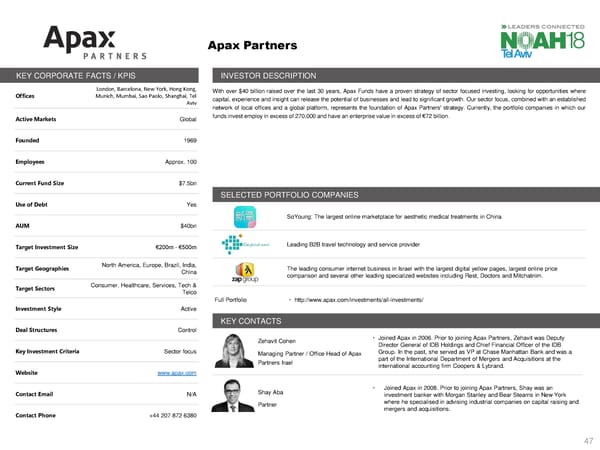

ApaxPartners KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION London, Barcelona, New York, Hong Kong, With over $40 billion raised over the last 30 years, Apax Funds have a proven strategy of sector focused investing, looking for opportunities where Offices Munich, Mumbai, Sao Paolo, Shanghai, Tel capital, experience and insight can release the potential of businesses and lead to significant growth. Our sector focus, combined with an established Aviv network of local offices and a global platform, represents the foundation of Apax Partners' strategy. Currently, the portfolio companies in which our Active Markets Global fundsinvestemployinexcessof270,000andhaveanenterprisevalueinexcessof€72billion. Founded 1969 Employees Approx. 100 Current Fund Size $7.5bn SELECTED PORTFOLIO COMPANIES Use of Debt Yes SoYoung: The largest online marketplace for aesthetic medical treatments in China AUM $40bn Target Investment Size €200m - €500m Leading B2B travel technology and service provider Target Geographies North America, Europe, Brazil, India, The leading consumer internet business in Israel with the largest digital yellow pages, largest online price China comparison and several other leading specialized websites including Rest, Doctors and Mitchatnim. Target Sectors Consumer. Healthcare, Services, Tech & Telco Full Portfolio • http://www.apax.com/investments/all-investments/ Investment Style Active KEY CONTACTS Deal Structures Control Zehavit Cohen • Joined Apax in 2006. Prior to joining Apax Partners, Zehavit was Deputy Key Investment Criteria Sector focus Director General of IDB Holdings and Chief Financial Officer of the IDB Managing Partner / Office Head of Apax Group. In the past, she served as VP at Chase Manhattan Bank and was a Partners Irael part of the International Department of Mergers and Acquisitions at the Website www.apax.com international accounting firm Coopers & Lybrand. Contact Email N/A Shay Aba • Joined Apax in 2008. Prior to joining Apax Partners, Shay was an investment banker with Morgan Stanley and Bear Stearns in New York Partner where he specialised in advising industrial companies on capital raising and Contact Phone +44 207 872 6380 mergers and acquisitions. 47

NOAH 18 Tel Aviv Investor Book Page 46 Page 48

NOAH 18 Tel Aviv Investor Book Page 46 Page 48