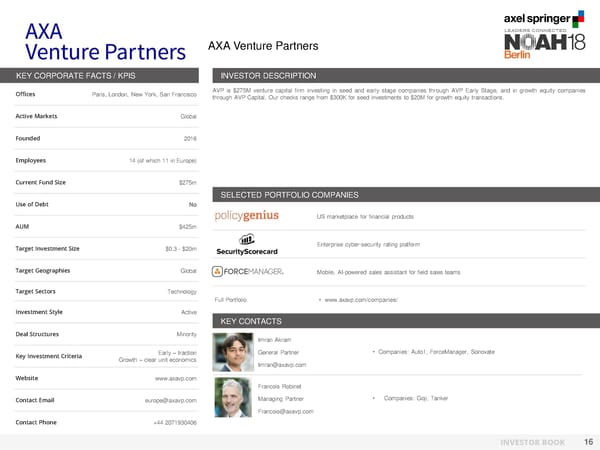

AXA Venture Partners KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices Paris, London, New York, San Francisco AVP is $275M venture capital firm investing in seed and early stage companies through AVP Early Stage, and in growth equity companies through AVP Capital. Our checks range from $300K for seed investments to $20M for growth equity transactions. Active Markets Global Founded 2016 Employees 14 (of which 11 in Europe) Current Fund Size $275m SELECTED PORTFOLIO COMPANIES Use of Debt No US marketplace for financial products AUM $425m Target Investment Size $0.3 - $20m Enterprise cyber-security rating platform Target Geographies Global Mobile, AI-powered sales assistant for field sales teams Target Sectors Technology Full Portfolio • www.axavp.com/companies/ Investment Style Active KEY CONTACTS Deal Structures Minority Imran Akram Early – traction [Photo] General Partner • Companies: Auto1, ForceManager, Sonovate Key Investment Criteria Growth – clear unit economics [email protected] Website www.axavp.com Francois Robinet Contact Email [email protected] [Photo] Managing Partner • Companies: Goji, Tanker [email protected] Contact Phone +44 2071930406 INVESTOR BOOK 16

NOAH Berlin 2018 - Investor Book Page 16 Page 18

NOAH Berlin 2018 - Investor Book Page 16 Page 18