockholm, Munich FSN Capital is a leading Nordic private equity investment company focused on the middle-market segment. Originally established in 2000, FSN Capital seeks to make control investments in Nordic companies with significant potential to become international leaders. Active Markets Nordics Founded 2000 Employees 30 - 40 (of which all in Europe) Current Fund Size €1bn SELECTED PORTFOLIO COMPANIES Use of Debt Yes Mørenot Group consists of companies with leading positions in the international market as suppliers to customers in fisheries, aquaculture and marine seismic AUM €2.1bn Target Investment Size n/a Gram Equipment is a global market leader within advanced ice cream processing equipment Target Geographies Nordics Holmbergs Safety System is a leading global supplier of mission critical safety systems to the child safety seat industry Target Sectors Industrial, Business Services, Consumer & Retail, Healthcare & Education and TMT Full Portfolio • www.fsncapital.com/index.php/investments Investment Style Active KEY CONTACTS Deal Structures n/a Justin Kent • Justin joined FSN Capital in 2018. Prior to joining FSN, Justin spent nearly four years at Capvis Equity Partners, where he was responsible for Key Investment Criteria n/a Partner investments in the Consumer sector. Before that, Justin spent nearly eight years at The Riverside Company, focusing on investments throughout Email: [email protected] Europe. Website www.fsncapital.com Contact Email [email protected] Contact Phone +45 33134800 INVESTOR BOOK 100

NOAH Berlin 2018 - Investor Book Page 100 Page 102

NOAH Berlin 2018 - Investor Book Page 100 Page 102